- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I paid income to independent contractors and need to issue 1099 misc to hem and file with IRS, can you hlep me do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid income to independent contractors and need to issue 1099 misc to hem and file with IRS, can you hlep me do this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid income to independent contractors and need to issue 1099 misc to hem and file with IRS, can you hlep me do this?

You need to give a 1099NEC (previous a 1099Misc) to anyone you paid $600 or more to for the year. But not to corporations or for merchandise. You send the IRS a copy of the 1099Misc with the transmittal summary form 1096. These are due to the person by Jan 31 and to the IRS by Jan 31 also.

Starting in 2020 they added a new 1099NEC form to replace the 1099Misc. If you are using the Online Self Employed version or Desktop Home & Business program or Business program you can use Turbo Tax.

For Online Self Employed version,

Log into your account

Scroll down to Your Account and click on Show

Click on Create W-2s and 1099s

In your return, Anywhere on any screen you see....

Help me prepare and file W-2s and 1099s

Click on it and the side box will open, Then click on Quick Employer Formsin the side box.

Or from the Account Screen it will take you directly to Quick Employer Forms

See my answer with screen shots at the very end of this thread

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid income to independent contractors and need to issue 1099 misc to hem and file with IRS, can you hlep me do this?

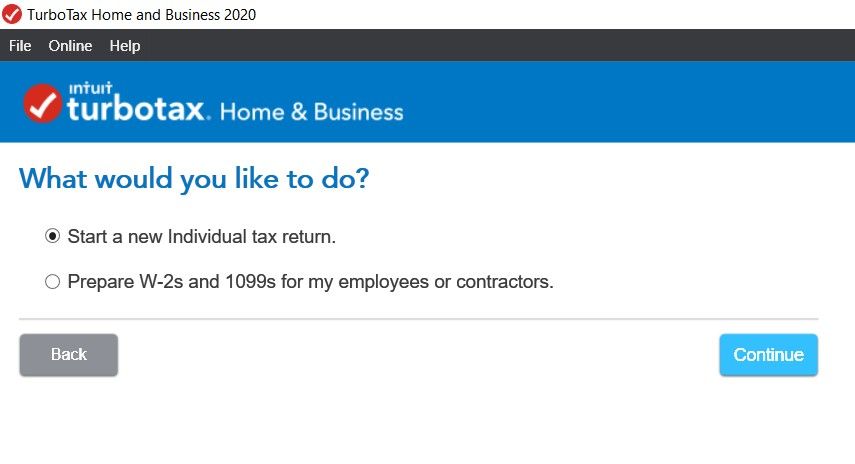

You need TT Home and Business to do this. It has the 1099 Misc built into it as a separate module. This was the only reason I ever bought TT H&B. When you open the program it will ask you if you want to start a new return, select that and then (see image) select Prepare W-2's and 1099's . . .

The Turbo Tax Self Employed version might also have this feature. I'm not sure.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lkjr

New Member

TMM322

New Member

user17552101674

New Member

user17539892623

New Member

wcrisler

New Member