- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Here's some differences between the Online version and th...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

What are the differences between Turbotax Online and TurboTax Desktop? Why would I choose TTO over TTD? Why would I chose TTD over TTO?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Online web version is only good for 1 return, federal and state are separate charges, It is free to start, you pay when you file or if you want to print. Price is determined at the time you pay. You can pay anytime like if you want to lock in an early discounted price. You can not see the forms until you pay and print them out. Online versions do not have the same forms so you may need to use a higher version to enter something. Online returns are stored online and after Oct each year you might not have access to it. So you should save and download both the .tax and .pdf files each year to your computer.

You can check out Online here, https://turbotax.intuit.com/personal-taxes/online/

The Desktop CD/Download program can do unlimited returns and you can efile 5 federal for free and Deluxe and above comes with 1 free state program download to prepare unlimited state returns but each state return (including the first one) is 19.99 (goes up to 24.99 in March) to efile or you can print and mail it for free. You can see and enter directly into the actual forms. Desktop has a What-If worksheet. Your return is kept on your own computer so you will always have access to it in the future like if you need a copy or need to amend it. And other features. Oh, and you can use a lower version because all the Desktop programs have all the same forms.

You can see the Desktop CD/Download programs here, https://turbotax.intuit.com/personal-taxes/cd-download/

If you buy the CD at the store the Basic version does not include the state. And Deluxe is available both with and without the state. Because some states don't have an income tax. So check the box carefully. Look around for sales at stores. You can see the Desktop versions here, https://turbotax.intuit.com/personal-taxes/cd-download/

I would buy at Costco or Amazon or wherever you can get the best price. If you want to use the Desktop program this year we can tell you how to get your 2016 return from Online to transfer into the Desktop program so post back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

@srk3 Do you need any help switching to Online? Here's some info....

If you used the Desktop program last year here’s How to transfer into the Online version. You need to have the prior year .taxyyyy file on your computer. Expand the link if you used the CD/download last year........

Do you have the .tax2019 file? If you can't find it, Here's an idea. Do you still have 2019 installed? Try opening 2019 program and see if you can get your 2019 return to show up in it. Go to FILE - OPEN. Then save it again with a name and place you can find. Go to File - Save As.

If you used the Desktop program before you may not like the online version. It has less features and no Forms Mode. You can only do 1 return. Your return is only saved online so be sure to save both the .tax2020 data file and the pdf file to your computer when you are done. In case you need to amend in the future or if you need a copy to get a loan or something. You might not be able to access your online return when you need a copy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Online web version is only good for 1 return, federal and state are separate charges, It is free to start, you pay when you file or if you want to print. Price is determined at the time you pay. You can pay anytime like if you want to lock in an early discounted price. You can not see the forms until you pay and print them out. Online versions do not have the same forms so you may need to use a higher version to enter something. Online returns are stored online and after Oct each year you might not have access to it. So you should save and download both the .tax and .pdf files each year to your computer.

You can check out Online here, https://turbotax.intuit.com/personal-taxes/online/

The Desktop CD/Download program can do unlimited returns and you can efile 5 federal for free and Deluxe and above comes with 1 free state program download to prepare unlimited state returns but each state return (including the first one) is 19.99 (goes up to 24.99 in March) to efile or you can print and mail it for free. You can see and enter directly into the actual forms. Desktop has a What-If worksheet. Your return is kept on your own computer so you will always have access to it in the future like if you need a copy or need to amend it. And other features. Oh, and you can use a lower version because all the Desktop programs have all the same forms.

