- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Do I file 1099-NEC to each the State it came from?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I file 1099-NEC to each the State it came from?

My wife and I are both resident of KY and we always filed married jointly. I only get W2 so my tax is straightforward. My wife did some work online (edited essays and taught a few courses all online). She got 1099-NEC from PA and NJ. I have reported those on Federal. 1099NEC from PA has box 1 and 5 whereas NJ only has box1.

My question is: do I need to file additionally to the state of PA and NJ even though we only reside in KY?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I file 1099-NEC to each the State it came from?

To clarify. Is she doing work for a business or is she offering these services to multiple individuals?If she is doing work for a company as a sub-contractor with no work performed in the state of PA, then she would not need to pay taxes in PA unless they have an office for her and she chooses to not work from the office in PA. If she is not subject to taxes, she would still need to file a PA return to claim a refund of taxes withheld.For NJ she will not need to file a return.

(Edited 3/17/23 @9:10AM) @ Jimmy1314

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I file 1099-NEC to each the State it came from?

Thank you for your response!

How big would the refund difference be if I did KY first then PA and NJ after?

Or should I restart by deleting KY now and work on the other 2 states first?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do I file 1099-NEC to each the State it came from?

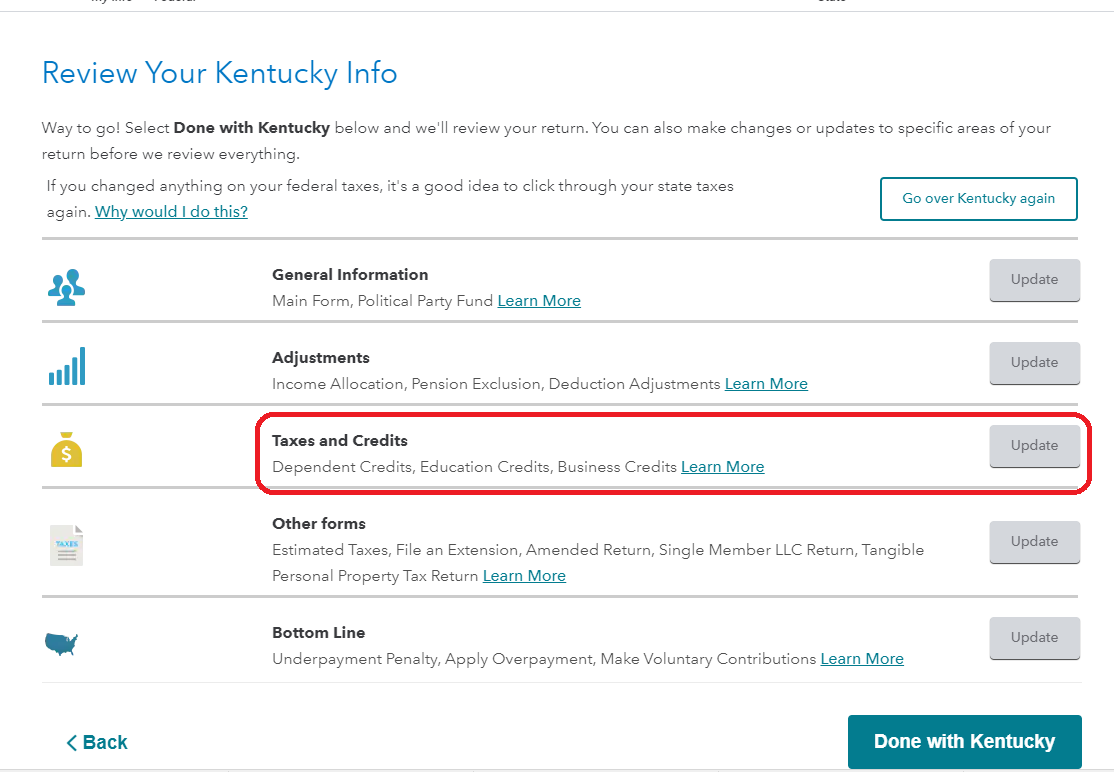

While you do want to complete your nonresident state tax returns first, you do not have to delete the Kentucky. Complete the Pennsylvania return then go back to Kentucky on the summary page, look for the Tax and Credit section to add the Pennsylvania credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dgurreri

New Member

dgurreri

New Member

ronscott2003

New Member

caitastevens

New Member

bob

New Member