- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requeste...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Yes there is a correct way of reporting this if these were personal items sales. Before you perform these steps, you may wish to delete your previous entries.

To report Personal item sales in TurboTax Online, follow these directions.

- Select Federal.

- Select Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

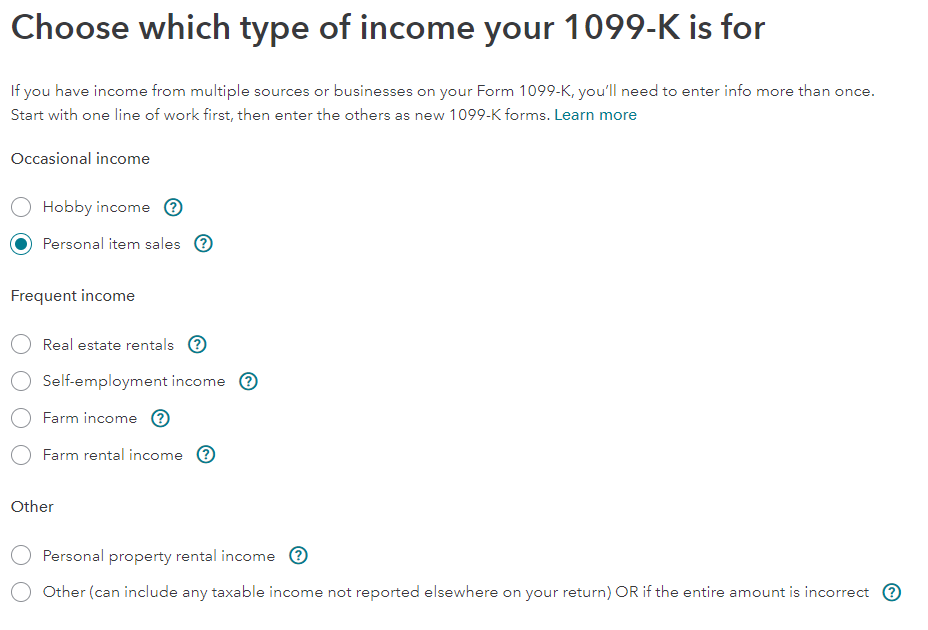

- At the screen Choose which type of income your 1099-K is for, select the button for Personal item sales. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Personal Item Sales, you are told that further information will need to be entered. Learn More provides detailed information for the next steps. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to ‘Sale of Personal Items’. Click Done.

- Under Your income and expenses, click the Edit/Add button to the right of Investments and Savings (1099-B, 1099-K….)

- At this screen, you will be asked to Review the Personal item sales (1099-K).

- At the screen Now, enter one sale…., answer questions about the personal item sale. Click Continue.

- If you have many sales, you may summarize your sales. You will be able to electronically file your return but you will need to send in details about your summary totals. Turbo Tax will instruct you on how to do this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

The software wants you to report additional information about a self-employment activity on Schedule C Profit and Loss from Business.

When you entered IRS form 1099-K income, you selected Self-employment income at this screen.

The software wants you to report additional information about your self-employment activity at:

- Federal

- Wages & Income

- Self-Employment

- Self-employment income and expenses

Or you may want to delete the IRS form 1099-K and start over.

You are able to remove the form by:

- Down the left side of the screen, click on Tax Tools.

- Click on Tools.

- Click on Delete a form.

- Find the form listed and click Delete to the right.

To report an IRS form 1099-K as Self-employment income, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Self-employment income. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Your Self-employment 1099-K income, you enter further information for the Self-employment income. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to Self-employment income. Click Done.

The entry will be reported:

- on Schedule C of the Federal 1040 tax return, and

- on Schedule SE of the Federal 1040 tax return, and

- on line 3 of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

Additional information about your self-employment income and Schedule C will need to be entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Thanks very much for the prompt answer to my question.

However, I'd like to report this not as "Self-employment income" but rather as "Personal item sales," which accurately describes my activity on eBay and allows me to later select "All items were sold at a loss or had no gain," which is also accurate. When I enter the 1099-K using these options, I get the error asking for a link to a Schedule C activity, but presumably there is no Schedule C in this case?

If I follow your instructions and enter the 1099-K as self-employment income, I get a lot of questions about "my business" but no opportunity to indicate that "all items were sold at a loss or had no gain," and I end up paying almost $200 more in federal taxes on the $696 from eBay. Moreover, if I try to enter business expenses, TurboTax want me to upgrade to the self-employed option in order to do that.

Seems like the "Personal item sales" category is exactly the right choice here and designed specifically for a case like mine, but it results in the Schedule C error that I can't find a way to fix...

Is there another way?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Just a follow-up to note that IRS delayed the implementation of the new $600 reporting threshold for third party payment networks to 2023, but nonetheless provides instructions for those who nonetheless received a 1099-K for 2022.

https://www.irs.gov/pub/taxpros/fs-2022-41.pdf

For example (from the second link above):

"The loss on the sale of a personal item is not deductible. For calendar year 2022 tax returns, if you receive a Form 1099- K, for the sale of a personal item that resulted in a loss, you should make offsetting entries on Form 1040, U.S. Individual Income Tax Return, Schedule 1, Additional Income and Adjustments to Income, as follows: Report your proceeds (the Form 1099-K amount) on Part I – Line 8z – Other Income, using the description "Form 1099-K Personal Item Sold at a Loss." Report your costs, up to but not more than the proceeds amount (the Form 1099-K amount), on Part II – Line 24z – Other Adjustments, using the description "Form 1099-K Personal Item Sold at a Loss."

Is there a way to follow the IRS instructions above using TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Yes there is a correct way of reporting this if these were personal items sales. Before you perform these steps, you may wish to delete your previous entries.

To report Personal item sales in TurboTax Online, follow these directions.

- Select Federal.

- Select Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Personal item sales. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Personal Item Sales, you are told that further information will need to be entered. Learn More provides detailed information for the next steps. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to ‘Sale of Personal Items’. Click Done.

- Under Your income and expenses, click the Edit/Add button to the right of Investments and Savings (1099-B, 1099-K….)

- At this screen, you will be asked to Review the Personal item sales (1099-K).

- At the screen Now, enter one sale…., answer questions about the personal item sale. Click Continue.

- If you have many sales, you may summarize your sales. You will be able to electronically file your return but you will need to send in details about your summary totals. Turbo Tax will instruct you on how to do this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1099-K from eBay results in an error on Federal review. A link to Schedule C is requested but it's not clear what needs to be entered to make it work. How to fix?

Thanks very much - that worked!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kh52

Level 1

mjlee999

New Member

user17525224124

New Member

user17521061672

New Member

Bwcland1

Level 1