- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Form 1065 Date Begin error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

My first year of filing Form 1065 on TurboTax I made an error in the field of the "date you started doing business". I entered that the date my certificate of organization was approved. For example the year 2017. However, I didn't actually start doing business until February 2018.

I did NOT file a 1065 in 2017.

Are either of these 2 an issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

The IRS typically starts looking for a return after the LLC applies for an EIN.

You can easily change the date in that field, otherwise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

The IRS typically starts looking for a return after the LLC applies for an EIN.

You can easily change the date in that field, otherwise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

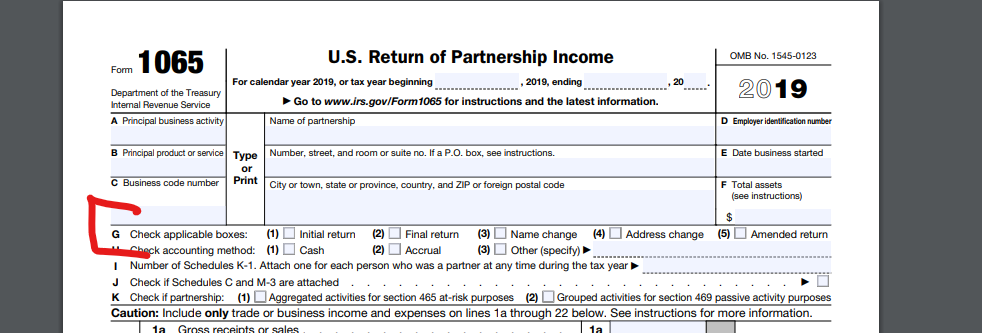

On the 2018 Form 1065

U.S. Return of Partnership Income

Department of the Treasury

Internal Revenue Service

Line "G", Which box is checked?

Intuit -TurboTax -xTest Team

Tax Accountant: How many dependents do you have?

Client: Well, that depends. How many do I need this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

It depends. If you didn't have income or expenditures you can deduct or get a credit for in 2017, you do not have to file Form 1065 for 2017.

The IRS Instructions for Form 1065 at this link have these instruction for Who Must File":

".......every domestic partnership must file Form 1065, unless it neither receives income nor incurs any expenditures treated as deductions or credits for federal income tax purposes."

For the date the business started, the IRS instructions Form IRS Form SS-4 at this link suggest that you should use the date you created the business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

DavidS nailed it. No need to file if no business activity in TY 2017.

Intuit -TurboTax -xTest Team

Tax Accountant: How many dependents do you have?

Client: Well, that depends. How many do I need this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

The first Year I filed I selected initial. This year the boxes are all blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1065 Date Begin error

You should be in good shape. No need to file 2017...what will the IRS do with a return containing nothing but zeroes anyway?

Intuit -TurboTax -xTest Team

Tax Accountant: How many dependents do you have?

Client: Well, that depends. How many do I need this year?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

owenm

New Member

user17701316428

New Member

gomo25mail

New Member

bschoung

New Member

eckleybk

New Member