- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: IRA Withdraw For First Time Home Purchase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

Hello,

In 2020 my wife and I withdrew 25k from my IRA for our first home purchase.

We then deposited 17k back into the account within the same year.

The turbotax software is saying that the limit for a withdrawal for a first time home purchase is 10k.

I'm wondering if there is a way to file a withdraw of 25k and then file that I put 17k back and the other 8k was for a first time home purchase?

Thank you so much for your time and help!

Tyler

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

The 10,000 amount is just the max you can use to avoid the 10% Early Withdrawal Penalty on the withdrawal if you are under 59 1/2. The whole amount is still taxable. Did you return the 17,000 within 60 days? If it was after 60 days it would be a new contribution and probably not allowed. So you may have an excess contribution and need to remove it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

Are you working on your 2020 return? You need to use the Desktop program to do 2020 now. After you enter the 1099R for the 25,000 you say you rolled over the 17,000 even if you put it back into the same account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

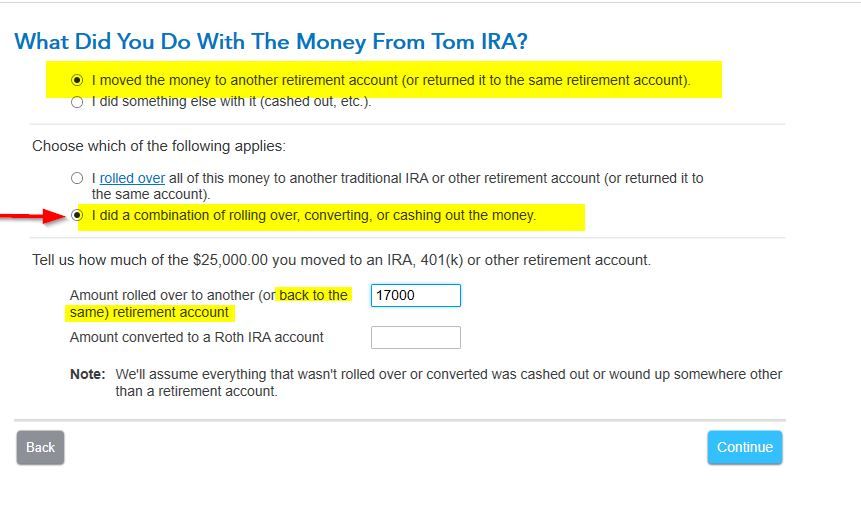

I just made you a screen shot. After you enter the 1099R you continue on and it will ask you several questions about it. You should get this screen

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

You can withdraw $10,000 for a first time home purchase, it will be exempt from the 10% penalty for early withdrawal but you still pay regular income tax. The other $15,000 you withdrew is subject to the 10% penalty as well as income tax.

You are only allowed to return funds to an IRA within 60 days of the original withdrawal. If the return was within 60 days, then you will answer in TurboTax that you withdrew 25k, returned 17k, and used the other 8k for the first time home buyer. You will pay income tax but not the penalty on the first time home amount and the returned 17K won’t count as taxable income. But, you have to spell this all out in TurboTax.

In the case of a withdrawal for a first time home purchase, you are allowed to return funds within 120 days. But, you must tell the trustee this is what you are doing, and not all trustees will accept a 120 day return because the limit for most people is 60 days.

If you returned the money after 60 days, or after 120 days, or you returned in less than 120 days but you did not tell the trustee this was a return, then it will be reported as a contribution. IRA contributions are tax deductible up to $6000, or $7000 if you are over age 50, and excess contributions over that are subject to additional penalties.

It’s very important in your situation to understand when you returned the $17,000 and whether you informed the IRA custodian that this was a return or a contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

@Opus 17 Thanks for explaining it with more details! Very nice. I'll have to bookmark your post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

Also note, an IRA is owned by a single individual. If you and your wife each had a separate IRA, you could each have withdrawn up to $10,000 for a first time home purchase. But, you can’t withdraw $20,000 from a single IRA even if you are married and buying the house together. The $10,000 limit is per account and each account is owned by a single individual.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

@Opus 17 But you can still take out more than the 10,000, right? The 10,000 is just exempt from the 10% Early Withdrawal Penalty. You can still use the amount over 10,000 for the house. There is no limit on how much you can take out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA Withdraw For First Time Home Purchase

Correct, any IRA withdrawal that does not qualify for an exception or that exceeds the exception limit will be subject to regular income tax plus the 10% penalty.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hoppsscotch

New Member

TexasAubs

Level 2

satishsnehal

Level 2

dejale

New Member

kuroshvp

New Member