- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have to file an out of state return for some unemployment received in 2022. it's getting re...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Can you clarify which state? @flowerpicker62

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Yes and thank you for reaching out.

It's for the state of Arizona

See the attached screenshot I took of this portion of the state return.. if I go and put the same amount of $4,560 then when I get towards the end of the return process it's showing double the amount I was paid for unemployment and that's not accurate.. when I zero it out then it makes it look like I have no tax liability and I know for a fact that I do..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Actually the screenshot I just showed you is not the area that I was referring to and unfortunately I didn't take a picture of that area

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

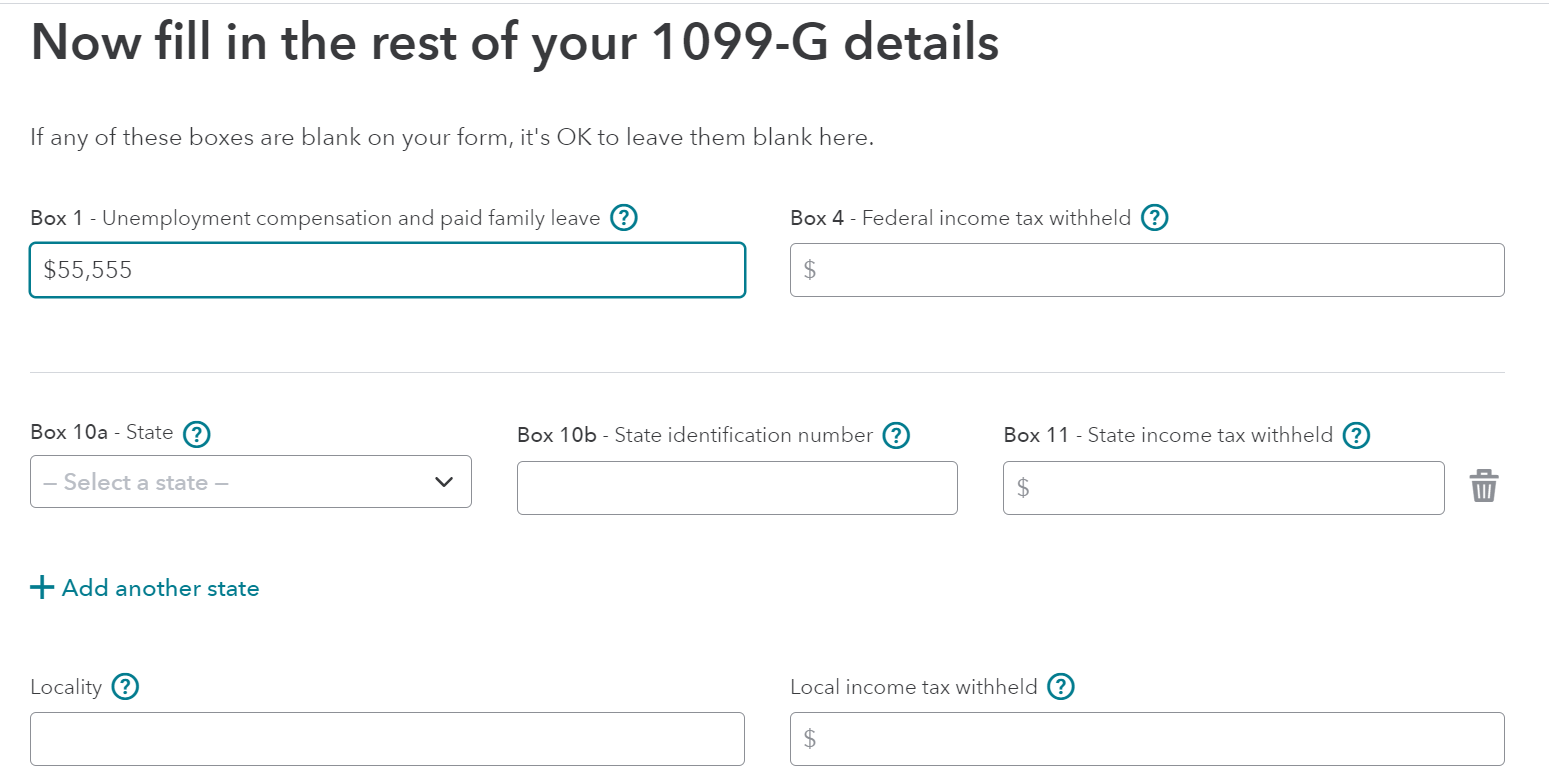

Two things to check: In the Federal part, go to your 1099-G and make sure there is no entry for State or Locality. (see below)

