- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 2210 TY 2021 error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

The updated form 2210 ecosystem is installed on my desktop version of TurboTax. There appears to be an error, as follows:

On form 2210AI, for the first estimate, my deductions are greater than my income. 2210AI correctly shows no installment due on line 27 for the first quarter.

For the second quarter, 2210AI shows an installment due of $1,353.

Moving to form 2210, on line 17 it shows $1,353 in BOTH columns 1 and 2. The mistaken entry in column 1 is then being picked up by the 2210 Underpayment Penalty Worksheet, which is trying to charge me a penalty based on the mistaken entry.

It appears that form 2210 installment 1 is mislinked to form 2210AI installment 2 rather than the first installment.

All 3 forms are correctly showing no additional installment due for the third quarter.

Intuit, can you please check on this and fix. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

I also see numerous errors on TY2021 Form 2210. The errors are in Part III Section A lines 10-19.

On Line 10, it is not transferring the correct values from Schedule AI line 27.

On Line 11, it is not transferring the correct values for estimated tax paid and tax withheld.

Once those two are wrong, that leads to Lines 17 and 18 (underpayment, overpayment) being incorrect.

Once those are wrong, Line 19 (Penalty) becomes incorrect.

In my case, I should not be paying a penalty, but TurboTax is showing a penalty.

I am using Turbotax Home and Business Desktop for MacOS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

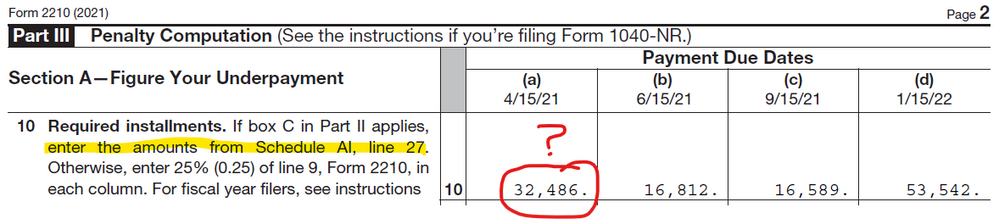

Also see several errors on 2210 on TT Premier. Just got off the phone with support with no resolution. The agent was unaware of any issues with the form. Line 10, col (a) of part III is not carrying the proper value from Sched AI, line 27.

Sched AI line 7 should include 1040, 12a and 12 b but only carries 12a.

This form is a mess and is keeping me from filing. Intuit needs to fix this asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

Please see this Help Article for further assistance. You will also be able to sign up for updates as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

Unfortunately, the response form HeatherPLO is not helpful. The link to signup for notices just puts me into a sign-in loop. Form 2210 has many errors. For example, line 10 of Part III, Section A is combining the values from Sched AI, line 27, columns (a) and (b), which is incorrect. That was the logic for the 2020 version of Form 2210 but was changed by the IRS for 2021. Perhaps this form was released prematurely. I would ask that Intuit review this entire form and correct it asap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

I am using the Annualized Income section of the Form 2210. and it is not calculating the line 14 tax correctly. Looks like tis form was released without proper review.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

I'm seeing this bug also. Here are two screen shots from the Form 2210 produced by TurboTax Deluxe. You can clearly see that the first value from line 27 in Schedule AI is not copied correctly to Form 2210 line 10.

My solution is to override the incorrect value in line 10 so that I can avoid the underpayment penalty that TurboTax had incorrectly added.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

An update. Looks like TurboTax won't let me efile with an overridden field. ☹️

So now I have to wait for TurboTax to admit there is a bug and provide a fix.

(or file by paper instead).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

p.s. anyone know how to submit an official bug report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

Re how to report a bug, I spoke with an agent last night about this. Couldn't get the agent to tell me a way to report a software issue. The agent suggested paying the extra fee to get a tax rep to help.

Soccerdavid's screenshot clearly shows one of the problems. The entry in line 10, col (a) is the sum of columns (a) and (b) from SchedAI, line27. Again this is TY2020 logic so it looks like that was never updated for the redesigned TY2021 form. There are numerous other issues with this form.

Hopefully, Intuit will get this fixed soon (how about with Form 2210F release, if they're listening).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

Just so you're aware, this isn't really helpful. There's no article, it's marked solved, it's from last year, and it was seemingly a different problem from this one, albeit on the same form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

This was in response to Heather's post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

You are correct regarding the error. Many unsuspecting customers will fill the form and overpay IRS. It will always result in paying too much and there is no way the IRS will catch this and issue a refund. And even if it gets fixed, those who filed already will never realize they overpaid. This is so frustrating. Paying customers spending countless hours trying to get Intuit to correct the software and sometimes being asked to pony up more money for a resolution. This should be a class action lawsuit. We would only get pennies, but it would send a message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

The turbotax error is that Line10 column (a) of form 2210 is supposed to equal line 27 column (a) of Section AI when using the annualized income installment method. Instead Line 10 column (a) is line 27 column (a) + line 27 column (b).

One would think TurboTax would be highly motivated to fix this error because it can very substantially increase underpayment tax penalties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2210 TY 2021 error

DO NOT USE FORM 2210. I have so far found 4 errors in the TurboTax calculation:

- When using the annualized installment method, line 10 column (a) in part 3 of form 2210 is supposed to be equal to schedule AI line 27 column (a). Instead, it is equal to line 27 column (a) + line 27 column (b).

- The tax computations on schedule AI, line 14 column (a), (b), and (c) are incorrect.

- Self-employment tax on line 15 of schedule AI is incorrectly also included in line 16, resulting in a double-counting of self-employment tax and a line 17 column (d) total tax that incorrectly exceeds the total tax shown on form 1040 line 24.

4. 2020 refunds applied to 2021 are supposed to count as a tax payment starting in the first quarter of 2021. Instead, 2020 refunds applied to 2021 are incorrectly ignored on form 2021.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lambell

Level 1

5d456c8d408d

Level 1

imaranchkid

New Member

ecbeane

Level 1

mcintyre210

Level 3