- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: I have entered info as found on two different 1099-NEC forms. Within this tab I see the info ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

Make sure you continue through the screens as you enter the information to ensure they are being pulled in correctly.

Log back into TurboTax and go to the Federal interview section.

- Select Income & Expenses

- Go to the All Income section and select Other Common Income

- Select Form 1099-NEC

- Proceed through the screens to enter/review your input so far. Make sure to answer all of the questions to ensure the income is classified correctly.

You can also view your tax summary by following the steps below to ensure your income is picked up in your return.

In TurboTax, you can view your tax summary for your 2020 tax return by doing the following:

- Go into the black panel on the left and select Tax Tools.

- Then select Tools beneath Tax Tools.

- A "Tools Center" box will pop up, select "View Tax Summary"

- You will see a screen that gives a snapshot of your taxes based upon your input so far.

- Click on the black panel on the left bar and select Preview my 1040

- This will allow you to review your overall line items on your federal tax return.

After you review the above items, simply select "Back" in the black panel to get back to the interview forms.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

JotikaT2,

I told the software that this income reported on 1099-NEC should have been reported on a W-2. The software tells me that I need to fill out SS-8 and file Form 8919 when I file my return. The owner of the 1099-NEC thinks she is a contractor and not an employee of the entity that issued the 1099-NEC forms. Taking this action does cause the compensation shown on these two 1099-NEC's to show up as income on my summary which is what I am after. Is this the correct move or not?

DVM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

"I told the software that this income reported on 1099-NEC should have been reported on a W-2"

Why? You said that "The owner of the 1099-NEC thinks she is a contractor and not an employee of the entity that issued the 1099-NEC forms." Don't you think she knows if she is a contractor or not?

If she is indeed a contractor, then she doesn't need an SS-8 or an 8919.

"my summary" Your summary? Are we talking about doing "her" tax return or your tax return?

The income amounts from the 1099-NECs should appear on her Schedule C. If they do, then that's good.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

Bill M,

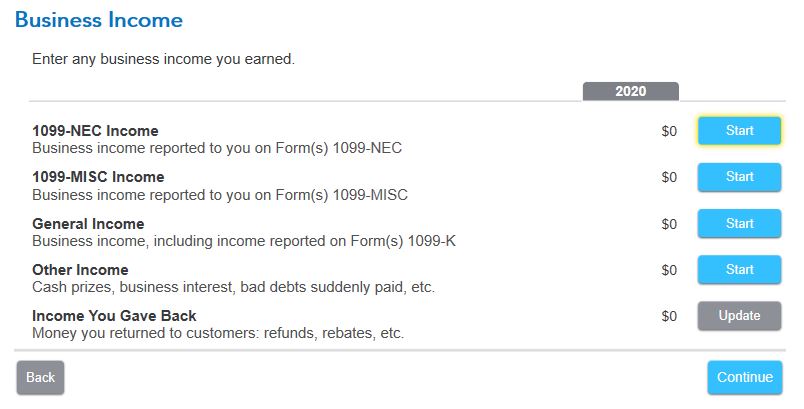

The issue I have is that the income shown on the 1099-NEC does not appear to be rolling back into our total wages. I had entered two 1099-NEC forms and I see everything when I am in the form. When I back out to the Federal Income Screen in Turbo Tax I see $0.00 for 1099-NEC.

I am trying to find a way to insure that TT is pulling and considering these two 1099-NEC in our joint return using TT-self employed.

David

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have entered info as found on two different 1099-NEC forms. Within this tab I see the info but when I back out of the "Edit/Add" section I see $0.00 Why is this?

Delete the 1098 forms that are not pulling through as they should. There are several places to enter the form. Do this:

- Go into the business.

- Go to the income section.

- Enter the 1099-NEC inside the business in order to connect it all.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

seple

New Member

ekudamlev

New Member

kkrana

Level 1

ke-neuner

New Member

TMM322

Level 1