- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Clergy Social Security Exemption on Honorariums

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clergy Social Security Exemption on Honorariums

I am clergy with Social Security exemption. I understand how this works with my primary income. However, on honorariums that I receive, I need to report those for income tax purposes (on Schedule C, I understand). However, since this is clergy income, I am not responsible for Self-Employment tax on this honorarium - but I don't see any way to exclude this added honorarium income from SSA tax.

How do I do this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clergy Social Security Exemption on Honorariums

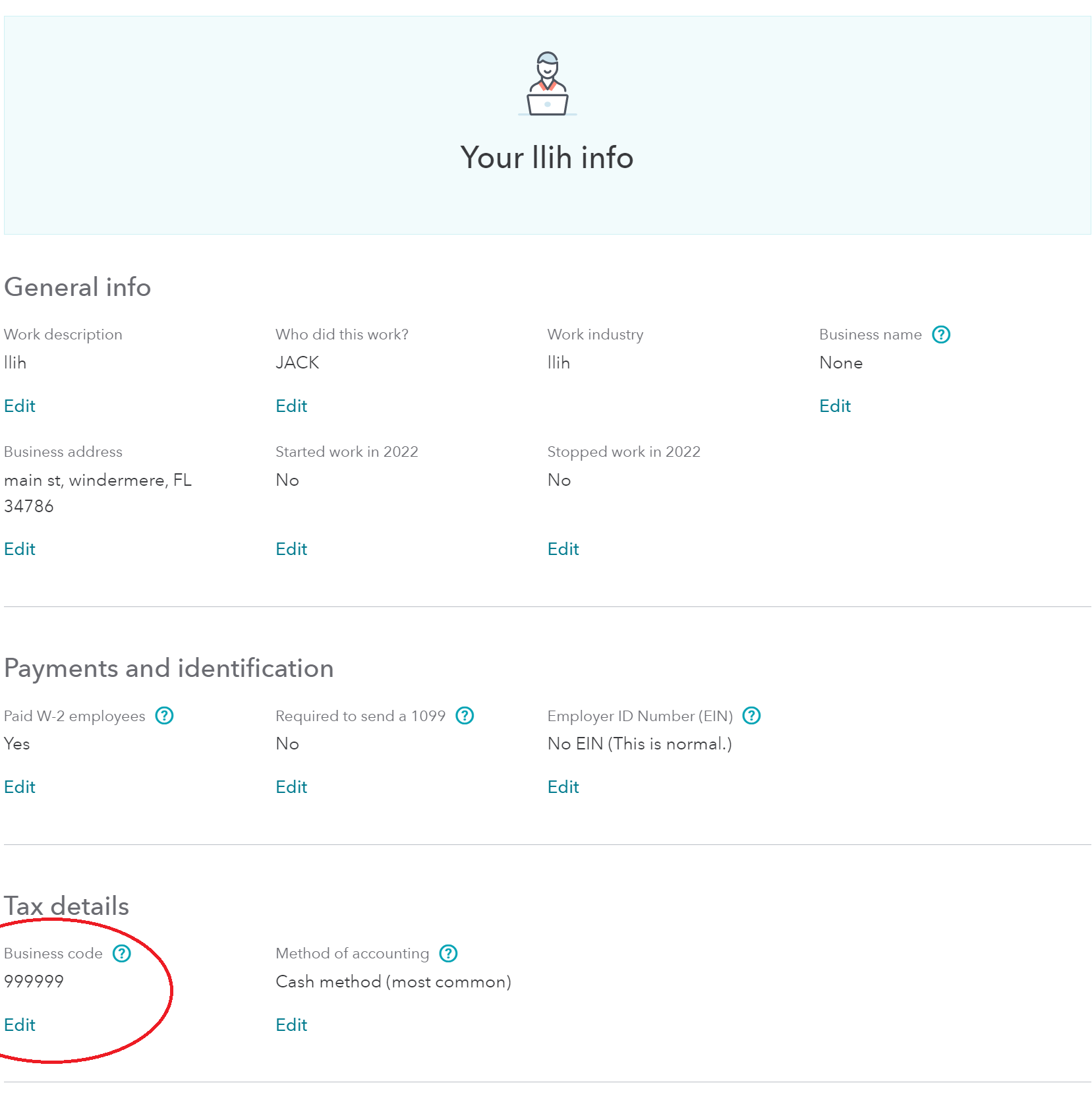

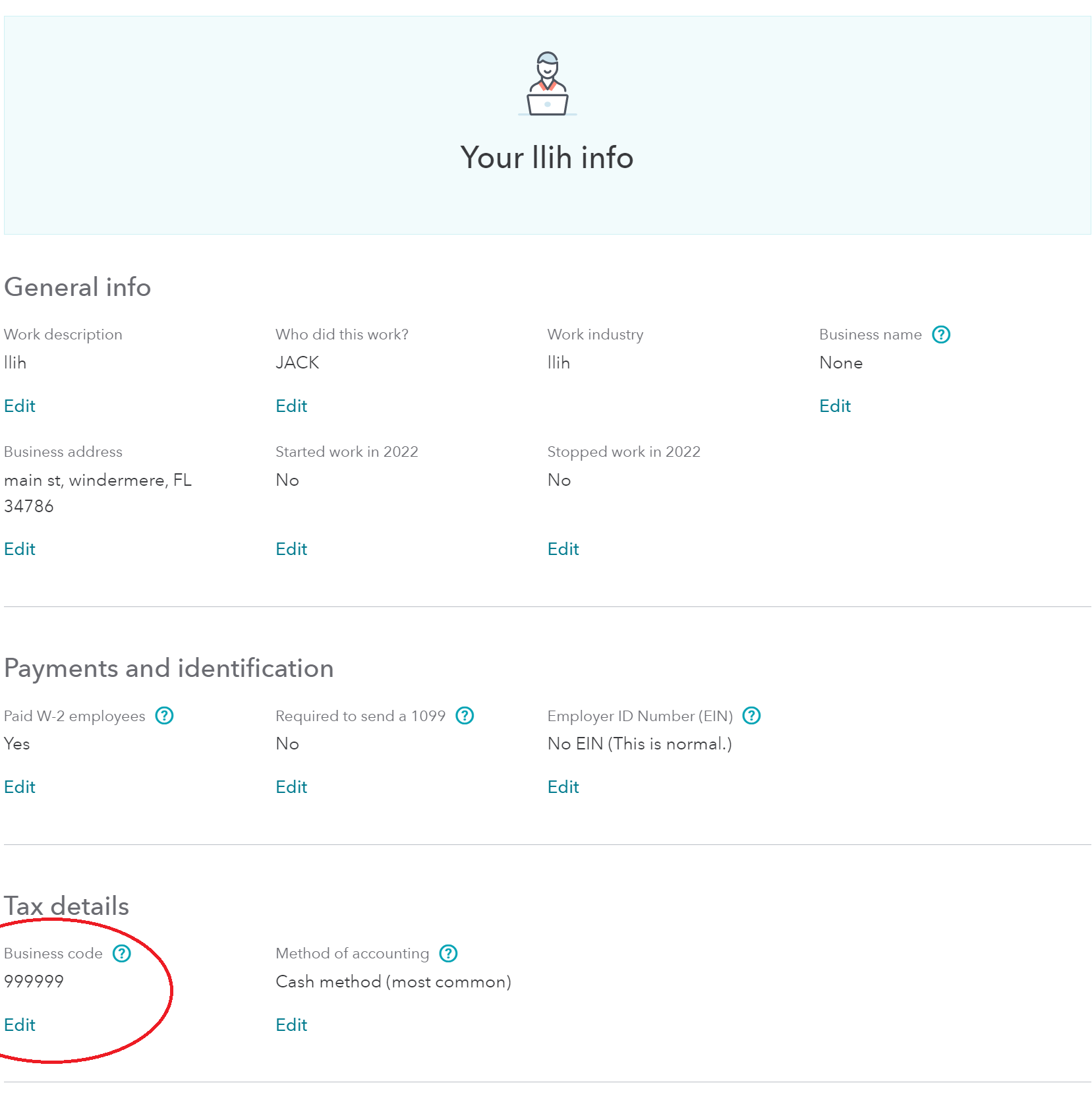

In the Business Info section, you must be sure to use the Business Code 813000. This will prompt the questions regarding the parsonage. See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clergy Social Security Exemption on Honorariums

In the Business Info section, you must be sure to use the Business Code 813000. This will prompt the questions regarding the parsonage. See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Clergy Social Security Exemption on Honorariums

excellent thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vermillionnnnn

Returning Member

gciriani

Level 2

madhumali78

New Member

jnsaurabh12

New Member

malex335

New Member