- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Hello,

Unfortunately, when I switched financial advisors last year - there was a miscommunication and my RMD was never taken from two inherited IRA accounts I possess.

Upon discovering the mistake my new financial advisor took withdrew the RMDs from the accounts and instructed me to file form 5329 along with a letter of forgiveness they wrote asking for the 50% penalty to be waived as the situation was immediately rectified when discovered.

I understand that Form 5329 is located under "Additional Tax Payments" then "Additional Taxes and Repayments" in TurboTax Online, however I see no clear option after clicking on that for late RMD withdrawals...nor where I can file my letter of forgiveness.

Any insight would be helpful.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

You will need to file a 5329 form and request a waiver of the penalty. (The waiver would only be denied if there is no reasonable explanation and the missed RMD was not taken at all.)

Unfortunately this can only be done using the "forms" mode that is only available with the desktop software if you do not have a 1099-R to file.

If you do have a 2019 1099-R to report then the RMD question in the interview will go to the form 5329 waiver interview if you say that the 2019 RMD was not taken.

If you are using the CD/download version:

Enter the forms mode and click on open form. Type in 5329. Choose 5329-T for the taxpayer (first person listed on your tax return), or 5329-S (for spouse - 2nd person on tax return).

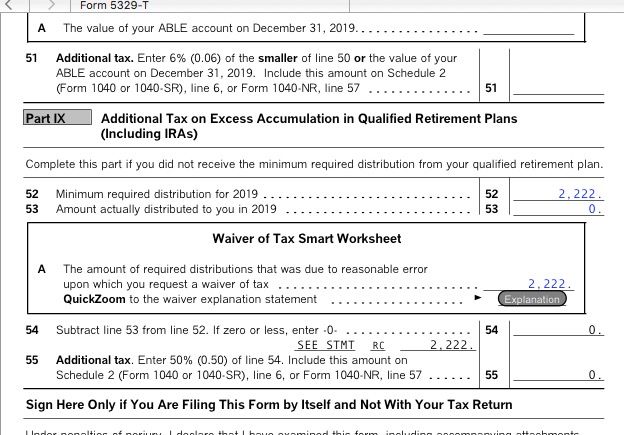

Scroll down to Part IX line 52 and enter the RMD amount that should have been taken. On line 53 enter the amount of the RMD that was actually taken (probably zero if it was missed).

Then in the box right under line 53 "Waver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount). Then click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waver.

You will not pay any penalty now until the IRS determines if it will grant the waver, then they will inform you if you owe the penalty.

OR - if using the Online version and have no 2019 1099-R to file, you will have to prepare the 5329 manually .

Download the 5329 form from the IRS website and fill it out the same as above. Print and mail your return with the 5329 form and explanation attached as described in the 5329 instructions.

The 2019 5329 must be attached to your printed and mailed 2019 tax return and cannot be e-filed.

[NOTE: You can only use this method if you are requesting a waver of the penalty and there is no taxable amount on the 5329 form line 55 that must be transferred to the 1040 form]

From 5329 instructions:

Quote:

"Waiver of tax. The IRS can waive part or all of this tax if you can show that any shortfall in the amount of distributions was due to reasonable error and you are taking reasonable steps to remedy the shortfall. If you believe you qualify for this relief, attach a statement of explanation and file Form 5329 as follows.

1. Complete lines 52 and 53 as instructed.

2. Enter “RC” and the amount you want waived in parentheses on the dotted line next to line 54. Subtract this amount from the total shortfall you figured without regard to the waiver, and enter the result on line 54.

3. Complete line 55 as instructed. You must pay any tax due that is reported on line 55.

The IRS will review the information you provide and decide whether to grant your request for a waiver. "

Download blank 2019 5329 form here:

Form: http://www.irs.gov/pub/irs-pdf/f5329.pdf

Instructions: http://www.irs.gov/pub/irs-pdf/i5329.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

@jackplym wrote:

I have a similar but slightly more complicated issue. Three years ago, Schwab switched part of my IRA to a separate account. Then for tax years 2018 and 2018 they did not withdraw an RMD for that separate account, only for the balance of the original account. I did not realize that their issued 1099-R did not include the new separate account and so did not report it. I just discovered the problem. I have already filed my 2019 taxes. My interpretation of this thread, as well as IRS Instruction, etc. is that I should:

1-Take the required distributions ASAP as a regular withdrawal,

2-Use Turbotax to prepare 1040-X amended returns for 2018 and 2019 with the year appropriate 5329’s. File paper forms. I use desktop version of TT.

