- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Foreign Tax credit handling - Frustrated

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Many thanks, @JohnB5677

I had my head up my proverbial...

FYI I randomly found somewhere in one of the TT tips links that if your taxes were paid in foreign currency, as mine were, that you must use "Forms Method" (or "Forms" + a word-similar-to-"Method," but I'm forgetting). So they obviously want me to go into Form 1116 and put the GBP value directly in (and therefore have nowhere to enter using Step-by-Step).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

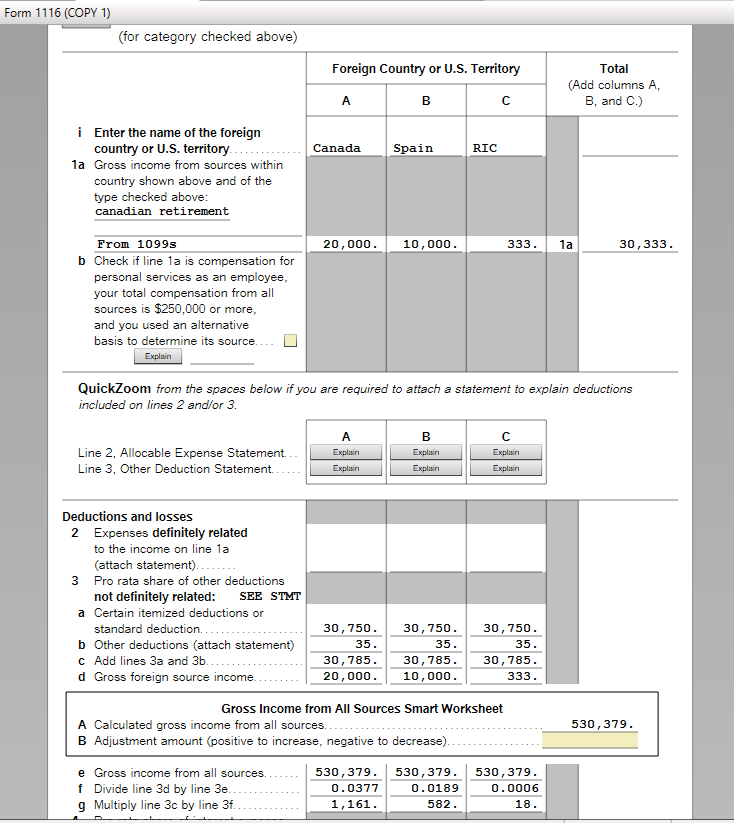

TT erroneously adds the number in Column A to Column C, unless a number is already there, on From 1116, line 3(g). I found no way to correct this in the software, so I have to print my form and mail it in, after crossing out the incorrect number in Column C. I can find no way to communicate this programming error to TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

If you're reporting similar income from three different countries, you'll have amounts in Columns A, B and C, which will flow down to Line 3g.

If you have no country in Column C at the top of Form 1116, there should be no numbers in this column. Since Line 3g is calculated, I'm unclear as to why you would need to delete the amount. If there is an amount in Column C, but no Country, go through the Foreign Tax Credit section again. RIC may listed as a country (for interest/dividends linked from Schedule B).

The info for Foreign Tax Credit/Foreign Income can be entered through the interview screens more easily than trying to decipher the calculations on Form 1116.

Basically, bypass the screens asking about INT/DIV that has already been reported; indicate you have other types of foreign income/tax to report, choose the type of income (Passive for Rental, Pension, General for Wages, etc.), then enter a Country, Income, Description, Tax, Date Paid.

Here's more detailed info on Claiming the Foreign Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilovesantos

New Member

2022 Deluxe

Level 1

ilian

Level 1

psberg0306

Level 2

anthonybrewington21

New Member