- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Estimated taxes change unequal to equal

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

Is there a way to make Turbotax change to way it figures estimated taxes?

As of now when it calculates Federal and State the estimated taxes in unequal amounts.

Such as nothing in periods 1 or 2 but 3 shows 100.00 and the 4th show 300.00.

Would prefer that they show equal amount for all periods.

As per the above example all 4 periods would be 100.00.

Where would I look to change this for both Federal and State?

I know I can ignore what it produces but I prefer to see equal amounts.

Thanks

Using TT Deluxe 2023 Federal and State Desktop

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

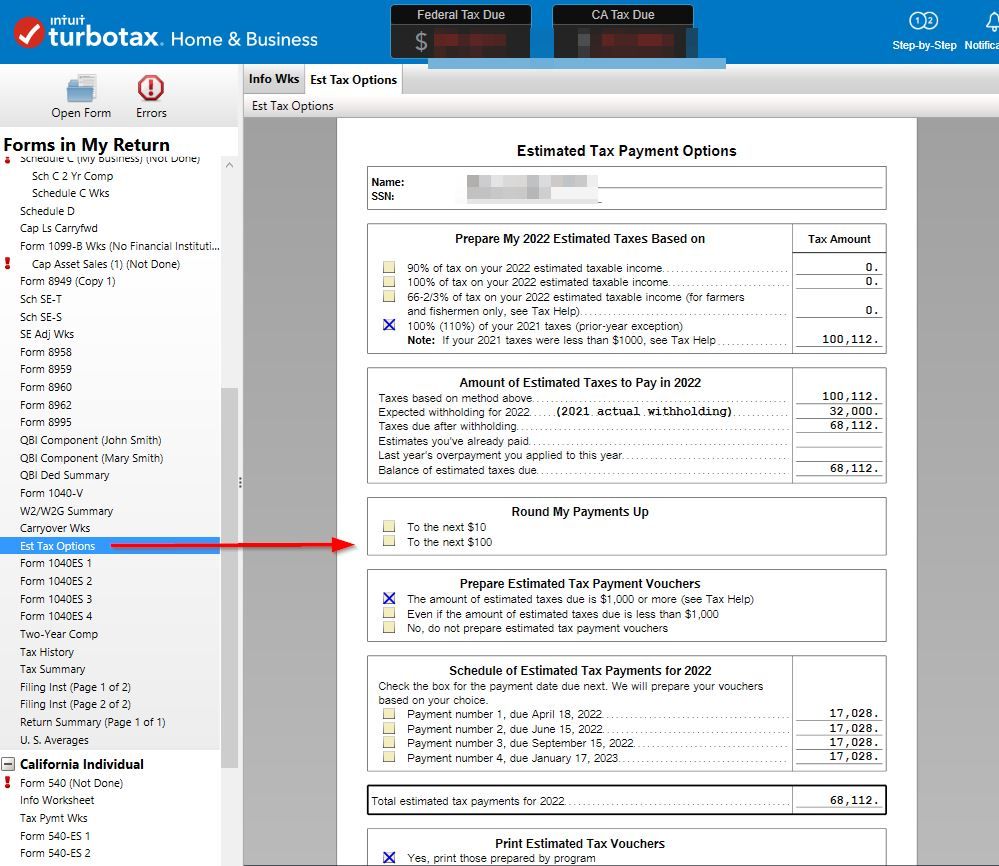

That's weird. I know that California prints uneven amounts and skips the 3rd quarter. Go to Forms Mode. Click Forms in the top right (left for Mac). Look though your forms in the left column for Est Tax Options about 3/4 way down near the bottom of the federal forms. You can play with all the options on that.

Since I pay estimates the IRS always sends me prefilled 1040ES forms each year with my name and ssn but no amount. So I prepare them in Turbo Tax and just write the amount on the real ones the IRS sends me. Then they fit in the window envelops.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

That's weird. I know that California prints uneven amounts and skips the 3rd quarter. Go to Forms Mode. Click Forms in the top right (left for Mac). Look though your forms in the left column for Est Tax Options about 3/4 way down near the bottom of the federal forms. You can play with all the options on that.

Since I pay estimates the IRS always sends me prefilled 1040ES forms each year with my name and ssn but no amount. So I prepare them in Turbo Tax and just write the amount on the real ones the IRS sends me. Then they fit in the window envelops.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

I wonder if it did uneven ones because you applied part of your refund to next year? I'm looking at mine. This year I have a large refund so I applied part of it to next year as an estimated payment. So it is skipping the first 1040ES and have a small amount for the 2nd Quarter then the 3rd & 4th are the same.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

Estimated tax payments are only permitted to be credited when paid. For example, a Q4 estimated tax payment is only permitted to be applied to Q4, not to Q1 or Q2. Only tax withholding (whenever it is withheld), not estimated tax payments, is permitted to be treated as paid evenly throughout the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated taxes change unequal to equal

FYI - I applied all refunds to next years return.

I always have to pay estimated taxes.

Normally they equal out.

Thanks for giving me where to look. Should have realized that myself.

Finally made the changes.

Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dalibella

Level 3

tbduvall

Level 4

johntheretiree

Level 2

kfscruggs

New Member

rblaineb

New Member