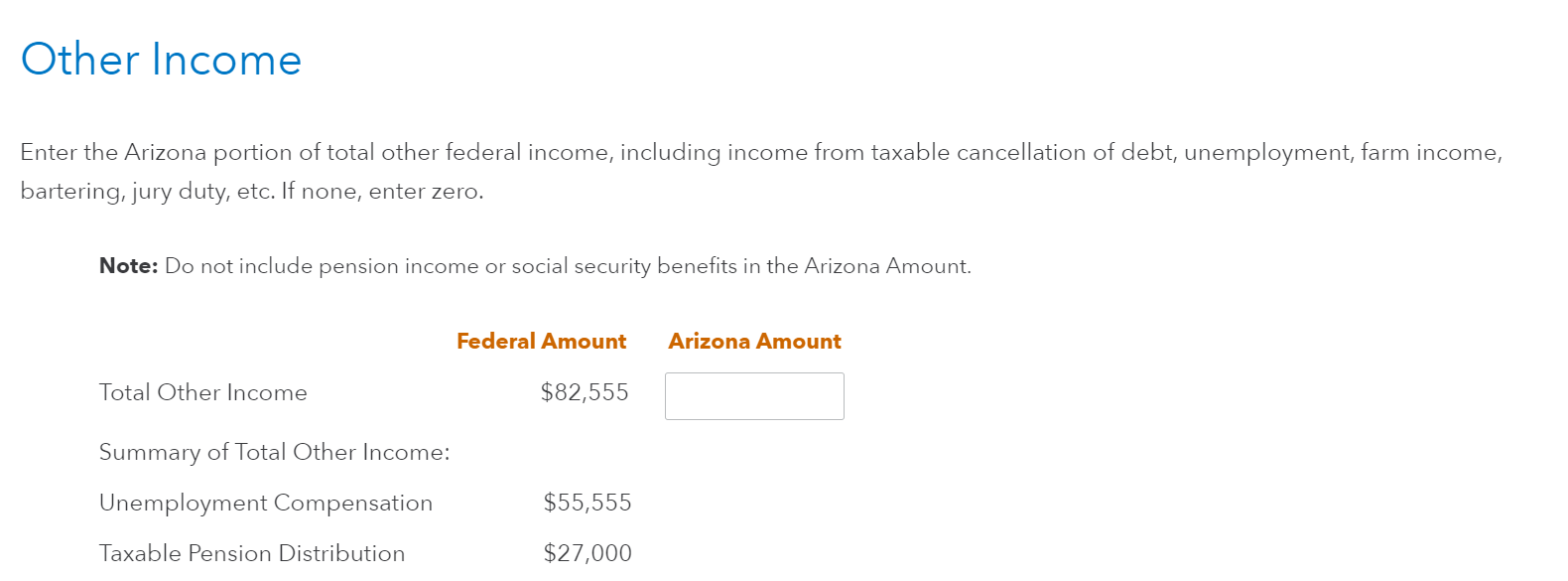

Next, in the Arizona state tax section, look for the screen to indicate Arizona income (see below). Post if you have these and it's still not working please.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Those are the exact two areas that I'm having challenges with and I've tried it so many different ways.

So I received in letter format a 1099-G copy b from Arizona department of economic security.. which shows my total unemployment compensation as well as the federal income tax withheld but zero for state income tax withheld so I know that I have to pay some taxes on that $4560.00

So would not having an official 1099-G type of format that were all used to I'm assuming there's no locality and so I left that blank. So even if I had it there would not be anything listed in 10A or 10 b or 11.. And therefore the box below that for locality I left blank.

Moving on to the second image that you provided.. mine of course looks just a little bit different because I only have two income entries which is some W-2 earnings and then the unemployment earnings then I also have the box to the right with the label Arizona above it.. but if I put the exact same amount in that Arizona box that's already in the left column for unemployment then it makes it look like double earnings for the state of Arizona and that is not the case. Initially when I did the return my tax liability was $29.. but if I go and put the same amount of 4560 in that box under the word Arizona then it ends up doubling my tax liability to $58.

I'm not sure what else to do here to resolve the rejection other than just signing and dating a hard copy of the completed part your resident return and putting it in the mail to them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

I took a screenshot of the error that I'm getting please take a look at that

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Here are two or more attachment images to look at

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

And in final here is another section that I had to mark yes or no to and I selected no.

I also did pay income tax to the state of California but not for any unemployment it was just those W-2 earnings that were earned in the state of California.

Potentially the first bullet point might be applicable or not??? The question is a little bit confusing

See attached

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

I did give half a thought to the resident state because Arizona is a reverse-credit state but specifically because you have California, which as you said does not tax the unemployment so there is no credit to factor. Try leaving the space blank and go to your Arizona tax summary (How do I preview my TurboTax Online return before filing?) - this should show if the income is on the return. @flowerpicker62

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

Appreciate you trying to help me.

Since I have already filed fed, cal state returns, I am no longer able to go to "tools" as that is not an option for me any longer.

I really don't know who to resolve this in turbo tax system, so I think I need to just live sign/date the AZ return and mail it to them with a check , but I have also already been charged by turbo tax the $39 e file fee, I guess I can call customer service and get a refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have to file an out of state return for some unemployment received in 2022. it's getting rejected due to nothing entered in locality, nothing there on the 1099G

You are correct. You will need to print and mail it in, and for assistance with a refund, please reach out to our TurboTax Customer Care team: Contact Us

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mrboobearsh

New Member

CWP2023

New Member

garne2t2

Level 1

mmack3388

New Member

duttchez27

New Member