- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is t...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

TY. I did not find exactly all of what you mentioned, including no specific item to click for Middle Class Tax Refund. But, after completing info/questions presented in TT for 1099-MISC, the system accepted and did NOT treat the amount (over $600) as taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

The MCTR is not taxable on the CA tax return, but no guidance has been provided by the IRS yet as to whether or not it is taxable on the federal tax return. If you received a 1099-MISC with the MCTR payment in box 3, you should go through the comprehensive 1099-MISC flow steps in TurboTax to enter the amount.

There will be a question asking if the payment is for the California Middle Class Tax Refund. Select “Yes” to automatically exclude this amount from federal income. On the federal tax return, the MCTR payment will reflect as a positive amount, as well as a separate negative amount, based on the OII.

Therefore, TurboTax software is not treating this payment as taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

Here's a new wrinkle. In 2021 I lived in California. During the first week of January 2023 I moved to Post Falls, Idaho.

It does not appear to be taxable in either state. I removed it from my state return completely. I did all

proposed fixes from the community board and apparently neither state nor federal will fie until this is resolved. I am not comfortable with removing the MCTR from my federal return even though I am confident that it will not result in additional taxes at my income level. I am pointing this out because of the unusual circumstances of getting a CA MTCR from 2021 received in 2022 and filled in 2023. Please remember that any solution must take these circumstances into account I am sure I am not the only in this boat. AT this point I am not sure where the problem is but I am distressed that I pad money to INTUIT for filing my taxes and a week later I have no end in sight. I would like a current answer from some one at TURBO TAX with a viable expectation on what and when a fix will be available. Neither the Federal government nor the state are entitled to more money but I can get mine? This is rediculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

I have no need to file yet, likely will wait until at least early April. By then, TT might have something more definitive on this.

But for now, I share the concern. I noted previously that, in the eyes of the law, Rev. Code Sec. 1001 provides that any item of income is taxable ... unless expressly provided otherwise. Of course, the tax code is replete with exceptions!

TT has connections to the IRS that most folks don't, and perhaps can lean on them to get a clarifying answer. Meanwhile, I am not convinced that TT's answer is right. There must be actual authority ... Code, Reg., or other official IRS pronouncement ... to support excluding MCTR from taxable income. Without cite to such authority, I am uncomfortable relying on TT's opinion, however well-founded it might be.

Of course, the tax effect on the income amount is not very material. If I exclude it and they later hit me up for tax, it's not a biggie. If I include it and it turns out not to be taxable, I could amend the return; but that can open Pandora's Box. If I exclude and they seek additional tax, likely they would not hit me with penalty; as, relying on TT's opinion that affects maybe thousands of filers might be seen as reasonable basis for excluding. In which case, adjustment but no penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

This matter is now clearly getting high-level attention ... as it should have much earlier, even before CA sent forms 1099-MISC.

“IRS says guidance on whether Middle Class Tax Refund is taxable could come next week”

https://www.kcra.com/article/rep-kiley-calls-for-irs-to-issue-guidance-on-whether-middle-class-tax-r...

Of course, be care what you wish for! The answer might not be what one seeks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

TurboTax is treating this as a non-taxable rebate.

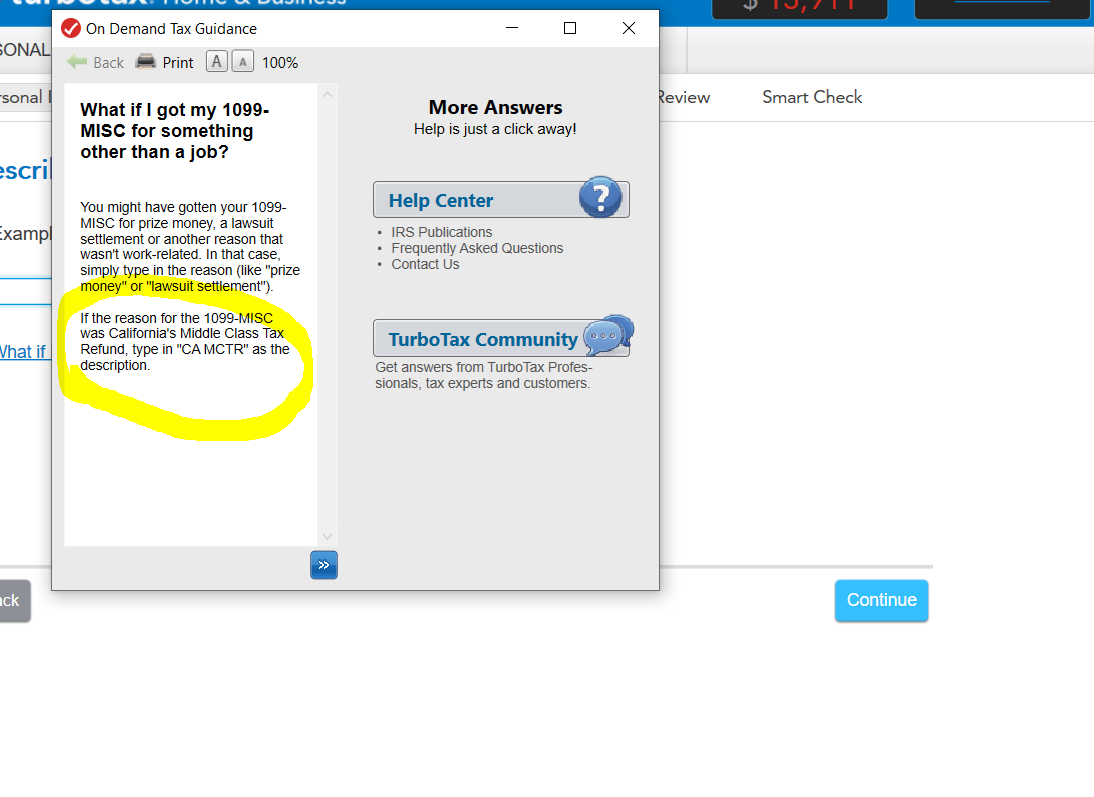

Please select CA MCTR as the reason for the 1099-MISC

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

My last post was not to question how TT is treating the CA MCTR now, or how to enter it in TT.

Rather, it was to note that, based on linked public information, the IRS is evaluating what the right answer is as to tax treatment.

Frankly, it matters not what TT thinks the answer is and how TT presently treats it. As I have stated before, there are grounds for treating it as either taxable or nontaxable. Until the IRS actually opines officially, I will not be satisfied with what TT is doing. Even the IRS advises to defer filing and not subsequently file an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

There has been no specific mention on whether this income is taxable or not on the federal level. Given this fact, this is taxable income unless it is specifically excluded by the tax code.

My suggestion is to report it now and if there is a tax code change regarding this rebate, you can amend the return excluding this income.

To report go to federal>wages and income>other common income>1099 MISC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

The IRS has reported that they will have guidance about the California Rebate this week. It would be wise to delay filing until then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

It is DISINGENUOUS to post this reply, when the IRS has not opined. Regardless, TT is treating it as nontaxable. I'll believe anything when I actually see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

NTA Blog: The IRS Must Be Proactive in Issuing Timely and Clear Guidance to Resolve Tax Reporting Ambiguities

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has TT received any specific IRS guidance, on whether 2022 CA gas tax / inflation rebate is taxable?

The IRS has opined officially --- MCTR is NOT TAXABLE. TT got it right.

IRS says it won't tax California's Middle Class Tax Refund - Los Angeles Times (latimes.com)

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ca105

New Member

Luna_Tax

Level 3

LynnMH

Level 1

Salsadude

New Member

gtbyrd

Level 2