- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, you can deduct the premium that you paid, but you cannot deduct health insurance premiums unless you itemize your tax deductions or you are self-employed and have a net profit for this year.

You can deduct qualified unreimbursed medical expenses that exceed 7.5% of your adjusted gross income if you use IRS Schedule A to itemize their deductions.

To get to those screens in TurboTax you can do the following:

To get back to that question, you can :

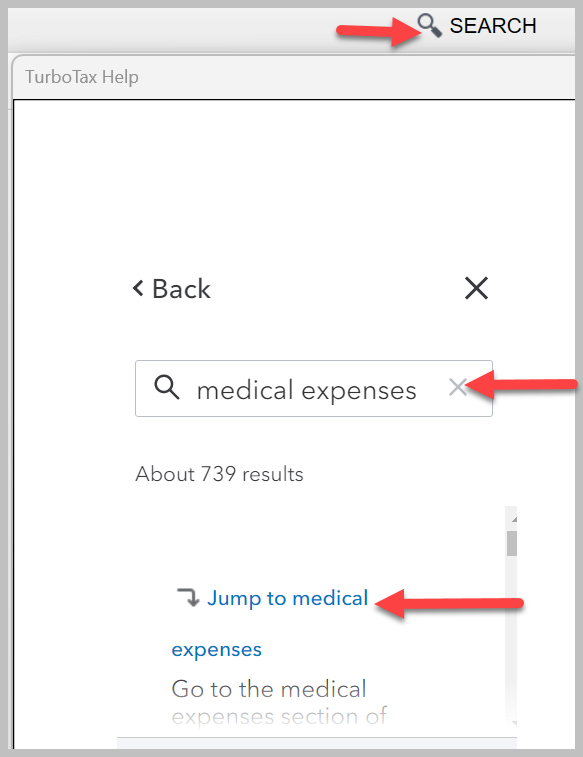

- Click on Search in the upper right of your TurboTax screen

- Type "Medical Expenses" in the search bar

- Click on the link "Jump to Medical Expenses"

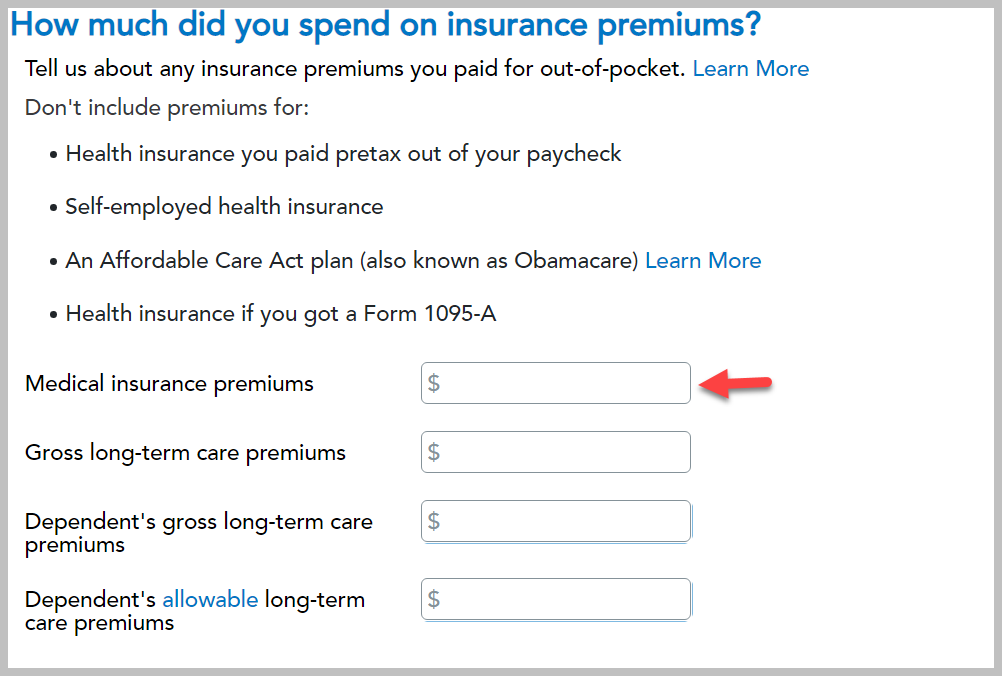

- Click through the screens and enter your medical expenses on the corresponding screen

- You can follow through the screens and enter any medical expenses that you have

- Answer all follow-up questions

Your screens will look something like this:

Click here for Can You Claim a Tax Deduction for Health Insurance?

Open Share Drawer

Click here for additional information on "Are Medical Expenses Tax Deductible?"

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 30, 2025

2:19 PM

581 Views