- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I enter a backdoor Roth IRA conversion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hi Dana

Thanks for your reply.

These are exact amounts I see in my Form 8606. I made non deducible contributions in 2017, 2018, 2019, 2020 and 2021 to Traditional IRA. Every year (all the 5 times) with in a week, I converted them in Roth IRA to ensure that always the Traditional IRA balance is zero. However in 2020 it so happened that, I contributed to Traditional IRA on Dec 24th 2020 and by the time I converted to Roth IRA it is 2nd Jan 2021. When I filed tax return in 2020, turbo tax expert helped me to make entries such that it will not impact my tax due. But I feel those entries are incorrect. Not understanding what is incorrect there.

FY 2019 Tax Return Form 8606:

--------------------------------------------

Box 1: 6000 Box 2: 11000 Box 3: 17000 Box 14: 17000

FY 2020 Tax Return Form 8606:

--------------------------------------------

Box 1: 6000 Box 2: 17000 Box 3: 23000 Box 13: 12000 Box 14: 11000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

It seems that your Form 8606 for 2017, 2018, 2019, and 2020 are wrong. For the years 2017-2019 the basis on line 14 should be $0 and for 2020 it should be the contribution amount for 2020 ($6,000).

Do you have the lines 6-12 on Form 8606 filled out or a star next to line 13? Also, if you entered the conversion correctly you should have part II of Form 8606 filled out.

Please review the steps to enter the conversion:

- Click "Federal Taxes" on the top and select "Wages & Income"

- Click "I'll choose what to work on"

- Scroll down and click "Start" next to "IRA, 401(k), Pension Plan (1099-R)"

- Answer "Yes" to the question "Did You Have Any of These Types of Income?"

- Click "I'll Type it Myself"

- Choose "Form 1099-R, Withdrawal of Money from 401(k) Retirement Plans, Pensions, IRAs, etc."

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “What Did You Do With The Money” and choose “I moved it to another retirement account”

- Then choose “I did a combination of rolling over, converting, or cashing out money.” and enter the amount next to "Amount converted to a Roth IRA account"

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2020 Form 8606 (should be $6,000) and the value of all traditional, SEP, and SIMPLE IRAs

@sureshr

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Hi,

Thank you for the clear instruction and the multiple options.

I'm having trouble because I made both 2020 and 2021 backdoor Roth IRA contributions in Feb '22 ($7K for each year, totaling $14K). So my 1099-R show $14K and if I enter $14K in the "Deductions & Credits" section for IRAs, in Turbotax, it calculates an over-contribution penalty. Technically, my 2021 contribution was only $7K, but then $7K on my 1099-R goes unaccounted for.

Could you tell me how to handle this? Should I share my file with an agent?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

In addition to my previous question re: making 2020 & 2021 Backdoor Roth contributions in Feb '22, I found that my after-tax IRA/Backdoor Roth contributions in 2019 were not characterized correctly as non-taxable, so I unnecessarily paid taxes on my so-called distributions (in my1099-R). I'd like to amend the return and get the back the money that I shouldn't have paid, but Turbotax 2019 does not have an "Amend my return" option.

Could you tell me how I could get help in amending this 2019 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Except a backdoor Roth conversion IS taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

Whether or not a backdoor Roth conversion is a taxable event depends upon whether or not you have pretax money in IRAs a the time the conversion is done. If you don't have any IRAs with tax deductible contributions or tax deferred gains, then the backdoor conversion is tax free.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I am "Rothifying" part of an existing IRA containing funds which were not added in 2022. (And not taxed when contributed.) Whether the term "Backdoor Roth" is appropriate I do not know.

However, TurboTax Premier 2022 does not appear to handle this. When reporting the income, one is given 2 choices. One being that it is being rolled over, the other is that is being cashed out. If rolled over, it assumes to another standard IRA, not taxable.

If it is being cashed out, it does not offer the option to convert it to a Roth. Trying to identify it as a Roth contribution fails because of income constraints and limits on amounts one can contribute directly to a Roth.

I did this for 2019 using TT, and it worked then. The income should be taxable. The second step to the process is to somehow get to IRA form 8606. TT 2022 does not offer a path for this that I could find, and instructions for how to do so do not work in TT Premier, at least.

