- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Error help please..Received 1099-NEC from a company. I do not run a business. I worked part t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

So when I do a final review in 2020 online Turbotax Online Web it states this upon review:

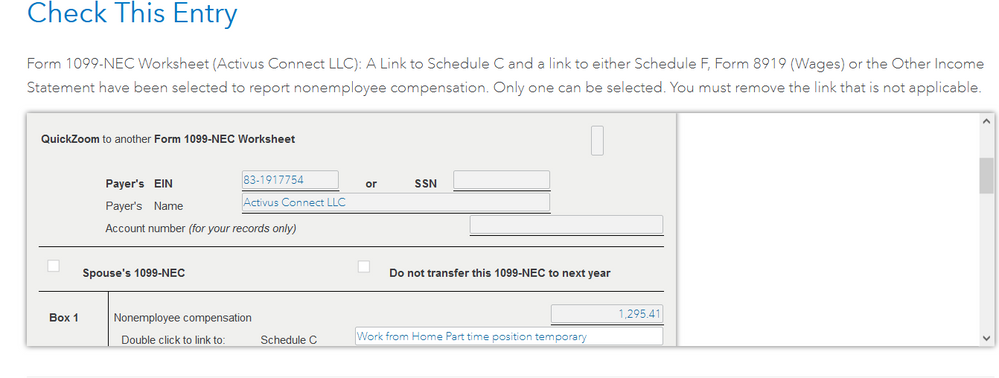

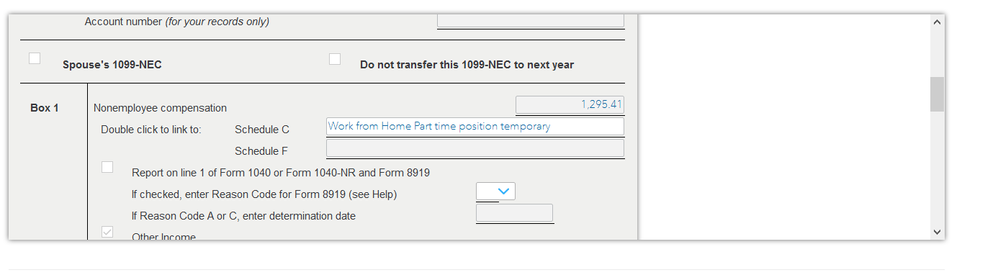

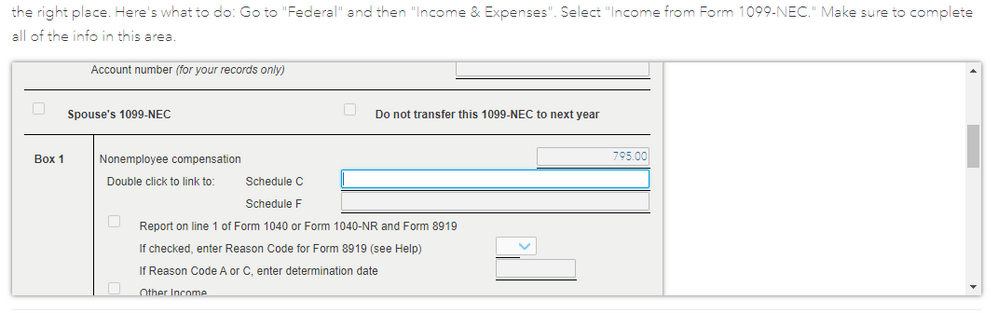

Form 1099-NEC worksheet (company name of company that paid me): A link to Schedule C and a link to either Schedule F, Form 8919 (Wages) or Other Income Statement have been selected to report nonemployee compensation. Only one can be selected. You must remove the link that is not applicable.

...It then shows a 1099-NEC worksheet where you cannot change anything except title of what you entered for position.

BUT it says to "Double click link to Schedule C or Schedule F" but you cannot click anything.

It did not produce a Schedule F when I go to Tax Tools and Delete a form. It does show a Schedule

C. There is no Schedule F.

What to do please?

