- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Charitable Cash Contributions line 12b glitch?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

NO! I just updated my Deluxe version, ran "review" and it changed the $600 back to $300! I even tried calling their tech (non)support and wound up going down a rabbit hole of automated nonanswers! I have used this product for years, but next year? Honestly, if I had to choose tonight, the answer is use a competitors!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

I just updated my TT Deluxe but am still getting the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

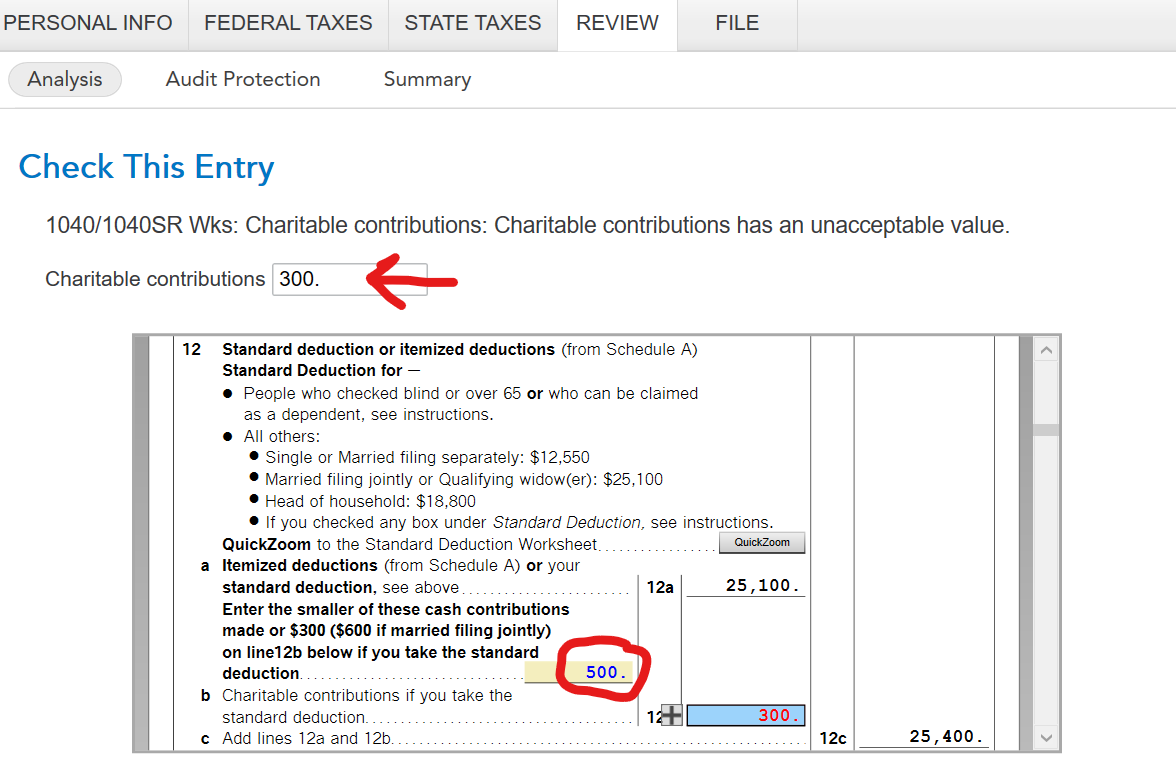

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

PLEASE fix the bug for those of us who need the charitable contributions for State Returns. PLEASE!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Nope, still glitching on my Deluxe version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

yep. I downloaded my stock info for Schedule D, which thankfully worked, but when I ran the error check on Schedule D, it messed up by override on 12b.

Not to mention that the 2116 form is not available so I am still hung up on finishing and filing!!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

I deleted my donations from the itemized section; once you do that, you get to input them in total on a screen after the "standard deduction is better" screen. This is the only way it works. It isn't just a problem for married filing jointly, I am doing my sister's married filing separate and it put in a limit of $150, so I had to do the same for hers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Don't know where you live, but be careful of your State return! If your state has an income tax, the software picks up data from the federal return, and the state (at least here in California), the federal return also goes to the state and the state computer checks the two returns against each other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

If the returns are compared, there would be no discrepancy between the Federal 1040 and the State return because the Federal return would not contain Schedule A (where the itemized donations would be listed) since the taxpayer is using the Standard Deduction on the Federal Return.

You could also enter the CASH donations on the Federal Screen as "Items" if you are sure you are not over the limit for cash donations on your state return. The amount will flow to the state the same as if it were split between items and cash.

Entering donations as "Items" and not as cash also eliminates the error on the Federal return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

This is crap this issue is over two weeks known and Turbo Tax has not fixed it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Also - if you do not see the Charitable Cash Contributions under Cares Act page - check each of your Charitable contribution line items. Turbo Tax uses the total of all items BUT you can only enter CASH (money) in line 12b. It may be less than the total line items if you have estimated a value for items such as clothing, shoes, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

After the Feb 23 update and restarting TT Deluxe I did not get an error this time through. Running back through the federal review and smart check sections seems to correct it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

I updated TT Premier today, Feb. 28 and this bug has been fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

I am having the same problem. I want to take the itemized deduction. My state accepts the federal itemized deduction and so my combined federal and state taxes are lower if I select itemized deductions. TT gives an error for line 12b. I would correct the error and TT indicates the error has been fixed. However, when you are about to file taxes it does a final check and automatically reinserts the $600 back at line 12b. TT keeps putting back the $600 in line 12b even when I correct it. This is clearly a bug. I've tried TT customer service twice and they are of no use. The problem is with the 1040 SR wks line 12b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Charitable Cash Contributions line 12b glitch?

Maybe this will help, if you haven't tried it already. The $600 charitable contribution for married filing jointly only applies to cash contributions. It does not apply to items (clothes, shoes, etc). You may have to manually enter the cash part of your charitable contribution on line 12b.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stefaniestiegel

New Member

organdan

Level 1

pv

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

IY

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

CTinHI

Level 1