- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My husband is a member of a union. He has not worked, but we have paid the health insurance p...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

Yes, health insurance premiums you paid can be deducted as medical costs on your return. To take this deduction, you will have to itemize your deductions. Also, you can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI).

To enter your medical expenses in TurboTax:

- Open or continue your return.

- Navigate to the Schedule A section:

- TurboTax Online/Mobile: Go to Schedule A.

- TurboTax Desktop: Search for Schedule A and then select the Jump to link.

How does the standard deduction differ from itemizing deductions?

Can I deduct medical expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

I assumee you're asking if you can claim the health insurance premium payment that you paid to maintain health insurance. Yes, you definitely can claim that. Definitely enter that info, e.g., about premiums paid et al., into TurboTax when you fill in the information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

Yes, you can deduct the premium that you paid, but you cannot deduct health insurance premiums unless you itemize your tax deductions or you are self-employed and have a net profit for this year.

You can deduct qualified unreimbursed medical expenses that exceed 7.5% of your adjusted gross income if you use IRS Schedule A to itemize their deductions.

To get to those screens in TurboTax you can do the following:

To get back to that question, you can :

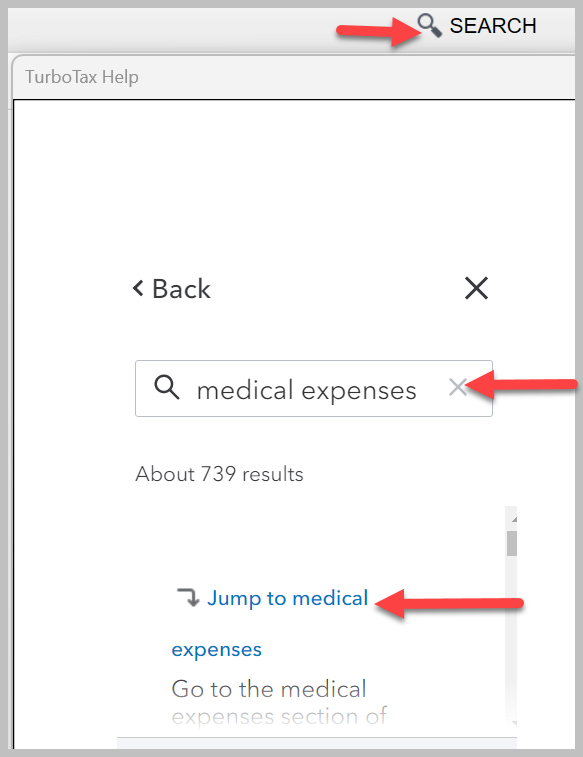

- Click on Search in the upper right of your TurboTax screen

- Type "Medical Expenses" in the search bar

- Click on the link "Jump to Medical Expenses"

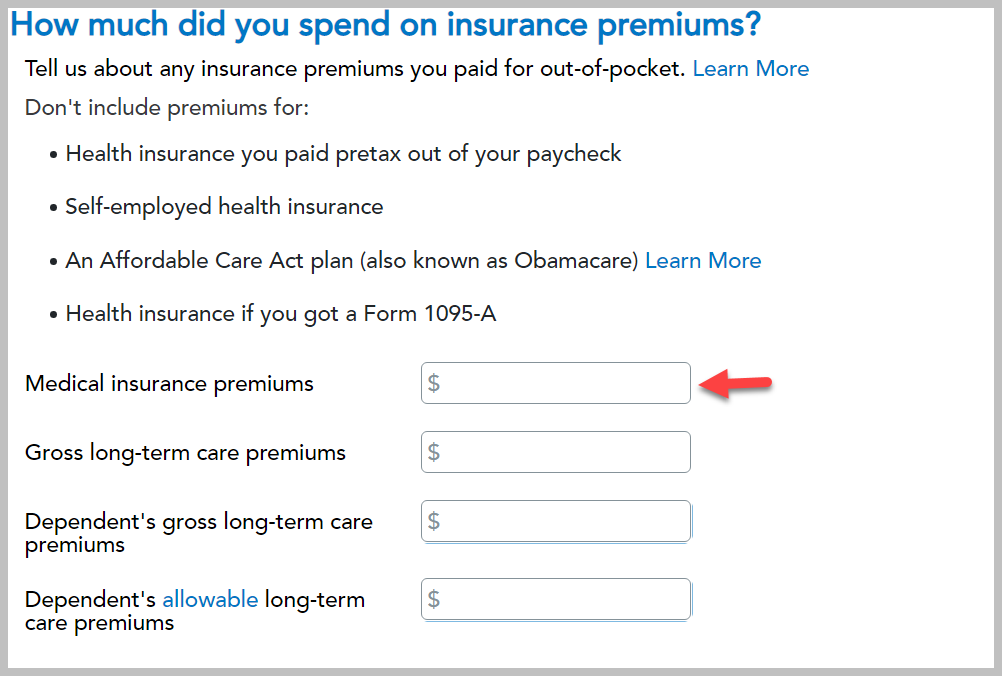

- Click through the screens and enter your medical expenses on the corresponding screen

- You can follow through the screens and enter any medical expenses that you have

- Answer all follow-up questions

Your screens will look something like this:

Click here for Can You Claim a Tax Deduction for Health Insurance?

Open Share Drawer

Click here for additional information on "Are Medical Expenses Tax Deductible?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

Clarification: What LindaS5247 said is more correct. I meant the following: When you enter your data into Turbo, one thing you can do is to enter your medical expenses (as Linda said). That will include the premiums you paid. Depending on your other information, including what state you live in, TurboTax will identify whether you it's best for you to take itemized deductions or the Standard Deduction. Probably for fed taxes, since the Standard Deduction is so high, you'll take it, so your insur premiums won't get deducted. For state taxes, it will depend on the state you live in, and other data from your situation. If Turbo recommends the standard deduction, your med expenses won't get used. But if Turbo recommends itemizing deductions, then they will. This year in my case I itemized deductions for my state, and so my insurance premiums were part of the expenses that got itemized. So it's possible that they'll get used - it depends on your specific situation. And TurboTax will help you decide. Linda's advice on how to enter all that info has great detail on how to proceed to enter what you need to enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband is a member of a union. He has not worked, but we have paid the health insurance premium to maintain. Can I claim this?

Thanks all!! I appreciate your help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vickiez1121

New Member

Vickiez1121

New Member

Vickiez1121

New Member

georgiesboy

New Member

Vivieneab

New Member