- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I kee...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

No, you cannot yet e-file a return with a K-3 through TurboTax. The IRS has issued the following statements about the e-file process for the K-3:

Schedules K-2 and K-3 will be available for MeF/XML filing in the following time frames. If you electronically file your return before the time frames, submit the schedules as separate PDF files attached to the return. Taxpayers will also be able to file their Schedules K-2 and K-3 via PDF attachments for the entire 2022 filing season.

Form 1065, Schedules K-2 and K-3 March 20, 2022

Form 1120-S, Schedules K-2 and K-3 Mid-June 2022

Form 8865, Schedules K-2 and K-3 January 2023

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

Thank you, Alicia. All the K-3s are associated with Form 1065. According to the statement you shared, taxpayers should be able to e-file after 3/20/2022, right? Does that mean Turbotax is adding K-3 e-filing for Form 1065 anytime soon or taxpayers have to mail the files to IRS this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

How do I attach a pdf file to e-file?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

You can't add a pdf file to your tax return for E-filing.

Most forms K-2 and K-3 forms do not need to be filed this year. The IRS announced on Tuesday February 15, 2022 that most K2/K3 reporting for 2021 can be delayed until the 2022 tax return filing.

This is an extract of the IRS announcement:

The IRS intends to provide certain additional transition relief for this year from the Schedule K-2 and K-3 reporting for certain domestic partnerships and S corporations with no foreign activities, foreign partners or shareholders, and without knowledge of partner or shareholder need for information on items of international relevance. For 2021, these qualifying domestic partnerships and S corporations will not have to file the new schedules. We are taking this step in response to feedback we received from the tax community and our stakeholders. The IRS will provide full details of this relief soon.

Source: MinhT1

[Edited 03/23/22|2:42 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

Thank you for your reply. Technically speaking, should I uncheck box 16 on TurboTax even though box 16 is checked on my K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

Before you uncheck Box 16, confirm that the K-1 Supplemental Information you received about that box doesn't pertain to foreign assets or income. If it does not, then you can uncheck the box and proceed to e-file your return.

Schedule K-3 is available in TurboTax now. So after the most recent update, you may find that you can finish your return without unchecking Box 16.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

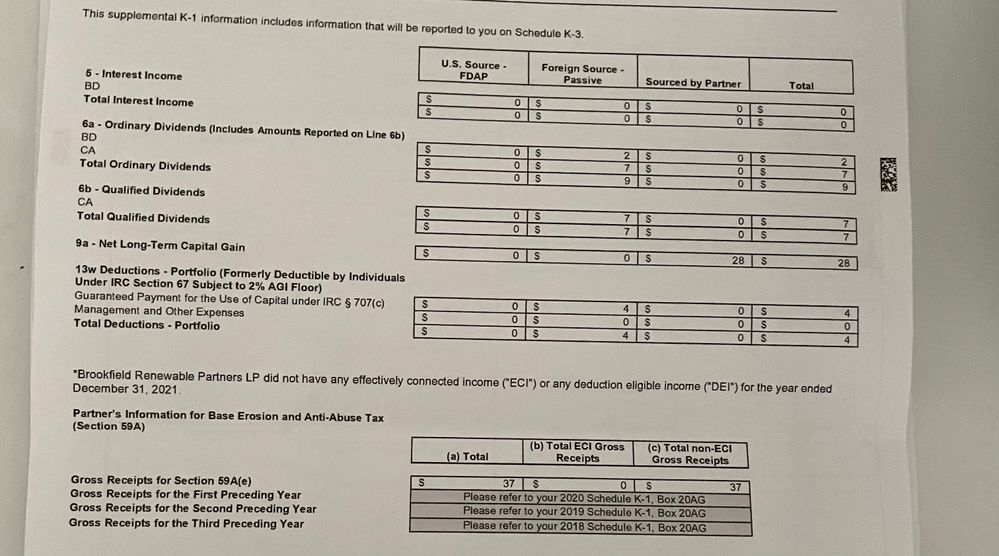

Hi @PatriciaV , can you please let me know if I have foreign assets or income from this K-1 Supplement Information? Also, my k-1 Box 20 has A and AG. Box 21 has no value. Based on this info, am I exempt to file K3 for year 2021? Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

