- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

If this is your only wash sale, keep in mind that you could leave this cell blank. The IRS does not require you to report amounts under $0.50.

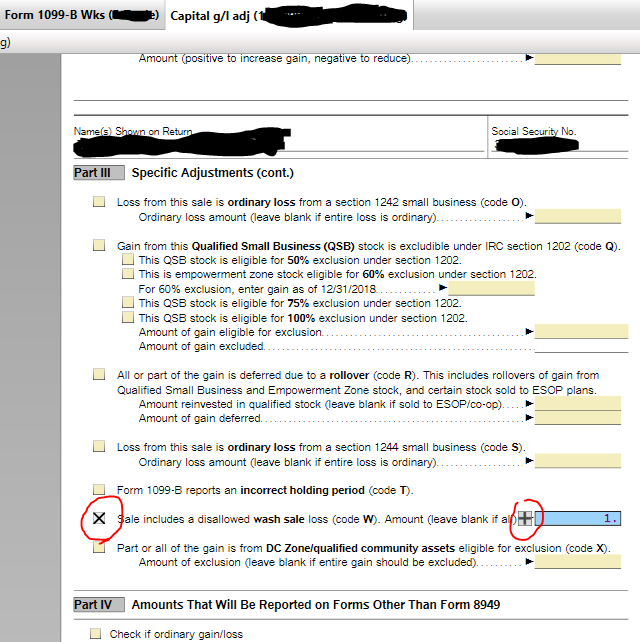

If you do want to adjust it to accurately capture what you received on your statement, then return to Part III of your Capital Gain (Loss) Adjustments Worksheet. Scroll down and follow these steps:

- Check the box Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

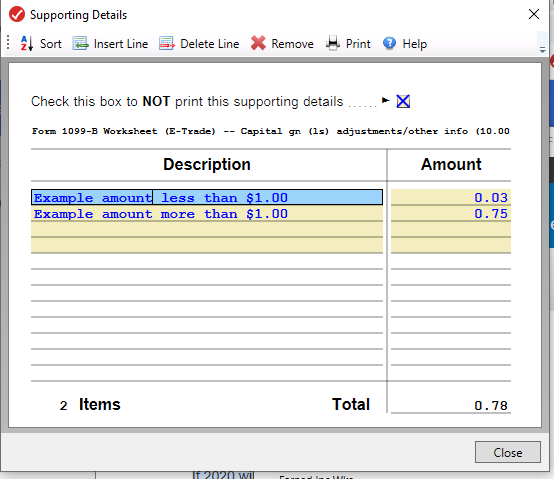

- Click inside the cell for the amount. This should immediately give you a + to the left of the cell.

- Click the + to enter your details.

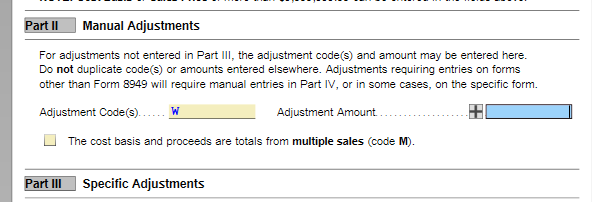

Alternatively, if nothing is in Part III for the wash sale, use Part II for Manual Adjustments. Enter Code W and enter the amount in the same manner as the steps above.

I have tested this and it does take amounts less than $0.50.

See the screenshots:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

Thank you for the information. I have tried the suggestions and have not been able to resolve the issue. I tried to enter "W" in the manual portion and the "X" in the box in part III still remained. This is the only error keeping me from e-filing. Anyone with the same problem, please send help!! Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

Since the IRS allows you to round to the nearest dollar, amounts under $0.50 could be considered as zero.

If TT is not allowing you to enter zero for the adjustment, then I'd just not enter the adjustment at all.

I can't give you legal advice, but if I could, I would absolutely guarantee you that if you don't intend fraud, the IRS will not send a SWAT team to your house to find out why you didn't report a 30-cent adjustment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

I have tried everything to change the amount in the box for the Wash Sale in Part III. Can't. Even went to the form 1099 for this Worksheet. Didn't know what to change to make this 'X' go away. My only solution may be to print my return and mail it, making Turbo Tax useless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have a wash sale amount of .3 but the from does not accept this as a valid number, and it does not let me leave it blank. How do I remedy this issue?

NOT HAPPY WITH TURBO TAX. NO WAY TO CONTACT TURBO TAX.!!!! NOT HAPPY!!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mmcdono7612

New Member

Laniegirl

New Member

brenda-lawson28

New Member

lagustaf

New Member

Thomas-nancy0

New Member