- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I am having a very tough time getting my Backdoor Roth contribution to go through correctly without TurboTax Smart Check freaking out. Here is the situation:

1. I opened my Traditional IRA in March 2022.

2. My spouse opened her Traditional IRA a few days later in March 2022.

3. We both made a $6,000 contribution into our respective Traditional IRA accounts a few days later in March 2022.

4. Both of these contributions were made for 2021.

5. We both converted our contributions from our Traditional IRA to your Roth IRA a day later in March 2022.

The 1099-R forms were automatically imported from the brokerage by TurboTax.

I followed all the directions here: https://ttlc.intuit.com/turbotax-support/en-us/help-article/retirement-benefits/enter-backdoor-roth-...

And I check the forms as suggested and everything appears right. But when I go to Smart Check it freaks out saying:

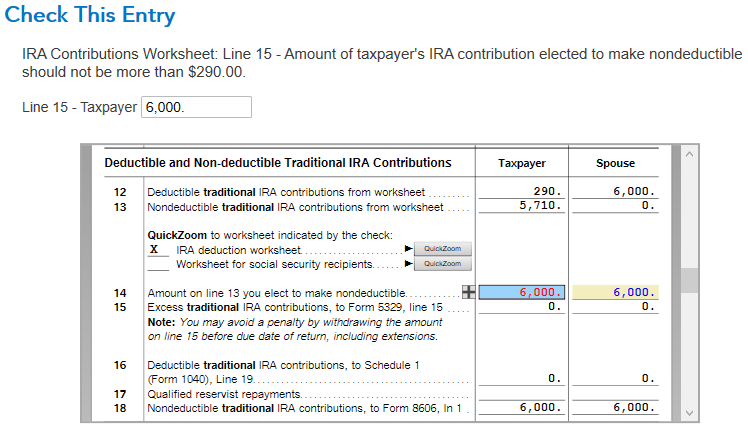

"Check this Entry - IRA Contributions Worksheet: Line 15 - Amount of taxpayer's IRA Contribution elected to make nondeductible should not be more than $290.00"

I have included a screenshot.

I have no idea how to fi this - Any help would be appreciated as it is driving me crazy! I never knew making a backdoor Roth for 2021 in 2022 would be so difficult.

Thanks!