- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Max deferral line 18 must be blank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

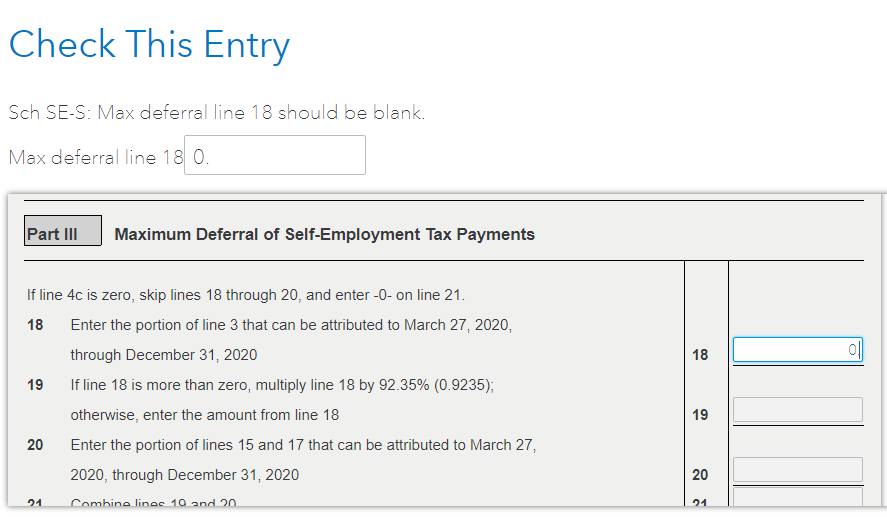

Max deferral line 18 must be blank?

I keep getting this error message for line 18 and 20 right before I'm about to file. It says the prompt needs to be blank; it's defaulted at 0 but it won't let me continue. Is this a bug that has not been fixed? How can I bypass this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

I am guessing that the option for the self-employment tax deferral was generated at a point when your tax return reflected:

- A balance due, and

- Self-employment tax due.

Subsequent entries changed:

- Your balance due status,

- Your self-employment tax due, or

- Both.

Can you temporarily return your tax return to the status of:

- A balance due, and

- Self-employment tax due.

So that you can access the self-employment tax deferral questions and remove that benefit from your tax return because subsequent entries made that benefit no longer available.

Are you able to go to Forms and override the dollar amount? If not, try these steps in the Step-by-Step.

- Across the top of the screen, click on Personal.

- Across the top of the screen, click on Deductions & credits.

- At the screen How do you want to enter your deductions and credits? click on I'll choose what I work on.

- Under Your 2020 Deductions & Credits, scroll down to Tax relief related to COVID-19.

- Click on Start / Update to the right of Self-employment tax deferral.

- At the screen Do you want more time to pay your self-employment tax?, click Yes.

- At the screen Let's start by getting your eligible income, I have left the dollar amount that was previously entered, others change this amount to $0.

- Click on Continue.

- At the screen Tell us how much you'd like to defer, change the dollar amount to $0.

- Click Continue.

- Scroll down and click Done with Deductions.

- Click through Federal Review to make sure than the Review issue has been removed.

- At the screen Some of your self-employment taxes may be eligible, click Skip.

After completing these steps, you would reverse the entries that eliminated:

- Your balance due status,

- Your self-employment tax due, or

- Both.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

You have to enter an amount on line 18 and can not be blank, if you want to defer the self-employment taxes. The form Schedule-SE are used to calculate self- employment taxes.You can elect to defer the full amount by 12/31/2021 or pay half and pay the rest by 12/31/2022.:

- Login to Turbo Tax.

- Jump to Business tab, then click Business taxes..

- Click Self-employment taxes, then continue.

- The screen "Some of your self-employment taxes may be eligible for deferral" click continue.

- Answer Yes on "Did you want more time to pay your self-employment taxes?".

- Next screen, enter the net self-employment income you earned from March 27, 2020 through December 31, 2020, or if you received steady self-employment income throughout the year, enter 76.5% of self-employment income.

- The next screen will show how much self-employment taxes you may defer, click continue.

- The next screen will say "okay, you're all set up", an itemized payment schedule will appear.You're deferring and $ amount of your self-employment social security tax.

- $ is due on or before 12/31/2021.

- $ is due on or before 12/31/2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

Hi Joanna,

Why does it say it must be blank then? Is that an error message? Also I believe that the taxes are getting taken out of my refund already, and I do not want to defer. My self-employment is part-time and I have a W2 that I filed from my current job.