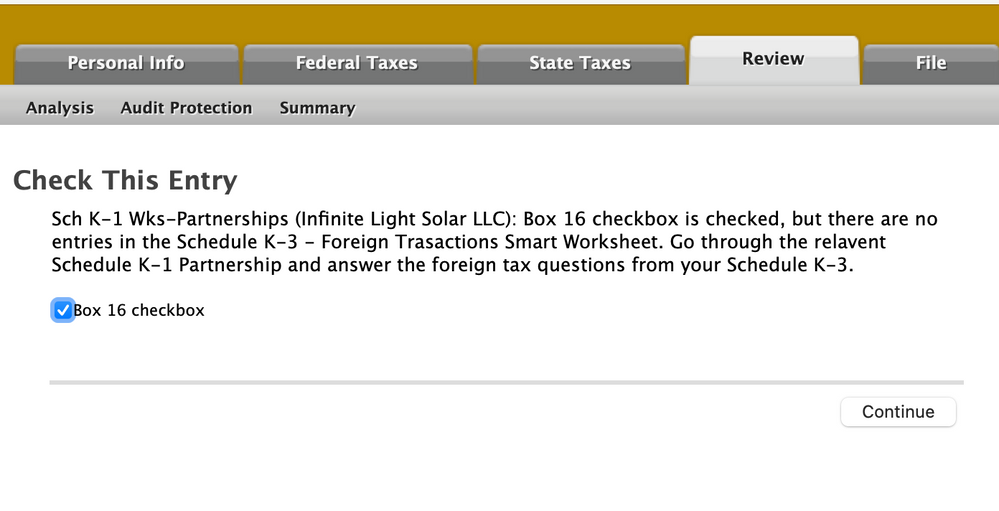

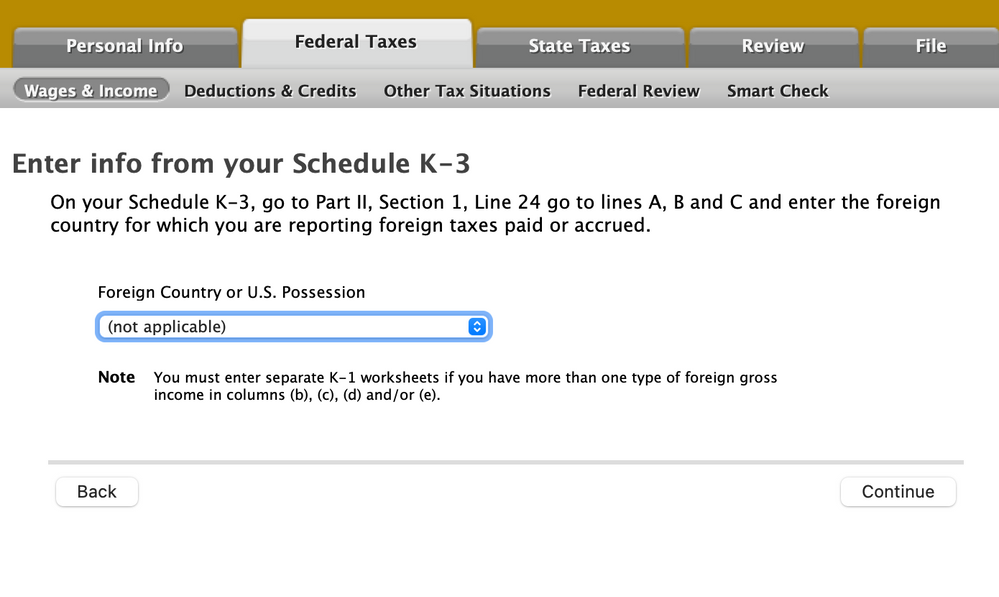

I'm having a different issue. The K3 is all US based. So the subsequent questions regarding K3 are all empty (box b, c, d, e, etc). I only have A (US) row filled.

So now TurboTax is flagging it as an error. How do I proceed?

I have to select "not applicable" for the Foreign Country or US Possession because there's no USA in the list.

Did I do something wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

Having the same issue here, my attached K-3 only lists a single entity (US) as the foreign country or US possession. Since this would indicate there are no foreign taxes paid/accrued can I simply uncheck box 16 and file? Or does TurboTax plan to add the US to the list and handle those inputs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

@strayshot If you are certain that the US is the only country then the box was checked in error. Uncheck it and file the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

@RobertB4444thank you! that was what I thought but great to have confirmation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

In schedule K-1, box 16 is checked (k-3)

Having the issue here, my attached K-3 only lists a single entity (US) as the foreign country or US possession.

the foreign country or US possession; US IS NOT AVAILABLE TURBO TAX

So, on my schedule K3, part 2, line 24 and fill out the total gross income $1797

Is show US

But on the turbo tax it shows Foreign gross income $1797

does TurboTax plan to add the US to the list and handle those inputs?

OR SHOULD I UNCHECK BOX 16 ON K1? PLEASE HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

The K-3 is used to report items of international tax relevance from the operation of a business. If there is no international income then you can uncheck box 16 and e-file your return.

However, you want to make sure you will not be receiving a K-3 at a later date that will include international income. If you receive a K-3 at a later date that includes international income, you will need to amend your return to include the corrected K-3.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In schedule K-1, box 16 is checked (k-3), does that mean I cannot e-file with Turbotax? I keep getting message saying k-3 will be available in future release.

THANK YOU

can I ask you a question

on schedule k-3 part 2 section 1 line 24 shows US source income of $1797

but on turbo tax (foreign gross income - gross income from all sources (collum G )

do I need to enter $ 1797 or just leave it alone since this is not a foreign income?

thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

spunky_twist

New Member

ekudamlev

New Member

DavidRaz

Returning Member

Greenemarci2

New Member