3-Include the required taxes due (not any penalty) with the 1040-X’s.

Am I on the right track?

You are not.

#3 - There should be no additional tax due. You must take that distribution in 2020 so that distribution and the tax must be paid with your 2020 tax return next year. You ask for a waiver of the penalty with the 5329 form and to not pay the penalty so there should be no change in the tax at all for 2018 & 2019.

First, it does not matter what "account" the RMD was taken from as long as the total RMD amount based on the total value of ALL accounts was satisfied. If it was not, then you need to take the combined 2 year shortfall RMD amount from any of your Traditional IRA accounts ASAP.

Then prepare 5329 forms for each missed year (2018 & 2019 if those years were missed) as in the above discussion, and attach an explanation as yiu just explained it. Then mail the stand alone 5329 form to the IRS (I would use a tracking service or certified mail with tracking). No need to amend 2019 since you are not changing anything, only sending an additional original 5329 form late that should have been part of the tax return but was not. (Sending a late form that does not change the original return that can be filed by itself does not require amending the original tax return if nothing changes).

If you wish to amend and send the 5329 forms and explanation with a 1040X you can do so if you want to.)

https://www.irs.gov/pub/irs-prior/f5329--2018.pdf

https://www.irs.gov/pub/irs-prior/f5329--2019.pdf

https://www.irs.gov/pub/irs-prior/i5329--2018.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

You will need to file a 5329 form and request a waiver of the penalty. (The waiver would only be denied if there is no reasonable explanation and the missed RMD was not taken at all.)

Unfortunately this can only be done using the "forms" mode that is only available with the desktop software if you do not have a 1099-R to file.

If you do have a 2019 1099-R to report then the RMD question in the interview will go to the form 5329 waiver interview if you say that the 2019 RMD was not taken.

If you are using the CD/download version:

Enter the forms mode and click on open form. Type in 5329. Choose 5329-T for the taxpayer (first person listed on your tax return), or 5329-S (for spouse - 2nd person on tax return).

Scroll down to Part IX line 52 and enter the RMD amount that should have been taken. On line 53 enter the amount of the RMD that was actually taken (probably zero if it was missed).

Then in the box right under line 53 "Waver of Tax Smart Worksheet" enter the same amount as line 52 (the RMD amount). Then click the "Explanation" button and enter the reason for missing the RMD and your statement requesting a waver.

You will not pay any penalty now until the IRS determines if it will grant the waver, then they will inform you if you owe the penalty.

OR - if using the Online version and have no 2019 1099-R to file, you will have to prepare the 5329 manually .

Download the 5329 form from the IRS website and fill it out the same as above. Print and mail your return with the 5329 form and explanation attached as described in the 5329 instructions.

The 2019 5329 must be attached to your printed and mailed 2019 tax return and cannot be e-filed.

[NOTE: You can only use this method if you are requesting a waver of the penalty and there is no taxable amount on the 5329 form line 55 that must be transferred to the 1040 form]

From 5329 instructions:

Quote:

"Waiver of tax. The IRS can waive part or all of this tax if you can show that any shortfall in the amount of distributions was due to reasonable error and you are taking reasonable steps to remedy the shortfall. If you believe you qualify for this relief, attach a statement of explanation and file Form 5329 as follows.

1. Complete lines 52 and 53 as instructed.

2. Enter “RC” and the amount you want waived in parentheses on the dotted line next to line 54. Subtract this amount from the total shortfall you figured without regard to the waiver, and enter the result on line 54.

3. Complete line 55 as instructed. You must pay any tax due that is reported on line 55.

The IRS will review the information you provide and decide whether to grant your request for a waiver. "

Download blank 2019 5329 form here:

Form: http://www.irs.gov/pub/irs-pdf/f5329.pdf

Instructions: http://www.irs.gov/pub/irs-pdf/i5329.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Sorry this is a bit confusing. I tried to follow the IRS instructions and got...

