- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Help on reporting non-covered securities in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

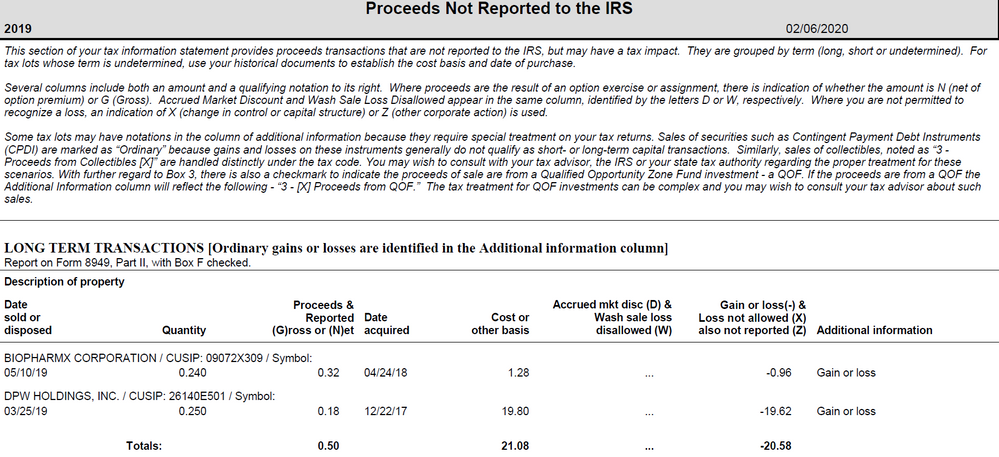

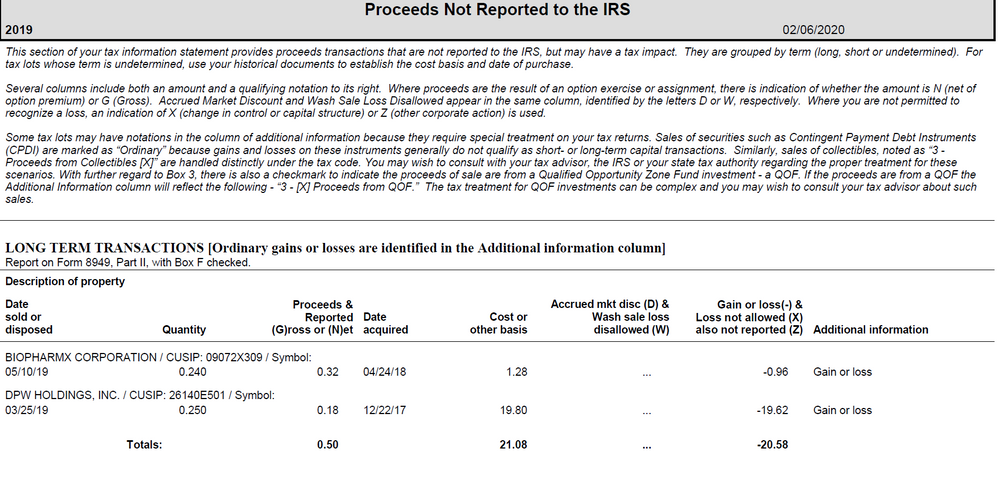

I got 1099 from Robinhood which had the below classification for "Proceeds not reported to the IRS"

