- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Foreign Tax credit handling - Frustrated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Friends,

I have two foreign source investment incomes (one from my mutual find and another from country where I lived). Entering these and taxes paid and figuring credit has taken more than 6 hours. It is not straight forward at all.

Now to my question :

I have a form titled Part III(1116) - Credit Carryback / Carryforward from my prior year returns. I cannot find anywhere to enter these. When I searched, I saw a post that mentioned I have to create a country "Carryback" but I am unable to add a country. Can some of you please reply with the info on how to enter "Credit Carryback / Carryforward" from my prior year.

Thank You

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Thanks for the response. Am I right in interpreting Carryforward is called as Carryover by TT? MY previous year return done by CPA shows numbers till 2027 and Turbotax does not allow beyond 2020. What happens to the numbers for years 2021 to 2027? Please refer to my screenshot. Also where do I enter Carryback details in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Carryover and Carryforward are synonymous. As far as reporting carryover projections into future years, this doesn't get reported to the IRS so no such schedule exist. As a value-added benefit, your CPA may have prepared this in a worksheet for your own reference but but it is premature to project what the carryover is because you may have future Foreign Tax Credits to report. If that is the case, which would make these projections null and void. Also, keep in mind, you may apply some of these carryforwards in future years so some of these carryover amounts may not be correct from 2021-2027

In a nutshell, we are only interested in your past carryovers to report on Form 1116 for this year. Turbo Tax automatically does this from the information you record in the screen above. Whatever, credit is unused this year will be reported as a carryforward or carryover. From then on, the carryforwards will be reported on next year's 1116 and will be carried over indefinitely until used.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

yes there is a bug in the app

in forms mode

scroll down until you get to the 1116 line

click on the +

highlight schedule B

click on open form

highlight sch b 1116

click finish

a form will open that can not be used (bug 1)

under the forms in my return you should see under form 1116 - 1116 comp wks

highlight it - the form should open

if you scroll down to part II you see certain pink areas that need to completed. they probably were completed previously but the data is now gone (bug 2)

if you scroll down further you should get to the amt c/o section. entering amounts should generate schedule B which you won't see until you close the form (bug 3?)

c/o can only be entered for the category checked. that means if you have multiple 1116s because of different categories you must go through this process for each category for which you have a c/o

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

If the 1116 bug was identified, why wasn't it fixed? The foreign tax paid was minimal less than $10 and did not warrant the pain trying to figure out what was wrong. I didn't see your fix until after I sent the return in. This years Turbo Tax did odd things this year and was much more frustrating that usual. I'm thinking of changing next year.

t

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

While I appreciate you for candid, I am unclear how to enter Credit carryback / Carryforward. I am unable to still see the form where I can enter the data. Can one of you please let me know how to enter? Is there a way I can get someone on line who knows this stuff without waiting for days and explaining the issue to multiple folks. Please note that I am using Desktop ver and confirm that this applies to Desktop ver too.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

ok folks. I really need some urgent help to finish. As soon as I open SchB 1116, all my foreign tax credit is gone and the tax due shot up. I do not know how to fix. Please Please can one of you message me to talk? I have spent way too much time with no end in sight.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Still struggling. I am not even finding carryforward in TT Desktop ver. I am enclosing the data taken from the picture from my previous year (done by CPA). Can someone from TT help me, how to enter this? I have been struggling with this and I cannot find any CPA who will do it this time. Since it is too late. Many thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

