- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: e filing with form 1116 Foreign Tax Credit is being rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

it is quite frustrating that Turbo tax has yet to fix this bug and is recommending we file paper tax return. In New York State one is obliged to e-file and can be fined if you file by paper.

As there is a large audience affected I'm hoping Turbo tax customer service sees this complaint and remedies the bug or otherwise I guess we all should ask for a refund of the fee paid to turbo tax and secondly look towards another provider for next year tax filings.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

May I know which e filing issue you are referring to?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

thanks for reaching out.

This is in regard to Part 2 of Form 1116, when it requests a date for taxes paid or accrued. In prior years the form accepted " Various" as my withholding from Canadian dividends is quarterly. However for it to work in 2020 I needed to put in just one date. I refilled and it was accepted .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

This issue is related to e-file rejection error "ForeignTaxesPaidOrAccruedDt". It has been submitted and is currently under investigation. If you would like to receive an update for the progress, click on the following link to get notified:

Per IRS, if you have paid taxes to both foreign and the US tax authorities, the IRS allows you to claim a foreign tax credit on a Form 1116 along with your US tax return. The amount will show on Schedule 3 line 1 and line 20 on Form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

I have been rejected on 1116 three times. Tried it several ways. Is this still a bug or is there a solution on the carryover AMT election that will prevent us ever being able to file electronically?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e filing with form 1116 Foreign Tax Credit is being rejected

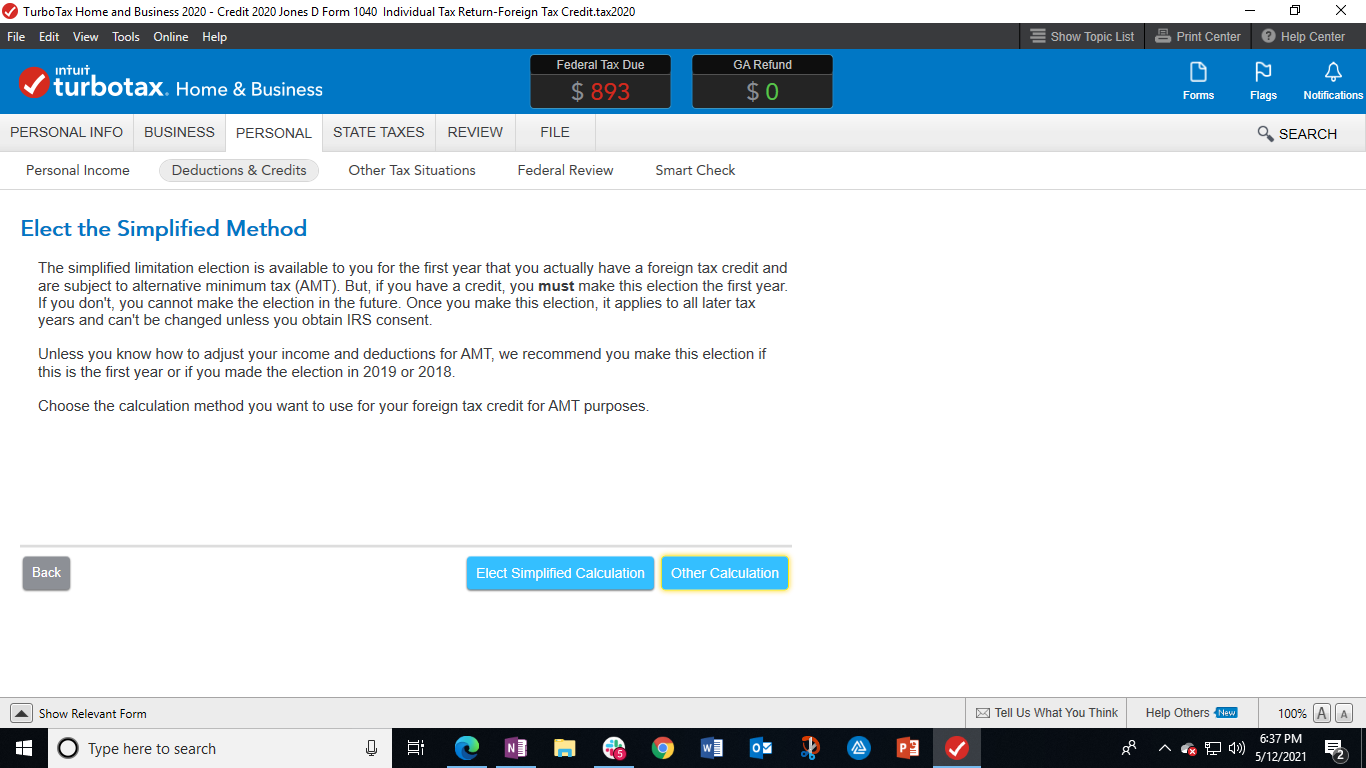

You can try to change the election choice from Simplified to other calculation. As you scroll through your foreign tax credit entries, when you reach the following screen, select other calculation to see if this will allow you to efile. This is what the screen looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

csilerm

New Member

djpmarconi

Level 1

kac42

Level 1

rtoler

Returning Member

botin_bo

New Member