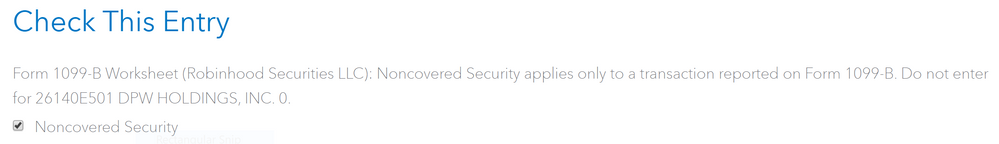

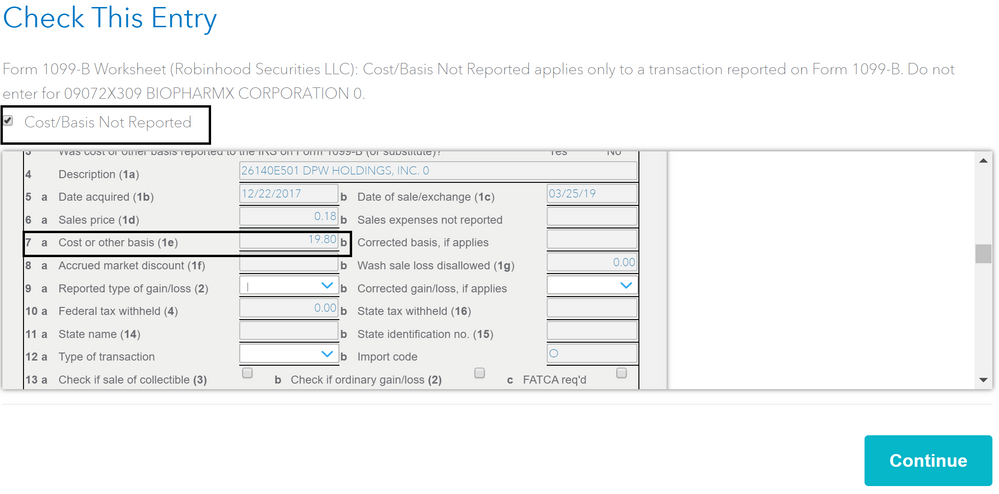

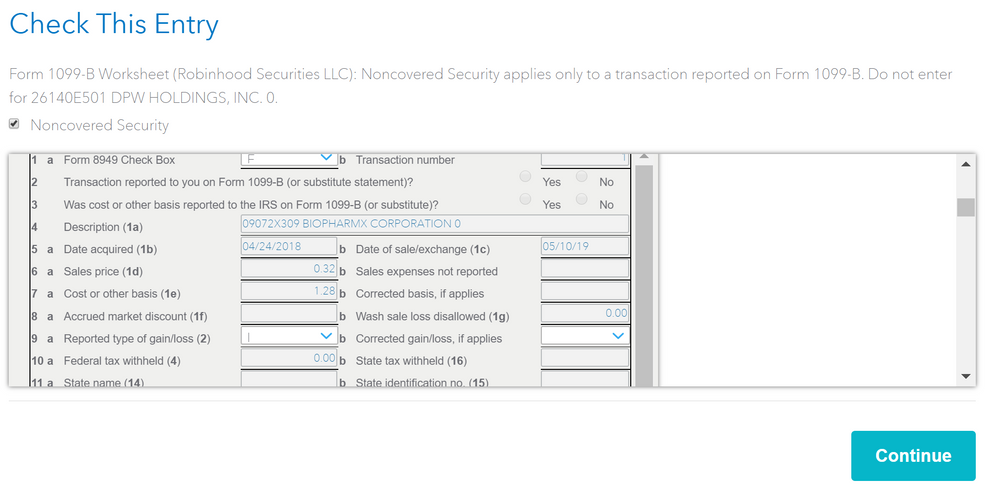

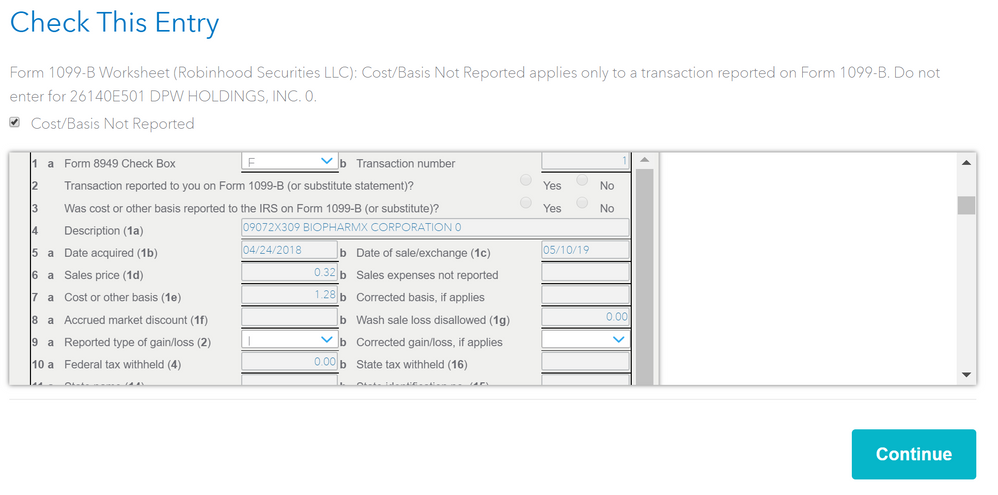

When i imported this in Turbotax, i kept getting an error to review to check this entry. It shows the below errors to be reviewed :-

- Form 1099-B Worksheet (Robinhood Securities LLC): Noncovered Security applies only to a transaction reported on Form 1099-B. Do not enter for 26140E501 DPW HOLDINGS, INC. 0.

- Form 1099-B Worksheet (Robinhood Securities LLC): Cost/Basis Not Reported applies only to a transaction reported on Form 1099-B. Do not enter for 26140E501 DPW HOLDINGS, INC. 0.

- Form 1099-B Worksheet (Robinhood Securities LLC): Holding Period applies only to a transaction reported on Form 1099-B. Do not enter for 26140E501 DPW HOLDINGS, INC. 0.

I am not really sure what needs to be done here. Can i get some help on this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

I'm not sure what the error message is implying, but it is referring to the DPW investment sale. I suggest you delete that transaction in Turbo Tax and re-enter it manually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

Should i be just completely deleting that transaction as its not been reported to IRS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

I would delete what was imported, and enter it manually.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

It states "Cost/Basis Not Reported applies only to a transaction reported on Form 1099-B" but when i see the PDF which opens up it clearly has the cost basis value. Not sure what i am missing here. Is turbotax just prompting me to review the values here? Do i need to uncheck the checkbox stating "Non-Covered security".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

Your 1099B should match what you received except for maybe the basis. Leave the non-covered box checked. Non-covered security means the broker isn't sure about the basis. You should review your records and verify the basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

Thanks @AmyC ! So Turbotax is just asking me to review the data in the PDF (1099-B Worksheet) with what I have in the 1099 received from Robinhood? But even when I click "continue" after reviewing everything, the review still doesnt get cleared. Apart from verifying what i see in the Robinhood 1099 with whats in the Turbotax 1099-B worksheet pdf, do I need to do anything to get this thing cleared from the review section?

Also, why does the checkbox stating "Cost/basis not reported" checked when I could see that in the PDF it has a value. Can you please share if there is anything I need to do for this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

If there is a basis for that transaction, try to edit that entry and uncheck the box cost basis not reported and then enter the cost basis.

- If using Turbo Tax online go to:

- Federal>wages and income>investment income>

- Go to stocks Bonds and other and select edit next to Robinhood.

- Try to find that particular transaction and enter a cost basis in Box 1E that is listed on your pdf and

- Right below that is a drop-down box if it is long term indicate it is long-term covered

- if short term, then it is short term covered.

- Long term and short term are defined by the holding period of the security. If held on more than 1 year, it is long term. Held on shorter than one year, short term.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