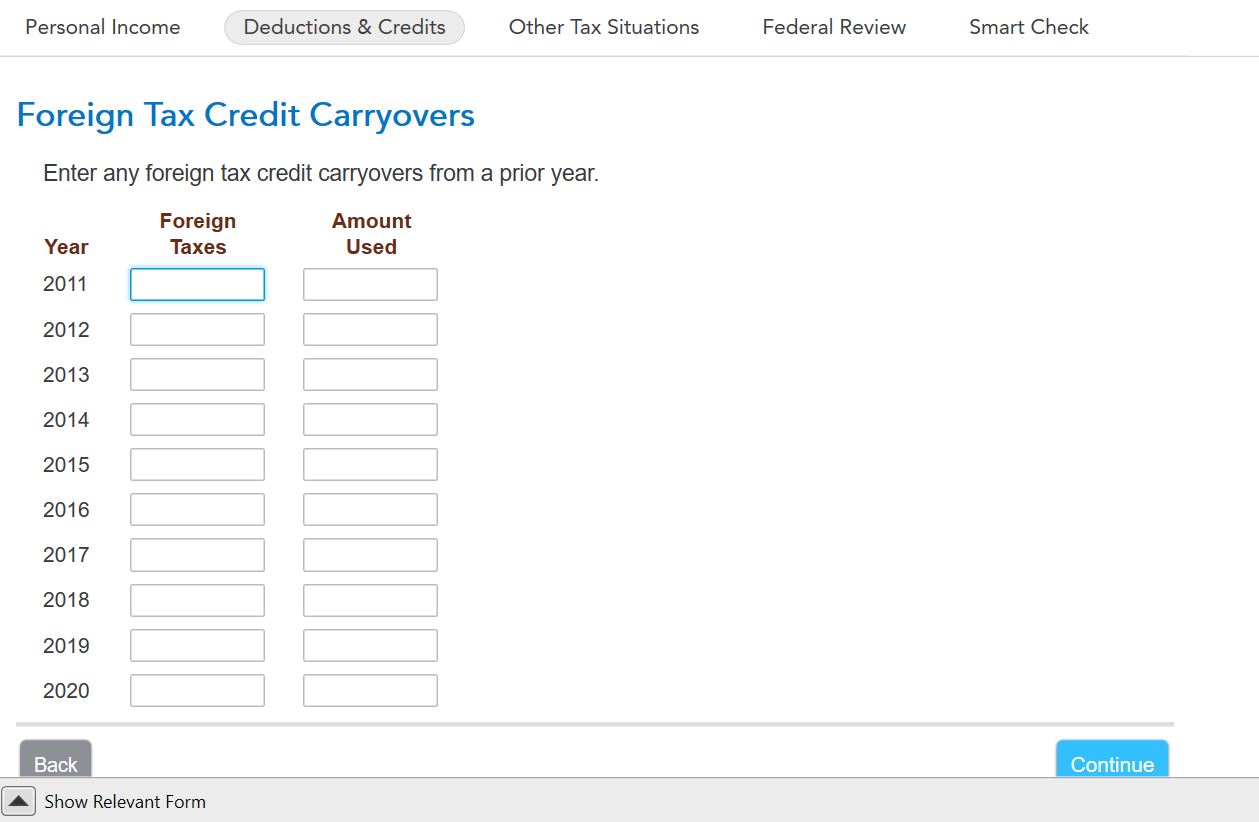

Select Deductions and Credits

Scroll down to "Estimates and Other Taxes Paid"

Scroll down to "Foreign Taxes" and click Start or Update

YES

Continue through the interview until you get to this screen and enter

The amount you can use for 2021 will be applied

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Thanks for the response. Am I right in interpreting Carryforward is called as Carryover by TT? MY previous year return done by CPA shows numbers till 2027 and Turbotax does not allow beyond 2020. What happens to the numbers for years 2021 to 2027? Please refer to my screenshot. Also where do I enter Carryback details in TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Carryover and Carryforward are synonymous. As far as reporting carryover projections into future years, this doesn't get reported to the IRS so no such schedule exist. As a value-added benefit, your CPA may have prepared this in a worksheet for your own reference but but it is premature to project what the carryover is because you may have future Foreign Tax Credits to report. If that is the case, which would make these projections null and void. Also, keep in mind, you may apply some of these carryforwards in future years so some of these carryover amounts may not be correct from 2021-2027

In a nutshell, we are only interested in your past carryovers to report on Form 1116 for this year. Turbo Tax automatically does this from the information you record in the screen above. Whatever, credit is unused this year will be reported as a carryforward or carryover. From then on, the carryforwards will be reported on next year's 1116 and will be carried over indefinitely until used.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

You mentioned Carryover and Carryforward are synonymous. Can you please let me know Carryback? I see only entry for Carryover, not carryback. Are all three Carryback, Carryover and Carryforward are synonymous?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

No. While carryover and carryforward refer to claiming any excess credit in a future year, carryback is used to claim excess credit in a previous year.