You can see the Desktop CD/Download programs here, https://turbotax.intuit.com/personal-taxes/cd-download/

If you buy the CD at the store the Basic version does not include the state. And Deluxe is available both with and without the state. Because some states don't have an income tax. So check the box carefully. Look around for sales at stores. You can see the Desktop versions here, https://turbotax.intuit.com/personal-taxes/cd-download/

I would buy at Costco or Amazon or wherever you can get the best price. If you want to use the Desktop program this year we can tell you how to get your 2016 return from Online to transfer into the Desktop program so post back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

thank you. from what I've researched, staying with the CD is best for many reasons, including all you reference. the concern is new computer has no drive, so guessing a portable CD DRIVE is answer. Any suggestions on what brand to purchase?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

How can I tell which version I bought? I'm not sure if I have business online or business download.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

TurboTax Business (for S-Corps, Partnerships, Trusts, and Estates) and TurboTax Home and Business are both download/cd products. TurboTax Self Employed is the Online version of Home and Business.

If you are using a browser to open your TurboTax program then you are using an online product. If you are opening an application on your computer then you are using a download/cd product. If your program has Forms Mode, it is download/cd. If it does not have Forms Mode it is Online.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Online refers to downloading from the web without purchasing a CD/DVD at, for example, Costco, Sam's, Office Depot, etc. Download refers to having purchased a CD/DVD version from Costco, Sam's, Office Depot or any other locations where they are sold; inserting the DVD into your computer and downloading from the DVD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

TurboTax Online is a web-based program that is not installed on your computer.

TurboTax CD/downloaded versions are stand-alone programs installed on your computer. The installation may be done either by purchasing an actual CD from a brick and mortar store or by purchasing a 'download' directly from TurboTax (without an actual CD).

One important difference between the two options is that you can view all the tax forms included in your return when you use the CD/downloaded version versus the online version. With TurboTax Online, you can only preview your Form 1040 prior to paying the TurboTax fees.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

The online products offer the feature for their tax experts to review the returns. Is the same feature offered by the desktop version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

No. Only for the Online versions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Most of the so-called "Champs" (formerly known as "SuperUsers") - none of whom are Intuit Employees - recommend that for most tax returns that are more than "simple" the Taxpayer will benefit in ease of navigating the tax program using Desktop. A truly major and valuable feature of the desktop program is the ability to switch to a view of the tax forms themselves as they are filled in and calculations are made.

