- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: If you have income in Box 6, for medical and health payme...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc, medical and health care payments

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc, medical and health care payments

If you have income in Box 6, for medical and health payments, follow these instructions to enter into TurboTax:

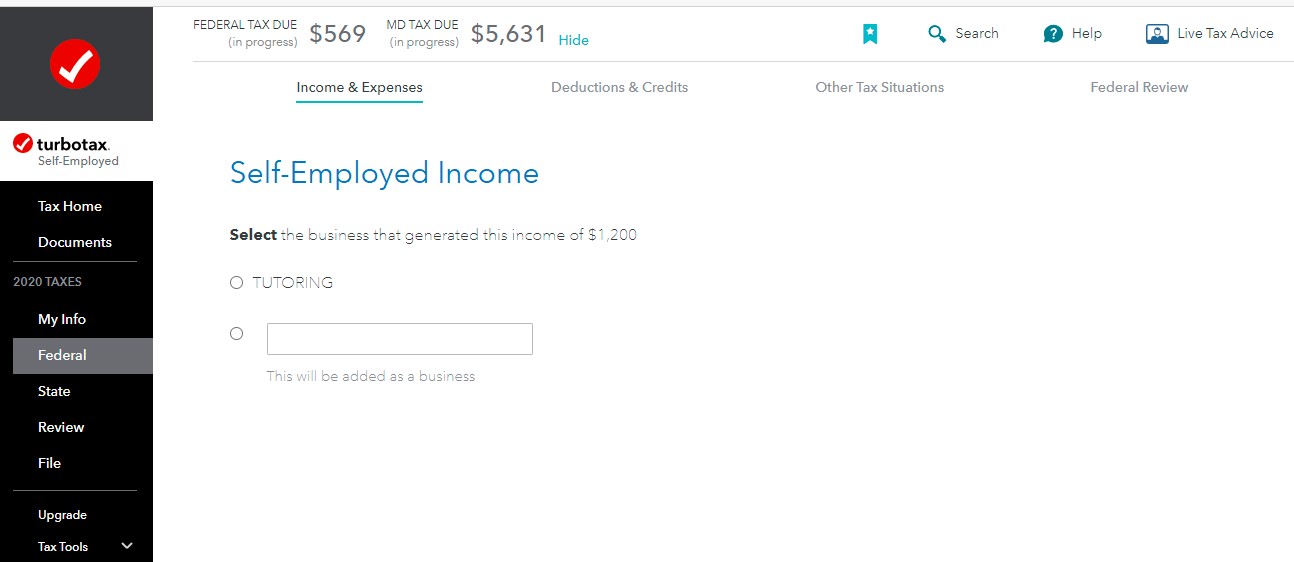

Sign in and click Take Me To My Return if not already signed in to your return.

- Federal (left side menu) >>

- Wages & Income (top menu) >>

- I'll choose what I work on OR Show all Income types >>

- Self-Employment >>

- Answer YES to the 'Did you have self-employment income and expenses?' question >>

- Continue through the business set-up screens/interview >>

- Click on 'Looks Good' after reviewing your general business information (make edits if needed) >>

- Choose 1099-MISC when you get to the income entry >>

- Under box 7, you may need to put a checkmark in the box that says 'My form has other info in boxes 1-18' in order to view the entire form. See image below.

****You can also enter the amount in Box 7 instead of Box 6, as TurboTax and the IRS treat Box 6 and Box 7 income the same (self-employment). The entry process is the same as the above instructions.

The only reason its not in Box 7 is because of the line of work you are in. The IRS just requires medically-related income to go in that box. Per their own instruction, the income goes on Schedule C. Medical payments can be reported in Box 6 or 7 on your tax return since the result will be the same.

[Updated for new TurboTax version on 02/08/18]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc, medical and health care payments

If you have income in Box 6, for medical and health payments, follow these instructions to enter into TurboTax:

Sign in and click Take Me To My Return if not already signed in to your return.

- Federal (left side menu) >>

- Wages & Income (top menu) >>

- I'll choose what I work on OR Show all Income types >>

- Self-Employment >>

- Answer YES to the 'Did you have self-employment income and expenses?' question >>

- Continue through the business set-up screens/interview >>

- Click on 'Looks Good' after reviewing your general business information (make edits if needed) >>

- Choose 1099-MISC when you get to the income entry >>

- Under box 7, you may need to put a checkmark in the box that says 'My form has other info in boxes 1-18' in order to view the entire form. See image below.

****You can also enter the amount in Box 7 instead of Box 6, as TurboTax and the IRS treat Box 6 and Box 7 income the same (self-employment). The entry process is the same as the above instructions.

The only reason its not in Box 7 is because of the line of work you are in. The IRS just requires medically-related income to go in that box. Per their own instruction, the income goes on Schedule C. Medical payments can be reported in Box 6 or 7 on your tax return since the result will be the same.

[Updated for new TurboTax version on 02/08/18]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc, medical and health care payments

In the past my client has listed the medical and health care services I provide in the nonemployee compensation box. For 2020, for whatever reason, they put it in the Medical and Health care payments box. When I moved the amount from nonemployee compensation to Medical and Health care payments, my refund shot up like a rocket! When I looked at the Schedule C, it had not counted all of that income as taxable!!!!! This is WRONG! What is going on??????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc, medical and health care payments

If you added the 1099-MISC Medical Payments but have not completed the Schedule C business section, the refund will be higher because TurboTax does not have all of the calculations. After you enter all the business information, the refund will be more accurate.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

georgiesboy

New Member

kac42

Level 2

xiaochong2dai

Level 3

amy

New Member

jenneyd

New Member