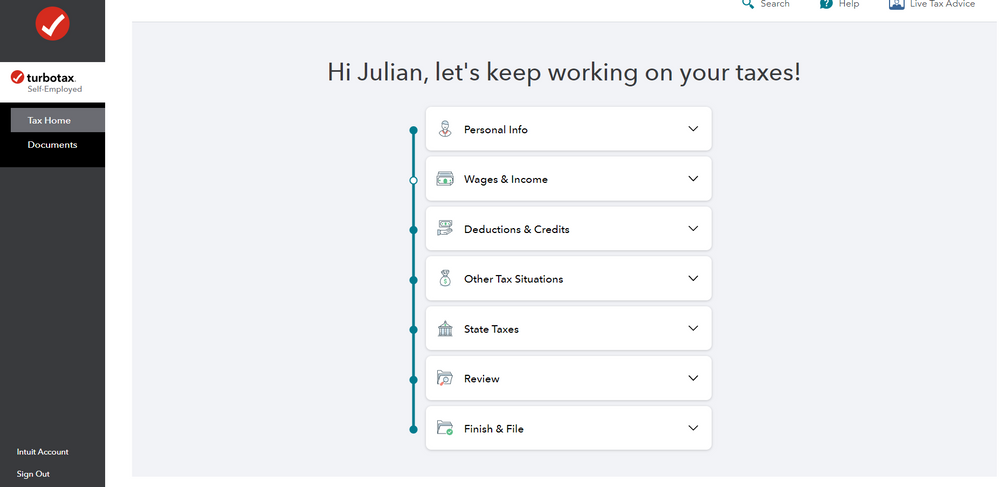

I also don't see "business tab" or business taxes anywhere. This is what my home screen looks like.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

You can elect not to defer self-employment taxes by:

- Login to Turbo Tax.

- Jump to Business tab, then click Business taxes..

- Click Self-employment taxes, then continue.

- The screen "Some of your self-employment taxes may be eligible for deferral" click continue.

- Answer No on "Did you want more time to pay your self-employment taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

I don't see Business Taxes on my home screen, please refer to the photo in my last reply. I clicked through my self-employment taxes under Wages and Income but no prompt came up asking about deferral.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

I am guessing that the option for the self-employment tax deferral was generated at a point when your tax return reflected:

- A balance due, and

- Self-employment tax due.

Subsequent entries changed:

- Your balance due status,

- Your self-employment tax due, or

- Both.

Can you temporarily return your tax return to the status of:

- A balance due, and

- Self-employment tax due.

So that you can access the self-employment tax deferral questions and remove that benefit from your tax return because subsequent entries made that benefit no longer available.

Are you able to go to Forms and override the dollar amount? If not, try these steps in the Step-by-Step.

- Across the top of the screen, click on Personal.

- Across the top of the screen, click on Deductions & credits.

- At the screen How do you want to enter your deductions and credits? click on I'll choose what I work on.

- Under Your 2020 Deductions & Credits, scroll down to Tax relief related to COVID-19.

- Click on Start / Update to the right of Self-employment tax deferral.

- At the screen Do you want more time to pay your self-employment tax?, click Yes.

- At the screen Let's start by getting your eligible income, I have left the dollar amount that was previously entered, others change this amount to $0.

- Click on Continue.

- At the screen Tell us how much you'd like to defer, change the dollar amount to $0.

- Click Continue.

- Scroll down and click Done with Deductions.

- Click through Federal Review to make sure than the Review issue has been removed.

- At the screen Some of your self-employment taxes may be eligible, click Skip.

After completing these steps, you would reverse the entries that eliminated:

- Your balance due status,

- Your self-employment tax due, or

- Both.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

I was able to resolve the matter over the phone with TurboTax support, all I had to do was override the dollar amount and make the space blank. Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Max deferral line 18 must be blank?

In TurboTax Online Self-Employed, I was able to enter a self-employment tax deferral and pass Review. Then I was able to remove self-employment tax deferral and pass Review.

Follow these steps.

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Deductions & credits.

- Under Your tax breaks, scroll down to Self-employment tax deferral.

- Click on Edit/Add to the right of Self-employment tax deferral.

- At the screen Do you want more time to pay your self-employment tax?, click Yes.

- At the screen Let's start by getting your eligible income, I have left the dollar amount that was previously entered, others change this amount to $0.

- Click on Continue.

- At the screen Tell us how much you'd like to defer, delete the dollar amount.

- Click Continue.

- Click through Federal Review to make sure than the Review issue has been removed.

- At the screen Some of your self-employment taxes may be eligible, click Skip.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shari-l-w-coles

New Member

bb66

Level 1

oaosym

New Member

ellenbergerta

New Member

garne2t2

Level 1