- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: importing 1099-consolidate from eTrade

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

I got message “E-trade Security” 1099 forms not available at this time. Maybe 1-2 days

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

when will this issue be resolved ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

when will you have the e-trade nonsense fixed this is absurd

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

this does not work please fix the issue and provide better service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

Finally working!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

concur. My download worked too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

Happy to hear it is working today!

Please let us know if we can assist you further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

I'm all set with ETrade now too...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

2/21/2023

I can"t download my consoloditated Etrade 1099-B!

How is everyone doing it! Mine will only download as a .pdf not .txf

Please help!

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

It just worked!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

You do it from inside TurboTax. It sucks it in directly from E*TRade in the proper format. It also pulls any 1099-DIVs, INT, etc. Sounds like you are downloading directly from your E*Trade account instead of from within TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

How are you even finding etrade? I can't find that or Morgan Stanley Domestic Holdings in my list.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

E*Trade Securities is right on the main page.

On search, you can add Morgan Stanly Wealth Management and Morgan Stanley StockPlan Connect. If you are not able to import, it means your account is under a different Morgan Stanley entity. In that case, type the info in yourself.

To type the info in yourself:

- Choose Enter a Different Way on the screen "Let's import your tax info"

- Select Dividends, then Continue

- On "How would you like to upload your 1099-DIV?" choose Type it in myself

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

I can view and download my 1099 from Etrade but when I tried to import on Turbo tax, it does not work.

I keep getting the message "there are NO tax accounts associated with user name". If you fee this in an error, please view your official tax record on etrade.com" which I can view them on etrade.

However, I closed my brokerage account with etrade in late 2022 but still have the IRA. Since I closed my account but I still have the 1099 consolidated, Can I import the form or NOT?

It will take forever for me to manually enter 1099 into Turbor tax. Is there a solution for this?

Thank you for letting me know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099-consolidate from eTrade

There may be two options available to you.

Does ETrade generate a .csv file of your 1099-B information? It may be possible to upload a .csv file by following these steps:

- Go to Federal / Wages & Income / Your income / Investments and Savings.

- Click Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other.

- Click Add investments.

- At the screen Relax. We got it, click Continue.

- At the screen Let’s import your tax info, click Enter a different way.

- At the screen OK, let’s start with one investment type, select Cryptocurrency. Click Continue.

- At the screen Select your crypto experience, select Upload. Click Continue.

- At the screen What’s the name of the crypto service, select Other and enter Etrade and select Gain/Loss or 1099-B.

- Click Continue.

- At the screen Go ahead and upload your crypto CSV file, upload the file.

The second option is that you may elect to report summary information and upload the 1099-B in .pdf format.

Your brokerage statements should include a summary of your transactions, grouped by sales category, for example, Box A short-term covered or Box D long-term covered.

You will enter the summary info instead of each individual transaction. Follow these steps.

- Open or continue your return.

- Select Federal down the left side of the screen.

- Select Wages & Income down the left side of the screen.

- Select Show more to the right of Investments and Savings.

- Select Start / Revisit to the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2021?

- If you land on Your investments and savings, select Add investments.

- At the screen Relax. We got it, select Continue.

- On the Let's import your tax info screen, select Enter a different way.

- On the OK, let's start with one investment type screen, select Stocks, Bonds, Mutual Funds, then Continue.

- At the screen Which bank or brokerage, enter the information.

- Do these sales include any employee stock, enter No.

- Do you have more than three sales, enter Yes.

- Do these sales include any other types of investments, enter No.

- Did you buy every investment listed, enter Yes. Continue.

- On the screen Now, choose how to enter your sales, select Sales section totals. Select Continue.

- At the screen Look for your sales on your 1099-B, select Continue.

- You will now be able to enter the total proceeds (sales) and cost basis, along with the sales category. Refer to your IRS form 1099-B, IRS form 8949 and / or Schedule D Capital Gains and Losses for the amounts and category. When finished, select Continue

- You can add additional sales totals by selecting the Add another sales total on the Review your sales section totals screen.

- When completed, close the record and click Continue.

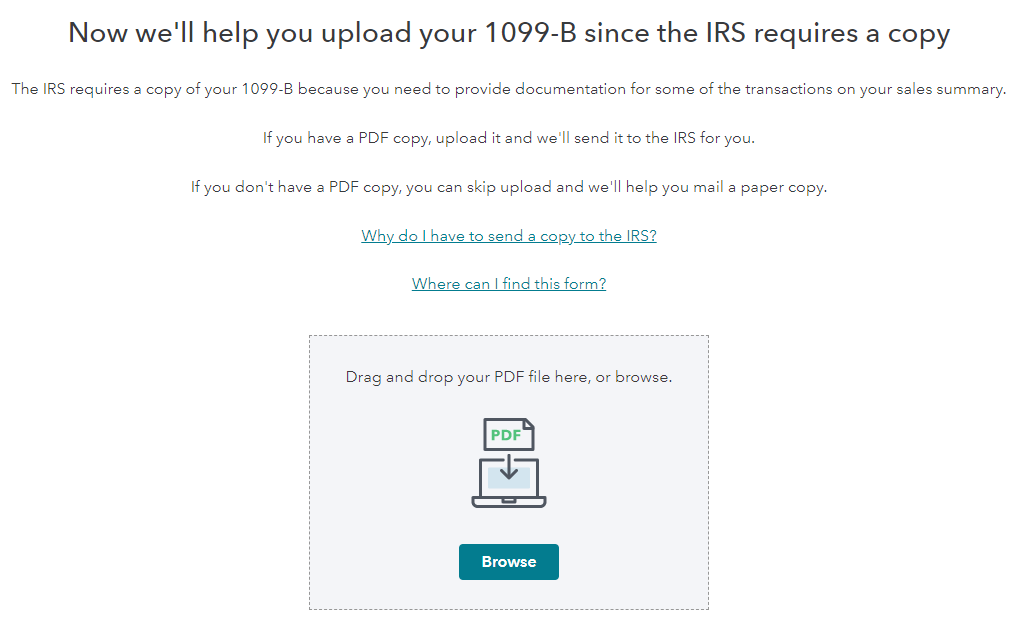

- At the screen Now, we'll help you upload your 1099-B since the IRS requires a copy, browse and select your document. Select Continue.

- When you upload your document, your filing instructions will not show that anything needs to be mailed in, and no IRS form 8453 will be generated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

melissapugs1234

Returning Member

spacenet2000

New Member

anastrophe

Level 3

srinisubyahoo

Level 1

dvwilkie

Level 3