However, since TT is unwilling to even acknowledge the problem, I see a work around. I call it a "cash out" to make the IRA withdrawal taxable and make the tax owed correct. I then print the 8606 form and manually fill out Part II (3 lines). (Part I and III don't apply in my case.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

No elaborate work around is required to report the rollover from a traditional IRA to a Roth IRA.

Here is the process:

- Select Federal from the left side menu.

- Select Wages & Income.

- Expand the list and scroll down to Retirement Plans and Social Security.

- Expand the section and click Start to the right of IRA, 401(k), Pension Plan Withdrawals (1099-R).

- Follow the steps to import or enter your 1099-R.

- Watch for the screen titled, "Tell us if you moved the money through a rollover or conversion"

- Pick the second answer, "I converted some or all of it to a Roth IRA."

- On the next screen you can indicate a complete or partial rollover.

- Continue through the end of this section.

If you have non-deductible IRA contributions, you also need to enter your IRA basis in the program to get a correct calculation.

- Select Federal from the left side menu.

- Select Deductions and Credits.

- Expand the list and scroll down to Retirement and Investments.

- Expand the section and click Start to the right of Traditional and Roth IRA Contributions.

- Check the type of IRA accounts you have and then answer the questions about contributions.

- Keep going until you complete the section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I have followed the instructions above, and TurboTax correctly calculates the taxes due on my traditional to Roth IRA conversion (including correctly reducing the taxable amount for the non-deductible contributions I had made to the traditional IRA). However, TurboTax is stating that a penalty of 6% is to be applied because the amount converted to the Roth IRA exceeds allowable limits. My understanding is there are no limits to the amount that may be contributed to a Roth IRA if that contribution in a result of a conversion (albeit income tax on the taxable component of the conversion is payable).

What do I need to do such that TurboTax does not apply the excess contributions penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

It seems you have entered the Roth conversion amount as a Roth IRA contribution. Please delete the Roth IRA contribution entry (keep the entry to the traditional IRA if you made nondeductible contributions for 2022). You only need to enter Form 1099-R to report the conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Review your 1099-R info" screen click "Continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

DanaB27 - Thank you! I went backed an zeroed out my Roth IRA contribution and everything looks good. Perhaps a clarification on the TurboTax instructions would be helpful, e.g., "Did you make any Roth IRA Contributions in 2022 (note, do not include conversions). Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

I am having a very tough time getting my Backdoor Roth contribution to go through correctly without TurboTax Smart Check freaking out. Here is the situation:

1. I opened my Traditional IRA in March 2022.

2. My spouse opened her Traditional IRA a few days later in March 2022.

3. We both made a $6,000 contribution into our respective Traditional IRA accounts a few days later in March 2022.

4. Both of these contributions were made for 2021.

5. We both converted our contributions from our Traditional IRA to your Roth IRA a day later in March 2022.

The 1099-R forms were automatically imported from the brokerage by TurboTax.

I followed all the directions here: https://ttlc.intuit.com/turbotax-support/en-us/help-article/retirement-benefits/enter-backdoor-roth-...

And I check the forms as suggested and everything appears right. But when I go to Smart Check it freaks out saying:

