- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

I'm not sure if this is the right spot to ask but I also received the 179 message.

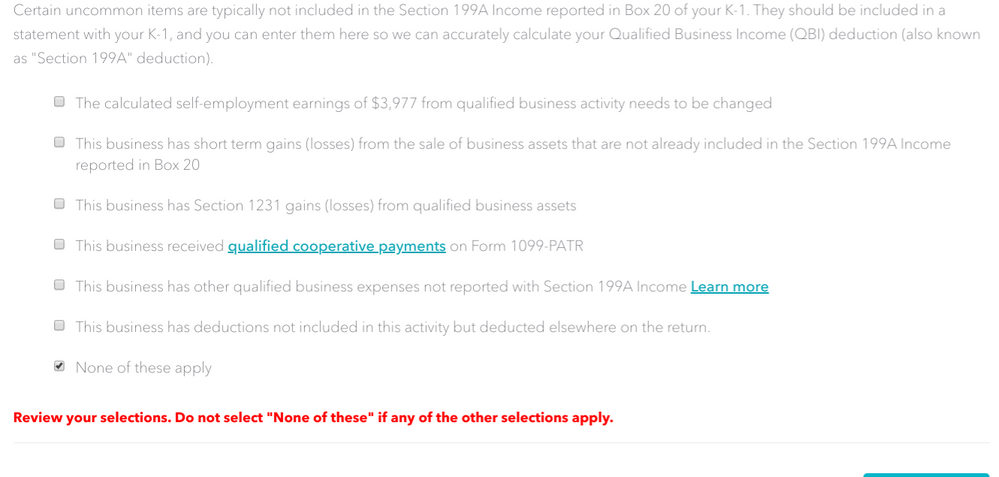

But before I even get there I get stopped with a screen stating "Let's check for some uncommon adjustments"

I am very new at this but here is my best guess on info that could help solve this:

- I don't know how to calculate self employment earnings to verify the number being correct?

- Next to Box 20 on k-1 it was marked STMT. It lead to me adding $2632 in deductions that I got from a supporting document to my 1065. I am wondering if I need to add this amount again to the line on this screen "other qualified business expenses not on 199a?"

- And last, since I took mileage and some office supply deductions, would I need to put that number on the last statement "this business has deductions not included in this activity but not deducted somewhere else?

I hope this leads to an answer cause I'm about to torch this laptop lol!!!

February 20, 2020

9:44 AM