- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If this is your only wash sale, keep in mind that you could leave this cell blank. The IRS does not require you to report amounts under $0.50.

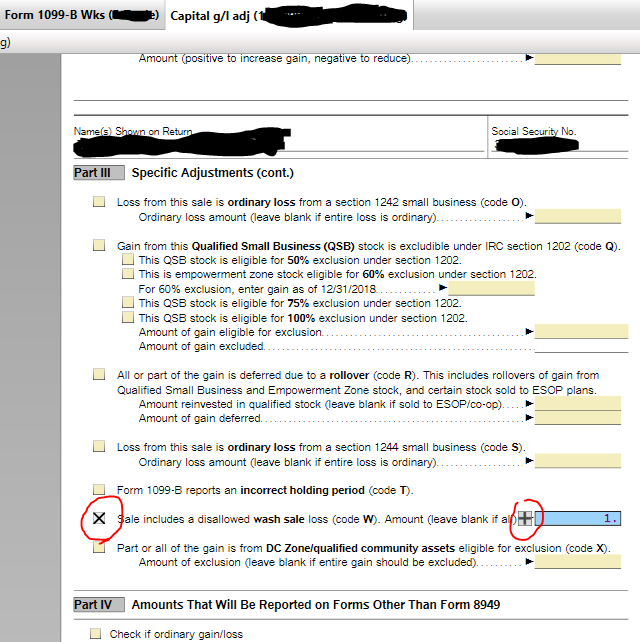

If you do want to adjust it to accurately capture what you received on your statement, then return to Part III of your Capital Gain (Loss) Adjustments Worksheet. Scroll down and follow these steps:

- Check the box Sale includes a disallowed wash sale loss (code W). Amount (leave blank if all)

- Click inside the cell for the amount. This should immediately give you a + to the left of the cell.

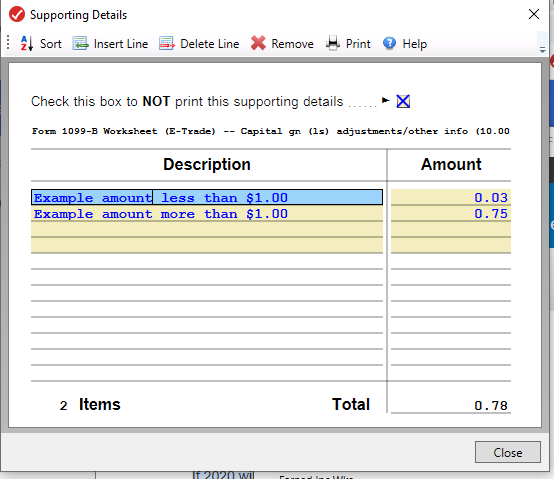

- Click the + to enter your details.

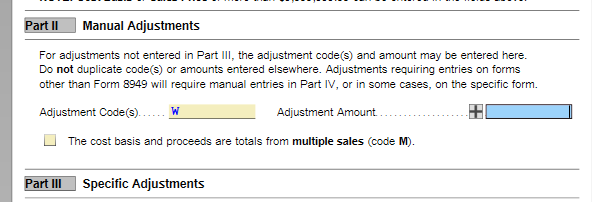

Alternatively, if nothing is in Part III for the wash sale, use Part II for Manual Adjustments. Enter Code W and enter the amount in the same manner as the steps above.

I have tested this and it does take amounts less than $0.50.

See the screenshots:

February 24, 2021

9:45 AM