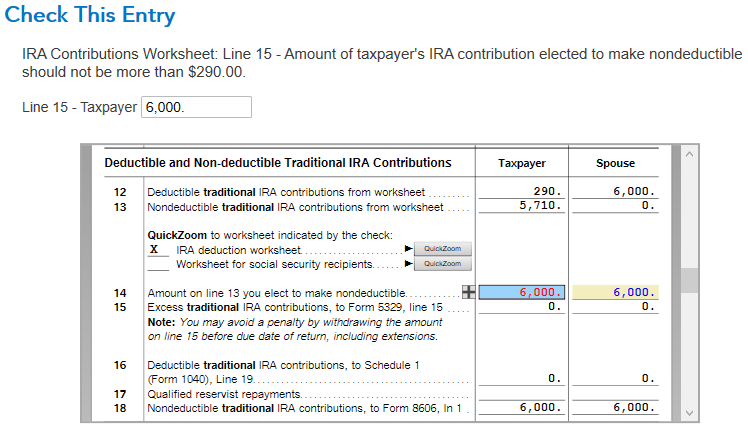

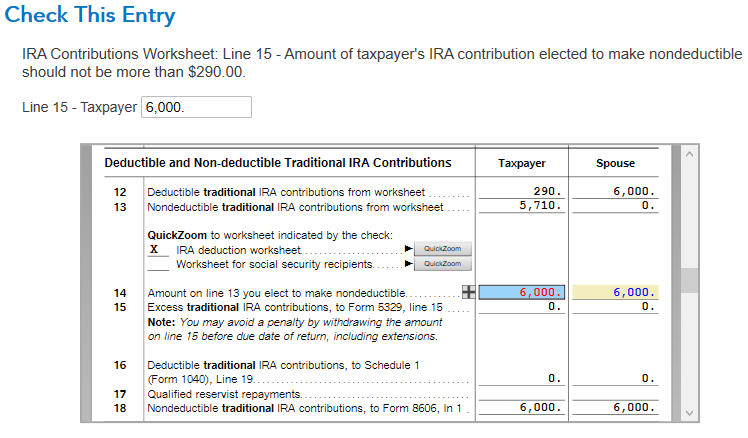

"Check this Entry - IRA Contributions Worksheet: Line 15 - Amount of taxpayer's IRA Contribution elected to make nondeductible should not be more than $290.00"

I have included a screenshot.

I have no idea how to fi this - Any help would be appreciated as it is driving me crazy! I never knew making a backdoor Roth for 2021 in 2022 would be so difficult.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

You should have reported the nondeductible traditional IRA contribution for 2021 on the 2021 tax return. TurboTax should have created the 2021 Form 8606 with the basis on line 14 to enter into the 2022 tax return.

You will enter your nondeductible traditional IRA contribution for 2022 on your 2022 tax return (and can enter your basis from 2021 in step 7 and 8 if not automatically carried over):

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” if you had a nondeductible contribution before this tax year.

- Enter your basis in the Traditional IRA from your 2021 Form 8606 line 14 (if you had a basis in the prior year)

- On the “Choose Not to Deduct IRA

To enter your conversion made in 2022:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Review your 1099-R info" screen click "Continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

You may want to delete your Form 1099R if the above steps do not work.

Please refer to the link below as well:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

So last year I used an accountant due to the complexities of my 2021 tax year. So unfortunately TurboTax wasn't able to import a previous year tax return. I honestly thought everything was finished with the Backdoor Roth in the 2021 tax return until I got the 1099-R since the distribution/move happened in 2022.

I followed the steps you provided but am still getting the same error about the IRA contributions Worksheet. Everything else looks right but this fails the Smart check. When I click on the "QuickZoom" to try and verify the 2021 basis of 6,000 it does nothing.

How can I fix this? I have literally spent weeks trying to figure this out and it is feeling helpless, I honestly thought this would be a no brainer with TurboTax but it is leaving me extremely frustrated. I do appreciate your help, thanks!

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter a backdoor Roth IRA conversion?

First, did you also make a traditional IRA contribution for 2022 or only for 2021 in 2022? If you only made one contribution for 2021 in 2022 then you will not enter the contribution part in the IRA contribution interview. You will only enter the conversion (Form 1099-R) and enter your basis from your 2021 Form 8606 line 14 in the follow-up questions (step 7).

To enter the Form 1099-R conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Review your 1099-R info" screen click "Continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

If you also made a traditional IRA contribution for 2022 in 2022 then you will enter these steps below to make the full contribution nondeductible. Some of your contributions are already automatically nondeductible and therefore you need to only make part of the contribution deductible.

To enter the nondeductible contribution to the traditional IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

- Enter the amount you contributed

- Answer “No” to the recharacterized question on the “Did You Change Your Mind?” screen

- Answer the next questions until you get to “Any Nondeductible Contributions to Your IRA?” and select “Yes” if you had a nondeductible contribution before this tax year.

- Enter your basis in the Traditional IRA from your 2021 Form 8606 line 14 (if you had a basis in the prior year)

- On the “Choose Not to Deduct IRA Contributions” screen choose “Yes, make part of my IRA contribution nondeductible” and enter for taxpayer $290 ($5,710 was already automatically nondeductible) and for spouse $6,000.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17727448620

Level 1

not_no_cpa

Level 2

superlyc

Level 3

DanH2300

Level 1

sc56md

New Member