Line 52 = $5986 (calculated RMD)

Line 53 = $0 or $5986? (no distribution was made in 2019, it was discovered and taken in 2020..I'm guessing $0)

Line 54 = assuming "$0" on Line 53 then = $5986 on line with "RC (5986)" to the left of the Line 54 box.

Line 55 = $2993 (penalty amount).....but do I actually include the payment with my mailed in taxes or not?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Line 55 will be zero because you are requesting waiver on the entire amount.

The 5329 should look like this:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Yes you followed the instructions in Form 5329.

Every year I send comment to IRS requesting to clarify the instructions.

However, according to the esteemed IRA experts on the forum macuser_22 and dmertz, you are misreading it.

Do it their way because it seems to always work, and you don't have to send in any money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

@fanfare wrote:

Yes you followed the instructions in Form 5329.

Every year I send comment to IRS requesting to clarify the instructions.

However, according to the esteemed IRA experts on the forum

macuser_22 and dmertz, you are misreading it.

Do it their way because it seems to always work, and you don't have to send in any money.

I am not "misreading it". The screenshot I posted is how TurboTax does it and is exactally as the IRS 5329 instructions say to enter it:

Quote:

1. Complete lines 52 and 53 as

instructed.

2. Enter “RC” and the amount of the

shortfall you want waived in

parentheses on the dotted line next to

line 54. Subtract this amount from the

total shortfall you figured without regard

to the waiver, and enter the result on

line 54.

The "amount of the shortfall you want waived" is (obviously) the amount of the RMD that was missed from line 52. When that amount is subtracted from itself, the result is zero, which goes on line 54. Line 55 is 50% of zero on line 54 that can only be zero on line 55.

What part of the IRS instructions do you not understand?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

OK macuser_22

I did not say you are misreading it.

I said you are telling the OP that he misread it.

Well what do you know -- IRS has changed the wording in the instructions for 2019 Form 5329.

We've had this discussion many times before in earlier years. I had conceded then and I concede now..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

@macuser_22 cc: @dmertz

P.S.

You should update your original boilerplate answer. In Step 2, you are quoting the old instruction, not the 2019 instruction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

@fanfare wrote:

@macuser_22 cc: @dmertz

P.S.

You should update your original boilerplate answer. In Step 2, you are quoting the old instruction, not the 2019 instruction.

I fail to see any material difference between my "boilerplate":

2. Enter “RC” and the amount you want waived in parentheses on the dotted line next to line 54. Subtract this amount from the total shortfall you figured without regard to the waiver, and enter the result on line 54.

and the current:

2. Enter “RC” and the amount of the

shortfall you want waived in

parentheses on the dotted line next to

line 54. Subtract this amount from the

total shortfall you figured without regard

to the waiver, and enter the result on

line 54.

Looks about the same to me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Well there's a big difference, and that should be clear to anyone. This discussion is going nowhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

@fanfare wrote:

Well there's a big difference, and that should be clear to anyone. This discussion is going nowhere.

I don't see any material difference, but I will add "amount of shortfall" to my answer- just to be current. Thanks for pointing that out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Also, the last paragraph of that section now indicates that the IRS will provide explicit notice as to whether they deny or grant the waiver. In the past they didn't always provide notice when they granted the waiver.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

Great thanks for the clarification! My advisor took the RMD's, but I don't have any 1099-R for 2019 from TD Ameritrade nor do I think I will receive any as far as I can tell since they were taken late in 2020 to rectify the mistake. I am using the online version - so I will need to print it out and file the form with the letter of explanation with it. I am assuming that in the end where you finalize everything there is an option to "print and mail" rather than e-file. Assuming this....where does Form 5329 and statement of explanation go in the the huge stack of tax papers? Very front? Very back? I want them to SEE it or put it in its proper place. I couldn't really find any information on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

2019 Instructions for Form 5329

"If your request is not granted, the IRS will notify you

regarding any additional tax you may owe on the shortfall."

the phrase you cited "deny or grant" does not appear.

@ender Refer to IRS booklet 2019 1040 and 1040-SR Instructions for how to assemble your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late RMD Penalty - File form 5329 and letter of penalty forgiveness with TurboTax online

From the instructions for Form 1040:

If you have supporting statements, arrange them in the same order as the schedules or forms they support and attach them last.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

bees_knees254

New Member

xiaochong2dai

Level 3

meenakshimishra

Level 2

meenakshimishra

Level 2