Thank you

Peter

---------SCREEN SHOT-------------------

Here are the forms Turbotax created via Tax Tools Delete a Form

| 1040/1040SR Wks |

| Delete |

| Form 1040 |

| Delete |

| Schedule 1 |

| Delete |

| Schedule 2 |

| Delete |

| Schedule 3 |

| Delete |

| Federal Information Worksheet |

| - this form cannot be deleted. |

| Personal Worksheet (Peter) |

| Delete |

| Personal Worksheet (Rosalind) |

| Delete |

| Form W-2 (COADVANTAGE RESOURCES 50, INC.) |

| Delete |

| Form W-2 (TOWN OF MATTHEWS) |

| Delete |

| Recovery Rebate Credit Worksheet |

| Delete |

| Form 1099-NEC Worksheet (Activus Connect LLC) |

| Delete |

| State Tax Refund Worksheet |

| Delete |

| Form 1099-R (Fidelity Investments) |

| Delete |

| IRA Contributions Worksheet |

| Delete |

| Form 1099-SA (Untitled) |

| Delete |

| Earned Income Worksheet |

| Delete |

| Tax Payments Worksheet |

| Delete |

| Medical Expenses Worksheet |

| Delete |

| Tax and Interest Deduction Worksheet |

| Delete |

| Home Mortgage Interest Worksheet (NewRez) |

| Delete |

| Form 1098 (Untitled) |

| Delete |

| Charitable Organization (Goodwill) |

| Delete |

| Charitable Organization (The Matthews Help Center) |

| Delete |

| Misc Itemized Deductions Wks |

| Delete |

| Schedule B |

| Delete |

| Schedule B -- Form 1099-INT (State Employees Credit Union) |

| Delete |

| Schedule C (Work from Home Part time position temporary) |

| Delete |

| Schedule C (Work from Home Part time position temporary) -- Schedule C Worksheet |

| Delete |

| Schedule D |

| Delete |

| Capital Loss Carryover Worksheet |

| Delete |

| Capital Loss Carryforward Worksheet |

| Delete |

| Earned Income Credit Worksheet |

| Delete |

| Schedule R |

| Delete |

| Sch SE-T |

| Delete |

| Schedule SE Adjustments Worksheet |

| Delete |

| Form 8582 p1 |

| Delete |

| Modified AGI Worksheet |

| Delete |

| Form 8582 p2: Wkst 1 - 5 |

| Delete |

| Form 8801 |

| Delete |

| Form 8862 |

| Delete |

| Form 8880 |

| Delete |

| Form 8889-T |

| Delete |

| Form 8889-S |

| Delete |

| Form 8915A-T |

| Delete |

| Form 8915A-S |

| Delete |

| Form 8915B-S |

| Delete |

| Form 8995 |

| Delete |

| Qualified Business Income Component wkst (Peter A Cumming) |

| Delete |

| Qualified Business Inc Deduction Summary |

| Delete |

| Forms W-2 & W-2G Summary |

| Delete |

| Forms 1099-Misc/1099-NEC Summary |

| Delete |

| Forms 1099-R Summary |

| Delete |

| Carryover Worksheet |

| Delete |

| Two-Year Comparison |

| Delete |

| Tax History Report |

| Delete |

| Tax Summary |

| Delete |

| Compare to U. S. Averages |

| Delete |

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

If you received a 1099-NEC, you might very well be self-employed. This does not mean that you run the company. If you earn money for work and are not paid by W-2, you are by default, an independent contractor.

This income should be reported on Schedule C.

- Type "Schedule C" in the search field at the top right hand of the screen.

- Select "Jump To Schedule C" and you will be brought to the section of TurboTax where you can enter or have entered your business income and expense information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

Still get error. Info already filled in by Turbotax. Program bug.

Error being reported states that somehow another form was filled out.

I never entered anything manually into a form. Just filled out the questions asked by Turbotax as I have for last 20 years or so.

Perhaps they will fix the bug. I found a workaround by deleting a worksheet.

Peter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

what form did u delete? we are stuck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

Currently there is a known issue when using TurboTax Online that is related to the program asking you to double-click to link to Schedule C.

