- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Mineral royalties ~ TT wants to put it as a business... it is not

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

I receive mineral royalties from an inheritance. I have had these before this year, but this year TT Home & Biz stuck my 1099 into a business.... how do I redirect it to the correct place? I only own a small percentage of these royalties.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

Did you receive a Form 1099-MISC with the amount of the royalties entered in box 2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

I did receive 1099-Misc for my mineral royalties. I am not sure what you mean by "box 2"? I have two choices, from what I gather, to enter this information. Using TT Home & Biz, Windows version -- In Personal Income section under "common income" it asks for 1099-Misc information. But TT also wants to put the information on Schedule E Supplemental Income and Loss along with income from apartments I own from which I receive rent. So I am not sure which form to put this information on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

Royalty income is also entered on a Schedule E. You should start a new Schedule E and designate the schedule for royalty income.

The reference to Box 2 was because a Form 1099-MISC has 19 separate numbered boxes. Box 2 is specifically designated from entering Royalties

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

Thanks so much for the clarification!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

I have royalties from oil that I've inherited. Neither of the options are correct. It's not from property I own and it's not a business. I can't get past this point to finish!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

The royalty income is reported on Schedule E even if you do not own the property. Schedule E is used to report both rental and royalty income and expenses. See the Introduction in these IRS instructions for Schedule E.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

But the next step asks for an address. There is no address and I can't move forward without putting one in

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

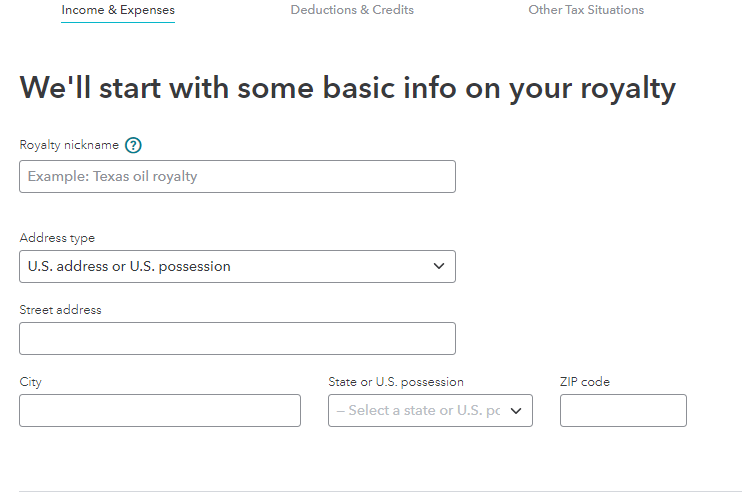

If you have gone to the Wages and Income section and then Rents and Royalties, and selected Royalties, it should bring up a screen that matches the image below.

If the royalty is not associated with an actual property address, as with mineral rights, you may use your own address in this in these fields.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

I have the same problem. Do I enter the oil and gas royalties in "1099-MISC and other common income" or do I enter it in "rental properties and royalties"? I think it may get entered twice. And it is trying to make one of them business income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mineral royalties ~ TT wants to put it as a business... it is not

Your best option is to delete (trashcan icon) the entry under Income from 1099-MISC. Then go to Rental and Royalty Properties and Edit/Start the royalty property found there. Be sure the type of property has the "Royalty" box checked.

If TurboTax prompts you to enter an address for the property, use the actual address if you know it (look on the property tax bill if you have one). Or use your own address. The IRS instructions say address lines 1 and 2 should be left blank, but sometimes the program won't let you continue without an address.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17522839879

New Member

justine626

Level 1

Mike1127

Level 3

atn888

Level 2

bonitatibusy

Returning Member