- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

Here's a link to the list of NY error codes & their meaning: https://www.tax.ny.gov/pit/efile/errorcodelistingty2016.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

Thank you! But how do I fix it? The system tells me theres an error but it doesn't tell me where the error is or let me fix it. When I click 'fix it' it brings me straight to the page to resubmit my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

I don't know if this will work for you, but here's what I'd do in your situation. First, I would carefully review my return to make sure I haven't made any incorrect entries. If the return is correct, and if TurboTax is telling you that it can't find any errors and that you should resubmit, I would just go ahead and resubmit - even if you haven't changed anything.

Then, if your return is rejected again, and neither you nor the program can find any errors, I'd print it and mail it in - on the theory that your e-file attempts are running into a computer glitch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

"..it is your job after all.."

This is a user-to-user forum. I am not a TurboTax employee. Just one user trying to help another.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

That NY reject code R0102 says "A computational error occurred in calculating the Federal Adjusted Gross Income on return."

But since that is done automatically by the program, I'm not sure how to fix that.

Did federal return get accepted?

You may have to end up calling support about this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

If you made no changes to your original return, and now it's being accepted, then apparently NY was previously rejecting a correct return. Sounds like the problem lay with NY, not with TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

Hello!

Thank you for all the responses and solutions. I live in Taiwan so I couldn't call support. I ended up FaceTiming my mom while she talked with support for me. The lady from support said that efile should not be an option for me since I'm out of the country and she didn't know how I got my federal return accepted in the first place. The "computational error" was because of my location. She suggested to submit one last time (which she didn't think would actually go through), and if it still didn't go through, to mail it in. I resubmitted and it was accepted.

When I put my address in and checked the foreign address box, there should have been some type of warning.

Again, thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

- we've been TTax users since '95 (for lack of anything better, NOT because we love it; we renew our Annual resolution never to use it again every April :-),

- after acceptance by Federal and another state, we recd. the NY rejection along with R0102 error,

- the most current NY error_code listing appears in one the hits for this search - https://search.tax.ny.gov/search?q=efile+error+codes&btnG=submit&ie=&site=NYSDTF&output=xml_no_dtd&c...

- sure enough, the relevant part is -

R0102 IT-201/X / IT-203/X line 19 / 19 - A computational error occurred in calculating the Federal Adjusted Gross Income on return.

- looking at IT-201 , line 19 = line 17 - line 18; on the native file (.tax2018 ) line 18 is blank, whereas on the generated pdf, 18 filled in with .00 ,

- since our 2017 returns show identical numbers on line 18, my hypothesis is that starting 2018, NY state's back-end DISallows blanks for line 18 and throws an exception/ error,

- we'll check with Albany in a couple of days; if their response is only as rapid as Intuit's, I'll try to RE-eFile (a what-if attempt to override line 18 in TTax is met with "you canNOT eFile with overrides" warning,

- we might have to follow thru' with THIS year's April resolution !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I've gotten 2 emails with notices that my New York state return has been rejected but there aren't any step in Turbo Tax to fix it. Reject Code: R0102. What does it mean?

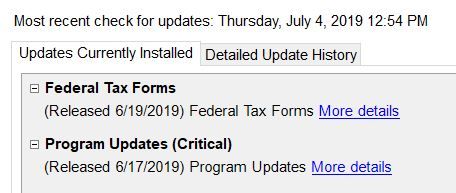

TomDB - Pinning the blame with NY and absolving TT of any defect might be true ONLY if NO TTax software update was applied across multiple eFile attempts!

this also begs the questions, why does Intuit:

- issue critical updates TWO months after 4/15,

- NOT publicize "critical" updates on their website w/ a ticker_tape that's hard to ignore

- add broken/useless links when trying to see More details at

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

loreyann

New Member

munozmm23

New Member

earnieebarniee16

New Member

dortiz445012

New Member

doubleO7

Level 4