- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

That part is not ready yet.

CARES Act retirement plan COVID-19 related distributions can be paid back over 3 years or the tax spread over 3 years.

That is reported on a new 8915-E form that is not yet available and there is no estimated release date since the form is still in the draft state at the IRS. There is no telling how long it will take the IRS to make the electronic form available. Typical it takes the IRS 2-4 weeks to release the electronic form specifications after the paper version is released. e-file providers must program from the electronic specifications.

The draft paper form is here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Also to see if you qualify for a COVID-19 related distribution see:

https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-...

Quote:

Q3. Am I a qualified individual for purposes of section 2202 of the CARES Act?

A3. You are a qualified individual if –

You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019 (COVID-19) by a test approved by the Centers for Disease Control and Prevention;

Your spouse or dependent is diagnosed with SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

You experience adverse financial consequences as a result of being quarantined, being furloughed or laid off, or having work hours reduced due to SARS-CoV-2 or COVID-19;

You experience adverse financial consequences as a result of being unable to work due to lack of child care due to SARS-CoV-2 or COVID-19; or

You experience adverse financial consequences as a result of closing or reducing hours of a business that you own or operate due to SARS-CoV-2 or COVID-19.

Under section 2202 of the CARES Act, the Treasury Department and the IRS may issue guidance that expands the list of factors taken into account to determine whether an individual is a qualified individual as a result of experiencing adverse financial consequences. The Treasury Department and the IRS have received and are reviewing comments from the public requesting that the list of factors be expanded.

End quote

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

So this seems unfair to taxpayers who took distributions assuming they'd be able to spread them out and also, take the penalty free. If the IRS and tax filing firms don't even have the forms available, how are we supposed to file our taxes? And when Congress is telling people to file early to get new COVID relief how can we do this if the IRS isn't even ready? What a joke.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

Feb 24 still no update with turbotax home and business. I assisted a family member who used freetaxusa over a week ago and that website was prepared to process cares act 401K cashouts as penalty free and spread over 3 years. Disappointed I bought turbotax and I am waiting while my friend got better service for free. Turbotax engineers, please run through freetaxusa and see how they handle it because he already got his tax refund completed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

At this point and time the Form 8915-E (Qualified 2020 Disaster Retirement Plan Distributions and Repayments (Use for Coronavirus-Related Distributions)) is not finalized. The 8915-E Form is projected to be e-fileable starting 02/26/2021. Please see the FAQ link posted below for more information:

Why am I getting getting a 10% penalty on my 1099-R when I withdrew fund during Covid? (Form 8915-E)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

Will Turbo Tax also be able to spread the Coronavirus Related Distribution over a three year period for those states that conform to the Federal IRC updates?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

I know it seems to be out of TT’s hands but why are other programs approved by the irs for the cares act special provisions? I don’t want to give a commercial for other programs but I used another “free” program last night and they prepared my taxes including schedule c and processed the cares (Covid) 401k withdrawal in accordance with the law. I wish I wouldn’t have spent $70 on Amazon for TT then waited 3 weeks for the program to be approved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

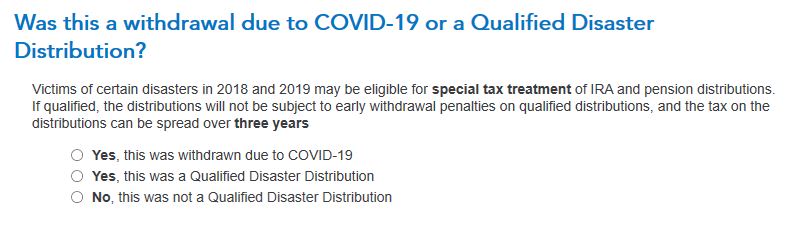

@Ezzo88 TurboTax does allow you to spread your pension plan distribution over three years if you qualify for Covid relief. You will see an option for this after you enter your form 1099-R in TurboTax.

You will see this screen in TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

There is still a problem in the software because on the page where TT asks if I want to spread the early IRA distribution over 3 years, it doesn't pickup from previous entries how much the early distribution was.

In the "script" it has $0 as the early IRA distribution, even though that is obviously not the amount based on my previous entries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

@usaroberts wrote:

There is still a problem in the software because on the page where TT asks if I want to spread the early IRA distribution over 3 years, it doesn't pickup from previous entries how much the early distribution was.

In the "script" it has $0 as the early IRA distribution, even though that is obviously not the amount based on my previous entries.

The distributions is the 1099-R box 1 or box 2a amount.

[edited to correct typo]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

In my case, I am dealing with 1099-R's.

Box 1 has an amount. Box 2A has the same amount. Box 7 code is 01, and the IRA/SEP/Simple box is ticked.

I followed all the new questions about Cares act eligibility in regards to whether the withdrawal falls under the CARes act requirements and itr does. Its just at that last page where the software asks about wanting to spread the distribution over 3 years or take the tax hit this year but the software doesn't pickup that amount of the distribution that has already been inputted, so the inputs on that page don't make a difference. The software has correctly removed the 10% penalty, but it seems like there is more work to update the software in regards to the 3 year spread or take tax hit for 2020 page inputs.

Hope that makes sense

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

@usaroberts wrote:

In my case, I am dealing with 1099-R's.

Box 1 has an amount. Box 2A has the same amount. Box 7 code is 01, and the IRA/SEP/Simple box is ticked.

I followed all the new questions about Cares act eligibility in regards to whether the withdrawal falls under the CARes act requirements and itr does. Its just at that last page where the software asks about wanting to spread the distribution over 3 years or take the tax hit this year but the software doesn't pickup that amount of the distribution that has already been inputted, so the inputs on that page don't make a difference. The software has correctly removed the 10% penalty, but it seems like there is more work to update the software in regards to the 3 year spread or take tax hit for 2020 page inputs.

Hope that makes sense

Did you repay any of the distribution in 2020? If not, and you did Not check the box to pay tax on the entire distribution in 2020, then 1/3 of the distribution will be entered on your Form 1040 Line 4b as taxable income.

All of the federal taxes withheld and reported in box 4 of the 1099-R will be entered on your Form 1040 on Line 25b as a tax payment.

What is shown on your Form 1040?

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

I didn't repay any amount last year, I did not check the box to pay tax on the entire distribution and on the 1040 form, line 4b shows the full amount of my IRA withdrawal. Box 4 of my 1099-R is $0, and line 25b on the current 1040 shows $0.

I'm pretty sure that Ive answered all the TT questions correctly and I strongly suspect that the software needs updating because its not picking up any of the distribution as any amount, even though the 1099-R's have been entered in the software and checking the box to pay tax on the full distribution versus not checking the box gives the same result.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

@usaroberts wrote:

I didn't repay any amount last year, I did not check the box to pay tax on the entire distribution and on the 1040 form, line 4b shows the full amount of my IRA withdrawal. Box 4 of my 1099-R is $0, and line 25b on the current 1040 shows $0.

I'm pretty sure that Ive answered all the TT questions correctly and I strongly suspect that the software needs updating because its not picking up any of the distribution as any amount, even though the 1099-R's have been entered in the software and checking the box to pay tax on the full distribution versus not checking the box gives the same result.

Are you using the online or desktop version of TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I spread the tax liability of a CARES Act withdrawal over 3 years on Turbo Tax, it is putting all tax liability on this year

Here's a screenshot of the page. Previous entries have confirmed the distribution was eligible for special CAREs act treatment etc.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Navigation

Returning Member

taxbear09

New Member

triman023b

Level 1

jamesjohn94

Level 1

GlennD1

Level 1