- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Error Check Message Section 199A Inputs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

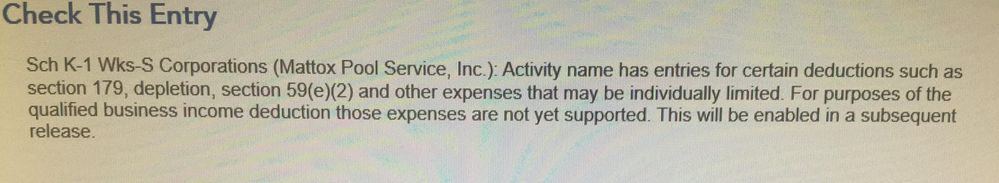

I am using TurboTax Premier for my personal taxes. I have finished all the entries and am getting an Error Check message that states the following:

I have entered all the K-1 Line 17 code V items on the table for Section 199A QBI. I had no issues last year. This year I have a Section 179 depreciation item that makes the overall income a net loss. Does this message mean that an upcoming TurboTax update will complete this item or is this something different?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Yes, TurboTax anticipates that an update will be available on 2/20/2020.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

I'm not sure if this is the right spot to ask but I also received the 179 message.

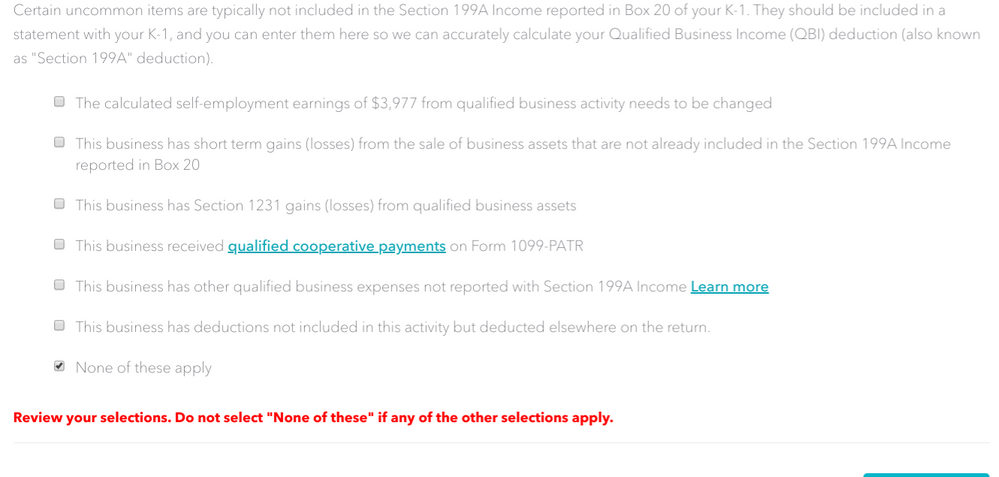

But before I even get there I get stopped with a screen stating "Let's check for some uncommon adjustments"

I am very new at this but here is my best guess on info that could help solve this:

- I don't know how to calculate self employment earnings to verify the number being correct?

- Next to Box 20 on k-1 it was marked STMT. It lead to me adding $2632 in deductions that I got from a supporting document to my 1065. I am wondering if I need to add this amount again to the line on this screen "other qualified business expenses not on 199a?"

- And last, since I took mileage and some office supply deductions, would I need to put that number on the last statement "this business has deductions not included in this activity but not deducted somewhere else?

I hope this leads to an answer cause I'm about to torch this laptop lol!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

I have the same issue and I too am ready to throw my computer through the window.

What's up with this? Can't click on "None of these apply"

Is this also being corrected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Is this update still supposed to be coming today?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

I got an update earlier today but it didn't resolve my problem. Same Error Message on Error Check.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Yes - Received an update today. Thought I would wait until tomorrow to see if it updates again. Hope that resolves it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

I got an update yesterday (2/20/20) but it did not correct my problem. No update yet today. Any news on when this will be resolved? If it can't, can I still e-file my return? After reviewing IRS publications and IRS FAQs on this subject, all my entries concerning this issue are accurate as best as I can determine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

As of this morning, this error is still occurring. There are no new updates to resolve this.

Can I ignore this error and still accurately and confidently e-file my taxes? This issue is the only thing holding me up.

Help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

I discovered this morning that IRS Publication 535 is still being revised for TY2019. This is what directs the Section 199A application. I am waiting for response from a TurboTax employee expert to answer your exact question. I also am waiting on this one issue before I can file. Hopefully I will get an answer today.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Thanks Mattox, that is good to know. Though the IRS needs to get it's **bleep** together and publish this thing, it's almost March.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Congress changed the law on December 20, 2019 so it put all the IRS people who have to update Publication 535 in a bind and of course TurboTax folks have to wait on that before they can change their code. I agree that they need to get on with the show.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

Appreciate the feedback. It wasn’t fixed earlier so I’ll check again Monday or so. Gonna take the weekend off to enjoy not doing my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

The only thing stopping me from filing my taxes is this error message.

As my name suggests, taxes aren't my wheel house but....

If it is just a Turbo Tax thing, can't the taxes be filed with this error message? Or, does the error in their code screw everything up?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Error Check Message Section 199A Inputs

You can file your taxes but if the change TurboTax is waiting for from the IRS affects your return, you'll have to file an amended return later to correct it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ben_mountjoy

Returning Member

Eddie Glastname

Level 1

TaxHead

Level 2

in Education

jaxoneilers1

New Member

dunyele

New Member