- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: ESPP Income - Cost basis computation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

This error is related to the known "Selling price per share" issue in TurboTax 2020.

Even after the Feb. 4th update, TT will still not properly compute cost basis on ESPP income. I compared a virtually identical transaction in my 2019 TT, to the same one (just slightly different amount) in 2020.

Here are screen shots from TT:

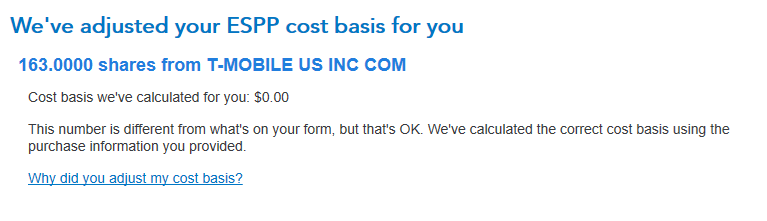

2020:

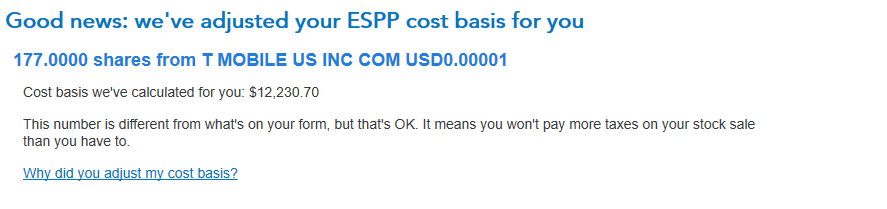

2019, same kid of transaction:

As you can see, in 2020, it's just computing a cost basis of Zero. That is a mistake. Each of those transactions were entered the same way, using information from my 1099-B (which was imported) and my 3922.

Is this still a known issue the developers are working on?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

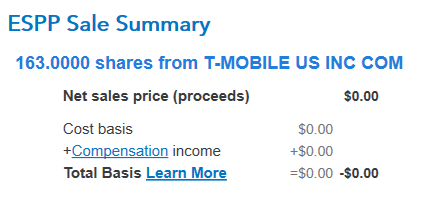

Here is another screenshot from TT on this issue, that I believe gets at the heart of the problem.

TT is simply not computing the cost basis correctly:

Everything is just "$0". All the sale data was entered, so this makes no sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Thank You for your patience

Many large companies offer Employee Stock Purchase Plans (ESPP) that let you buy your employer's stock at a discount. These plans are offered as an employment incentive, giving you an opportunity to share in the growth potential of your company's stock. For details about tax treatments, click here: Employee Stock Purchase Plans

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

Hi Linaj2020,

The selling price per share issue is actually a separate issue than the problem that TT has with ESPP transactions. The selling price per share issue was actually fixed in the TT maintenance release yesterday, Feb. 4th. The link you provided discusses that issue, which is now fixed.

What isn't fixed is the ESPP malfunction in the software that caused TT to compute $0 proceeds and a $0 cost basis on all ESPP transactions. I would love to hear an update specifically about that, if you have one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

During a recent test of an ESPP stock sale this experience did not happen. Here is a list of steps that were used.

- Open your TurboTax account (Desktop Only)

- Scroll to Investment Income > Stocks, Mutual Funds, Bonds, Other > Update > Edit beside the ESPP stock sale

- Continue > Edit > Enter the requested details for this stock > Choose the Sale Category > Continue

- Continue or review your information on Less common items > Done

- Yes stock was acquired through employee stock plan > No do not remember this answer for all sales > Continue

- Select Employee stock purchase plan (ESPP) > Continue > Select Company > Enter number of shares sold > Select owner

- Continue > Select I have all my info ..... > Continue > Enter your information under short or long term as applicable

- Continue to complete your sale

If you continue to experience your original issue you can click this link: Contact us

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

@DianeW777 That works for the first ESPP sale. Somehow for every subsequent ESPP sale after the first the cost basis is incorrect coming up as $0. I walked through an expert on phone support over the weekend and they confirmed with me that there is a bug and pointed me to this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

I also tested this on the 2/10/2021 update and the bug still persists.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

@DianeW777 Subsequent transactions, aside from the first, part way through the guided question asking, suddenly revert back to the first transaction. That is why you end up with a $0 basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

Hi Diane, thank you for your post above about how to enter ESPP transactions. However, I can confirm that this bug does still exist in Turbotax, and has NOT been fixed with the latest software release dated Feb. 10th.

Can you confirm for me that this bug has been identified by Intuit and it is being worked on? If not, we have a huge problem on our hands.

To clarify, as has been posted by myself and several others, turbo tax will compute a cost basis of $0 for all ESPP transactions, even when you follow the instructions as you detailed above.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

For what it's worth, I'm having the exact same issue...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

I can confirm that this is definitely a bug. As noted by another user, the cost basis calculation works for the first transaction, but all the others show the cost basis as $0. Also, I have multiple purchase lots and sales, yet the 3922 form I enter seems to be sticky... I enter it for the first sale where it is correct, but then enter it for another sale and it prefills the values from the first sale. When I update them, the entered amounts on the first sale are changed too when I go back to look at it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

Thank you for chiming in and saying you see the same thing. What concerns me here is there hasn't been any acknowledgement from anyone at TurboTax that this bug exists. The post from DianeW777 above seems to imply that they don't think the bug exists, which is not true. What could be happening is they might be confusing this issue with the one that affected RSU's, where selling price per share could not be entered. That bug was in the same interview process inside TT (1099-B income) that is also used for ESPP's. That was a more obvious bug, and it was fixed about a week ago. So I wonder if TurboTax thinks this bug is fixed, and they aren't working on it.

If that's the case, it would be a disaster for all of us with ESPP income, just sitting here waiting for them to fix it while we watch April 15th come closer. It would be nice to have a formal acknowledgement from TurboTax that they are working on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

Hi @DianeW777 , please look at the posts that follow your last message. There is a bug, and it is affecting every customer who has *multiple* ESPP sales (entering a single ESPP sale will work). Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

I am having the same problem. Cost basis is being calculated as 0. This is a BIG problem since this will increase our tax OWED significantly if it's not fixed and people blindly trust TT.

Please fix ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BUG: ESPP Income - Cost basis computation

For what its worth, updated toay ie 2/14, and bug still exists. If there are more than one ESPP sale, then it appears to "remember" old entries, misses cost basis computation, changes old entries when updating new ones, etc.

essentially, ESPP part cannot be used. Does anyone if anyone from Intuit acknowledged the issue ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

skmcheng

New Member

user314

Level 3

NancyKSCH

New Member

Michael16

Level 4

sayipm

New Member