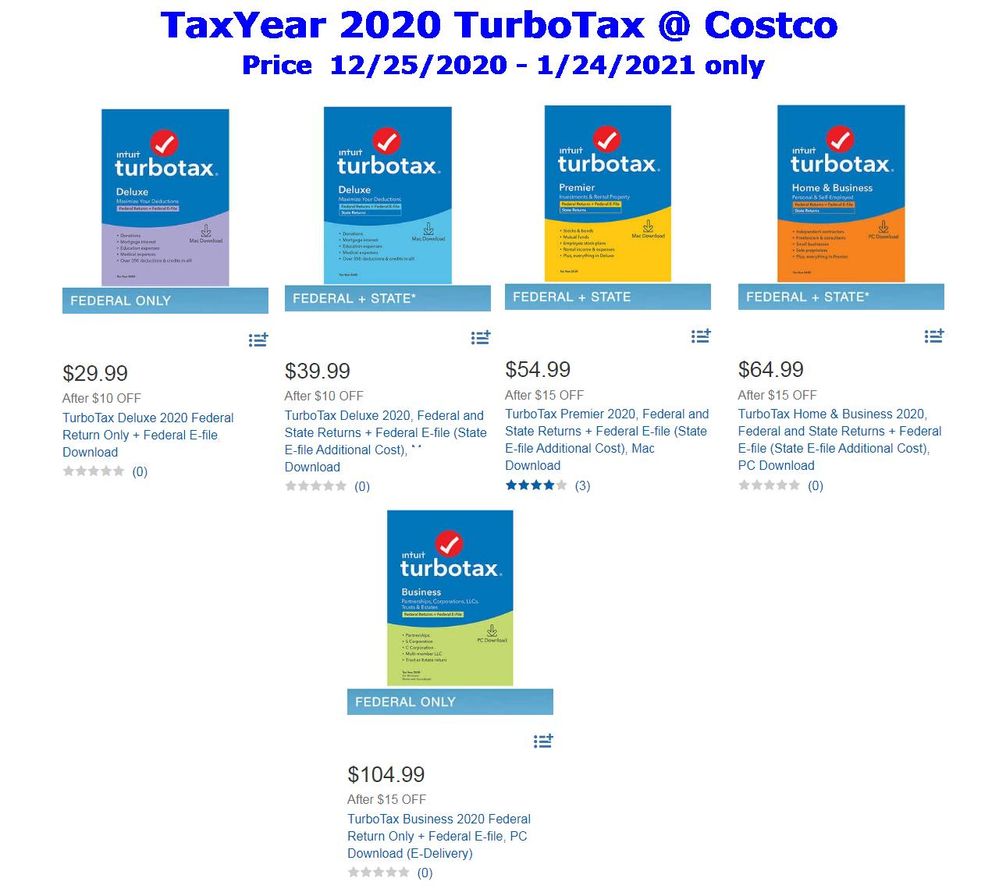

PRICING of Desktop Software for both Personal TurboTax (Form 1040) and for Business (Forms 1065, 1120, and 1041) are in the graphic - sold at these prices at Costco and for the period of 12/25/2020 - 01/24/2021

NOTE:

The Desktop products all provide FREE eFiling of Form 1040 but state eFile costs an additional $20 (at this time). The "Federal Only" Personal does not include a state program.

Personal TurboTax Desktop is sold in versions for Windows/10 PC or MAC - note the separate packaging. REPEAT: Windows/7 NOT SUPPORTED! (Netframe related!)

The "Business" program does not include a state module - that is an additional $50 and eFile of state an additional $20. "Business" only works on PC Windows/10.

Feel free to "thumbs up" - and yes there are other benefits to the desktop program - but Online offering is great for folks who have only one filing and a filing that is pretty simple; and none of this discusses the various "free" versions as they are announced by Intuit.

NOT INTUIT EMPLOYEE

USAR 64-67 AIS/ASA MOS 9301 - O3

- Just donating my time

**Say Thanks by clicking the thumb icon in the lower left corner -it means nothing but makes those than answer feel wanted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

online allows only one return per a/c. desktop allows doing as many what-if returns as you like. just be careful to e-file only the correct one. also, it allows free federal e-filing of returns for up to 5 taxpayers. with deluxe one state is free. there is a fee for state e-filing except for New York

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

also, hate to state the obvious, you also need a desktop / laptop for the download version; there are many today that just have their smartphones and are dependent on the online version.

frankly, I've never understood why someone who has a desktop / laptop would go with the online version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Going with the online version in 2020 because I'm on Win7 and don't want Win10.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

@srk3 Do you need any help switching to Online? Here's some info....

If you used the Desktop program last year here’s How to transfer into the Online version. You need to have the prior year .taxyyyy file on your computer. Expand the link if you used the CD/download last year........

Do you have the .tax2019 file? If you can't find it, Here's an idea. Do you still have 2019 installed? Try opening 2019 program and see if you can get your 2019 return to show up in it. Go to FILE - OPEN. Then save it again with a name and place you can find. Go to File - Save As.

If you used the Desktop program before you may not like the online version. It has less features and no Forms Mode. You can only do 1 return. Your return is only saved online so be sure to save both the .tax2020 data file and the pdf file to your computer when you are done. In case you need to amend in the future or if you need a copy to get a loan or something. You might not be able to access your online return when you need a copy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What are the differences between Turbotax Online and TurboTax Desktop?

Do NOT use the online version if you can help it if you situation is at all complex. I tried it first and it only downloaded a very limited amount of information gleaned from a pdf of last year's return whereas the desktop version imports all of your information from the previous year so you don't have to waste time re-entering lots of info.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AAA10

Level 2

indylovelace

New Member

denisse664

New Member

user17708576611

Returning Member

jim-randall8888

New Member