Please review the article below and use the link in the article to enter your email address to be notified once this is resolved:

TurboTax: Why Am I Unable to Link my 1099-NEC?

Also you can review the information below for steps to possibly solve the issue.

Income reported on Form 1099-NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form.

Revisit the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry, by following these steps:

- Open TurboTax.

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “1099-NEC” (or for CD/downloaded TurboTax, click Find),

- Click on the “Jump to 1099-NEC” link.

This will bring you a summary of all Form 1099-NEC that you have entered. Click Delete or the Trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return.

Follow these steps to go to the Schedule C section of your return:

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “schedule c” (or for CD/downloaded TurboTax, click Find).

- Click on the “Jump to schedule c” link.

If you already have created a Schedule C in your return, click on edit and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC along with any additional income you received for that business.

Once you have completed this, the error should be eliminate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

This worked. Thank goodness because I wouldn't have been able to finish and file. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

Didn’t work for me so we filed with another online company and there were no problems with them

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

The income you receive on a 1099-NEC is considered self-employment income. It is reported on a Schedule C. TurboTax will walk you through setting up your business's Schedule C. Your self-employment income has to be linked to a business return, so you should go through the Schedule C interview and then link your 1099-NEC to that business.

We'll automatically complete Schedule C when you set up your self-employment work in TurboTax or when you enter what the IRS considers self-employment income, which is usually reported on Form 1099-NEC or 1099-MISC. Schedule C is supported in TurboTax Self-Employed (both online and in the mobile app) and in all personal 1040 versions of the TurboTax CD/Download software.

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

If you need Schedule C to report a 1099-NEC or 1099-MISC, search for 1099-NEC or 1099-misc and select the Jump to link. Answer Yes to Did you get a 1099-NEC or 1099-MISC? We'll ask questions to find out if your 1099 income needs to go on Schedule C.

If your 2018 or earlier return requires Schedule C-EZ, we'll also generate a Schedule C for background calculation purposes only. It won't get filed with your return.

Related Information:

- What self-employed expenses can I deduct?

- What is the self-employment tax?

- Why am I paying self-employment tax?

- What tax breaks can I get for my 1099-MISC?

- What's the difference between self-employment income and other income?

- Am I considered self-employed?

- How is being self-employed different from being an employee?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

None of this advice works for me. I'm seconds away from filing, this is extremely frustrating as it's one tiny job that is holding me up. I've followed the instructions as well as deleted and entered the 1099 NEC several times. It all c

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

If you have self-employment income, it has to be reported on a Schedule C. You have not completed the Schedule C yet, so there is nothing to link it to as you are going through the review. Use the instructions above to enter the Schedule C details; it doesn't take much to enter. You can say you use your name and home address for your business. Answer no to the 'did you pay employees or contractors' questions. Skip the EIN information and once you go through that short section, you will be able to link your form. E-filing does not start until the 12th. @Jdiehl

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

Well first I deleted Schedule C but then I thought that was not the right thing to do so I deleted the 1099 NEC and reentered it which recreated the schedule C. The next thing I tried was deleting the 1099 NEC worksheet only and that worked for me at least. I did this by going into tools on the bottom left and then there was an option to look at forms if I remember correctly. Good luck, and I'm sorry if you already tried this. I'm just a user like yourself

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

I am using online TurboTax and I went into tools on the bottom left and I deleted the form 1099 NEC worksheet and then I could continue. But who knows if that will work for everyone

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

go with another company. It’s a hassle to have to start at square one and enter all your info in but we have all been having this same issues for over a week and it’s not getting fixed so they obviously don’t care.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Why am I not able to link my 1099-NEC

Thank You for your patience

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error help please..Received 1099-NEC from a company. I do not run a business. I worked part time. How resolve error pls?

I've deleted and re-entered my 1099-NEC information (along with expenses) 4 times. 2 of those times were with TurboTax reps. All I want to know is what is the ETA on the issue resolution? I'm tired of the "tax advice" that had me duplicating work over and over.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaoning

New Member

user17658387720

New Member

4136631086

New Member

saurabh-doctor1

New Member

ttstarac

New Member