- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How do I enter 1099-S in Turbo Tax Deluxe cd version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-S in Turbo Tax Deluxe cd version?

I'm using the CD deluxe version. The Investment Income section (where is said to enter second homes etc.) mentions 1009-S, but the process proceeds as if a stock sale. I'm never prompted to enter details from the 1099-S. I need to report proceeds from the sale of vacant land, but I'm not able to get past the 1099-B section to enter the 1099-S.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-S in Turbo Tax Deluxe cd version?

There is not a specific entry screen for the 1099-S. The sale of land is considered the sale of an investment.

You can report the sale in TurboTax using these steps:

- Click on Federal Taxes > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- [If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.]

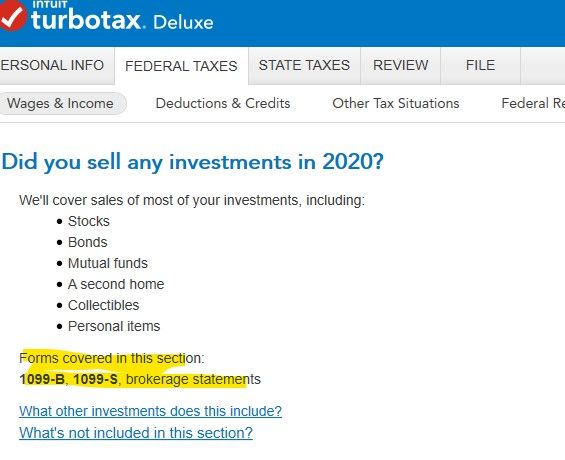

- Answer Yes on the Did you sell any investments in 2020? screen.

- Answer No on the “Did you get a 1099-B or a brokerage statement for these sales?” screen.

- The next screen is “Tell us about this sale”. Mark the radio button next to I’ll enter one sale at a time

- On the screen, Tell us about this sale, enter the total sales proceeds as well as the other information requested. [See Screenshot #1, below.]

- Continue to the screen, Select any less common adjustments that apply. (In TurboTax Online: Let us know if any of these situations apply to this sale)

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-S in Turbo Tax Deluxe cd version?

There is not a specific entry screen for the 1099-S. The sale of land is considered the sale of an investment.

You can report the sale in TurboTax using these steps:

- Click on Federal Taxes > Wages & Income

- In the Investment Income section click on the Start/Revisit box next to Stocks, Mutual Funds, Bonds, Other.

- [If you have already entered some investment sales, you will see a screen Here's the investment sales info we have so far. Click on the Add More Sales link.]

- Answer Yes on the Did you sell any investments in 2020? screen.

- Answer No on the “Did you get a 1099-B or a brokerage statement for these sales?” screen.

- The next screen is “Tell us about this sale”. Mark the radio button next to I’ll enter one sale at a time

- On the screen, Tell us about this sale, enter the total sales proceeds as well as the other information requested. [See Screenshot #1, below.]

- Continue to the screen, Select any less common adjustments that apply. (In TurboTax Online: Let us know if any of these situations apply to this sale)

- Mark the first box The reported sales price did not deduct all fees or selling expenses. [Screenshot #2]

- Enter the sales expenses not deducted from the sales price entered earlier.

Screenshot #1

Screenshot #2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter 1099-S in Turbo Tax Deluxe cd version?

Thank you so much for the quick response! I was able to follow the steps you outlined, really appreciate your feedback.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

landr421

Level 3

landr421

Level 3

landr421

Level 3

yolotom

Returning Member

TaxesForGetSmart

Level 1