When your qualified foreign taxes exceed the credit limit in a given year, you may be able to carry over or carry back the excess to another tax year. You’re allowed a 1-year carryback, and then a 10-year carryover, of the unused foreign taxes.

To perform a carryback you’ll need to amend your prior year return. The unused credit would be taken in Part III, line 10 of the 2020 Form 1116.

Please see 2021 Publication 514 for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

Thanks for the responses. I cannot seem to find anywhere to enter carryback. I can only see carryover. I went through step by step and also through forms. Hope one of you can kindly point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

In TurboTax online,

- Open up your TurboTax account and select Pick up where you left off

- At the right upper corner, in the search box, type in "foreign tax credit" and Enter

- Select Jump to foreign tax credit

- Follow prompts

- On-screen Excess Foreign Tax Credit, select Learn More.

- See the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

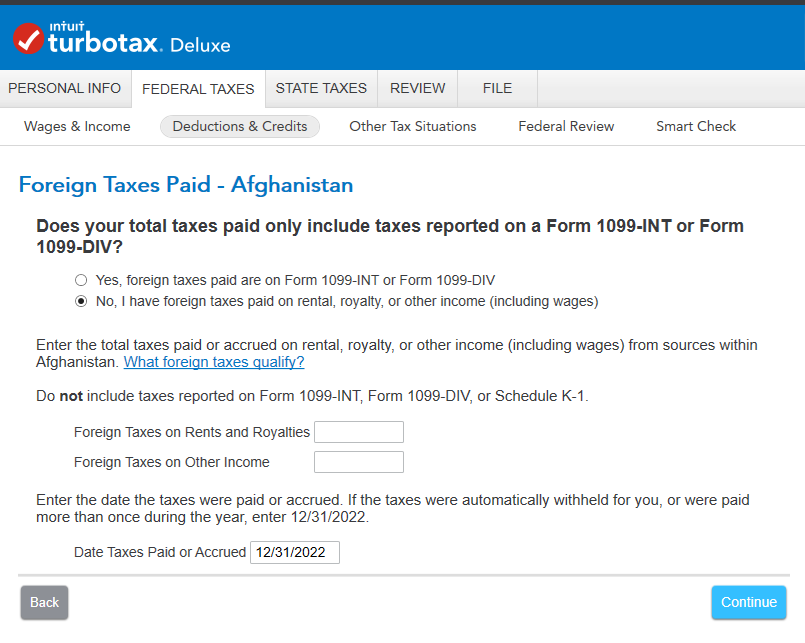

I have run into some very strange behavior in TT around Foreign Tax Credit and Form 1116, and your post comes closest to some of what I am seeing. For example, I never saw a place in the step-by-step questionnaire for FTC to actually enter the foreign tax (on my wages)! I eventually had to find and open Form 1116 and enter it that way. Is this another bug i.e. should there be a place to enter foreign income taxes paid in the questionnaire (in either USD or foreign currency + exchange rate)?

I realize your post was TT 2021 and mine is TT 2022, but I assume Intuit never fixed the bugs at all ... ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax credit handling - Frustrated

There is a place in the interview in the CD/Desktop version of TurboTax.

Go To Deductions & Credits

- Scroll to Estimates and Other taxes

- Select Foreign Taxes

- Continue the interview.

If you come to the Country Summary select EDIT and continue the interview.

Having a place to show the conversion of foreign currency does sound like a good idea. I will forward that idea.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

psberg0306

Level 2

anthonybrewington21

New Member

griverax

New Member

gocatt19731

New Member

ed 49

Returning Member