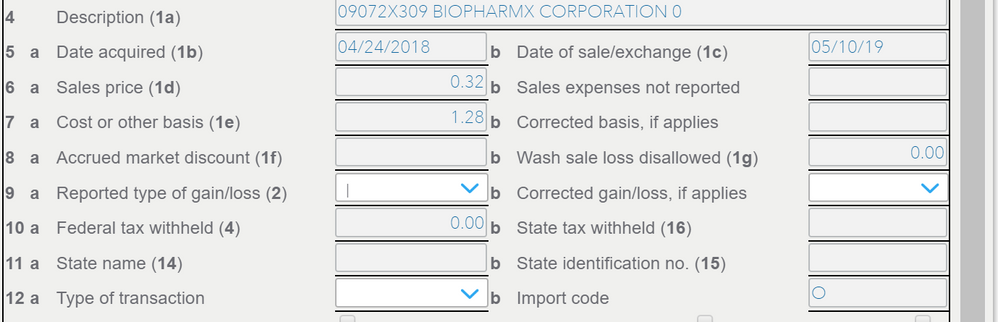

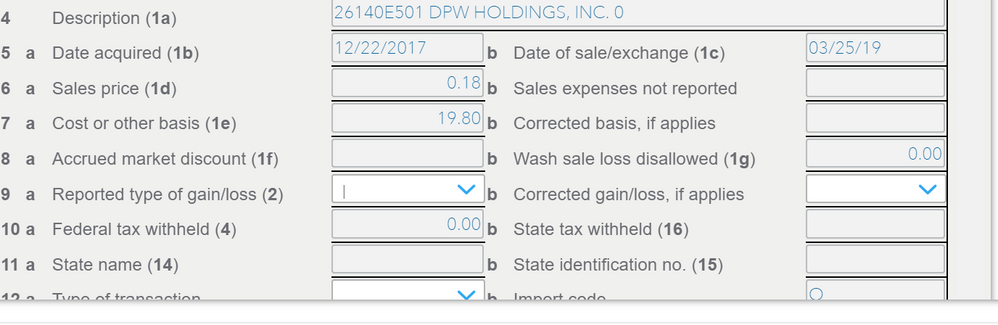

Thanks @DaveF1006 ! Below is the information I see in "stocks Bonds and other". I guess it has all the required info?

Should I be unchecking these checkboxes in review for "Noncovered security" & "Cost/Basis not reported"? In the PDF which Turbotax generates, it has the cost basis info(snapshots shared below). I am just not sure as to what is TurboTax trying to convey over here.

Can you please help on this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

Yes, uncheck the boxes for "noncovered security" & "Cost/Basis not reported" and check the box(es) for covered security basis reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

Can someone clarify on this? Should I be deleting the below entries in Turbotax as 1099 states "Proceeds Not Reported to the IRS"? Should these below transactions still be in Turbotax?

Or should i uncheck the boxes "Noncovered Security", "Cost/Basis Not Reported" in the review "Check this entry" section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

On the last screenshot, Proceeds Not Reported to the IRS, it does say, underneath Long Term Transactions - report on Form 8949 Part II (F). In English, that means:

Form 8949 - Sales of Capital Assets

Part II - long term

(F) - Not reported on 1099-B.

What you need to do:

You have the F marked.

Below it is line 2, mark that is was not reported on a 1099-B.

Uncheck Cost basis not reported - that does not apply in your situation since it is NOT a 1099-B.

It is a covered security with the basis confirmed by you as correct. It is not a non-covered security.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

I had the same issue with Short Term Security so I have guessed how it works:

When you get to review this transaction 3 times screen will pop:

1. Holding Period applies only to a transaction reported on Form 1099-B

-For this you should select No Entry. This means there is no entry on 1099-B. If you specify Short Team / Long Term that means this is reported to IRS, but in this case its not as mentioned in your 1099-B.

2. Cost/Basis Not Reported applies only to a transaction reported on Form 1099-B

-For this you should uncheck this checkbox as its not reported to IRS and you are kind of figuring this number yourself, robinhood is not sure about this number.

3. Noncovered Security applies only to a transaction reported on Form 1099-B

-For this you should uncheck this checkbox as you are covering it by reviewing it

-After making above 3 changes it worked like a charm for me.

I have seen this happening at time of Reverse Stock Splits to me. Suppose you have 122 stock of some company and reverse split is happening for 20 to 1. So you will have 6 stocks + 2/20. So to avoid this situation before reverse split make sure you have stocks in the multiple of 20, to avoid this situation in future. So here in the example either you can but 18 stocks or sell 2 stocks before reverse split date.

Hope this helps. Enjoy!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

I entered suggested options and it worked! Else it was asking to mail a paper return. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help on reporting non-covered securities in TurboTax

I am also having the same problem. ANy help?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cassieaitken1

Level 1

carolsuemum

New Member

b_benson1

New Member

clclemen

New Member

navyas

Returning Member