- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My father passed away in Jan 2021, after year end

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My father passed away in Jan 2021, after year end

My father passed away in Jan 2021. I normally did his taxes for him. What special things do I need to do when I file his 2020 taxes. Who signs the taxes. Do I need some type of special number to file under instead of his social security number?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My father passed away in Jan 2021, after year end

Your father's taxes would be filed as usual, including using his social security number. Include income only up to the date of death that he actually received before death. When filing you will answer the question about whether he is deceased and enter the date of death. 'I'm preparing this return for ______, who has passed away'

Any question that asks about the whole year, you would consider only the time he was alive (as though it was a whole year).

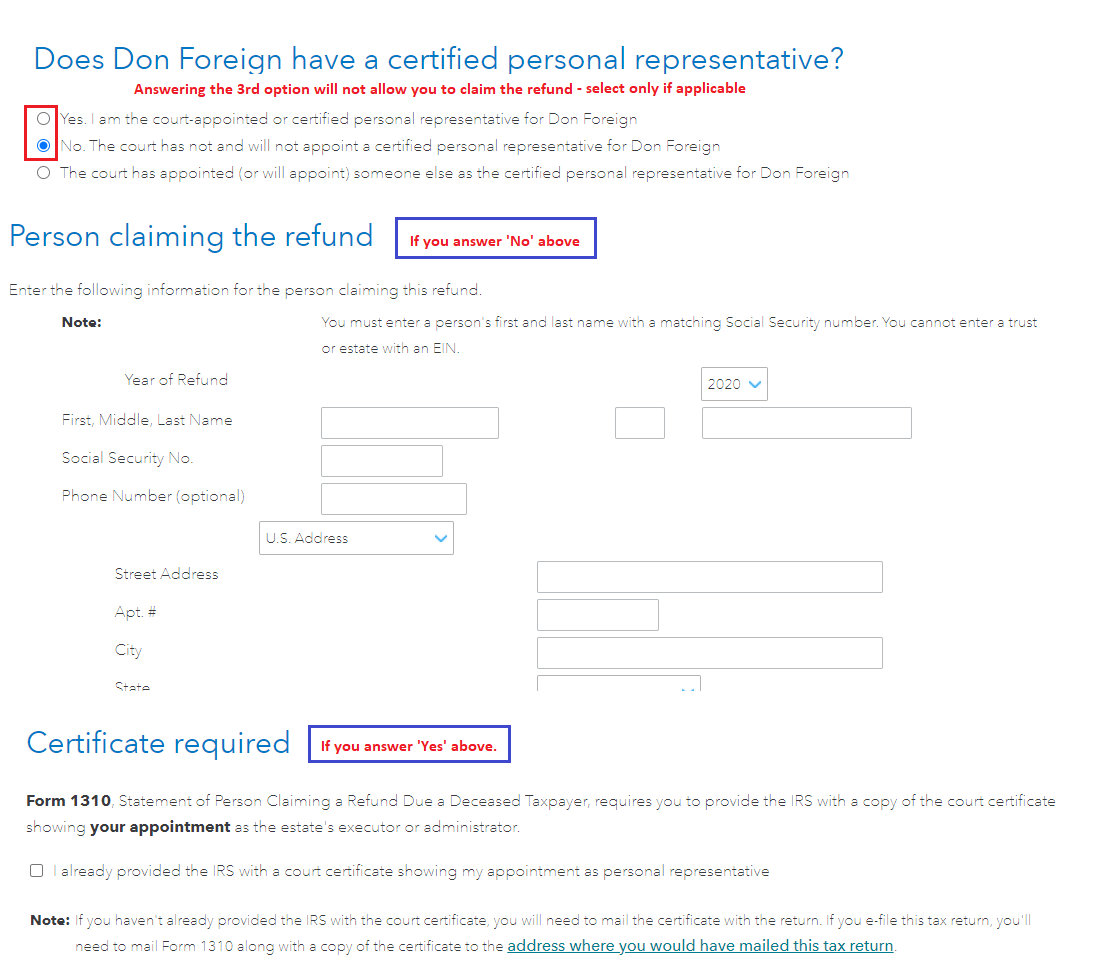

If there is a refund, then Form 1310 will also be included with the tax return.

- Open the TurboTax account > Use Search (upper right) > Type form 1310 > Press enter > Jump to .... link

- Continue to complete the form as requested - Your answers are important to complete the tax return (see the image below)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My father passed away in Jan 2021, after year end

don't include income he received in 2021, although that's probably zero (so far).

Sorry for your loss.

you need an Estate bank account with an EIN from the IRS to handle the affairs properly.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thisblows

New Member

jackkgan

Level 5

user17555332003

New Member

kim-gundler

New Member

Spetty1450

New Member