- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

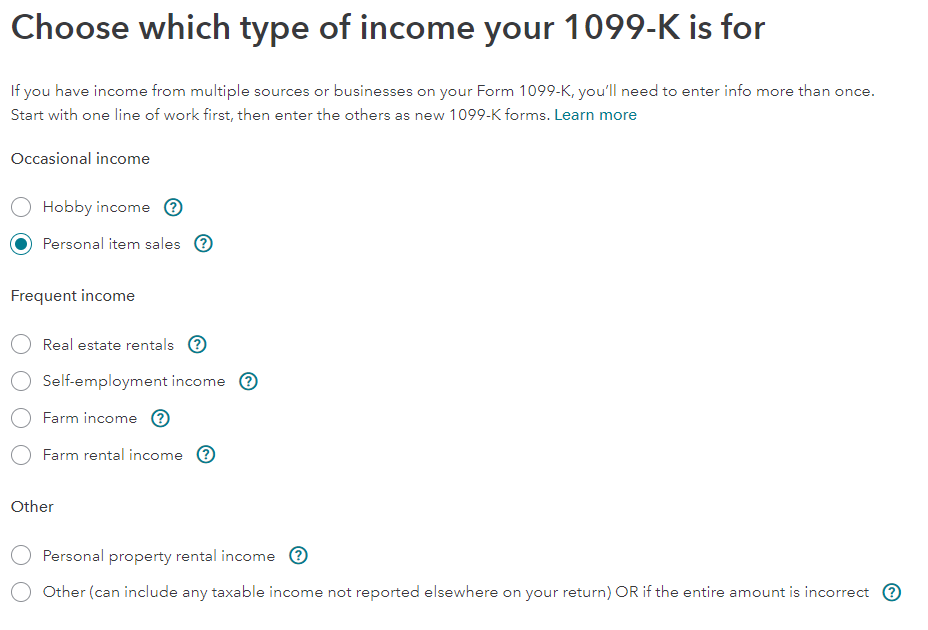

The software wants you to report additional information about a self-employment activity on Schedule C Profit and Loss from Business.

When you entered IRS form 1099-K income, you selected Self-employment income at this screen.

The software wants you to report additional information about your self-employment activity at:

- Federal

- Wages & Income

- Self-Employment

- Self-employment income and expenses

Or you may want to delete the IRS form 1099-K and start over.

You are able to remove the form by:

- Down the left side of the screen, click on Tax Tools.

- Click on Tools.

- Click on Delete a form.

- Find the form listed and click Delete to the right.

To report an IRS form 1099-K as Self-employment income, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Self-employment income. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Your Self-employment 1099-K income, you enter further information for the Self-employment income. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to Self-employment income. Click Done.

The entry will be reported:

- on Schedule C of the Federal 1040 tax return, and

- on Schedule SE of the Federal 1040 tax return, and

- on line 3 of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

Additional information about your self-employment income and Schedule C will need to be entered.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 1, 2023

5:29 AM