- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: cannot email my state return due to error message

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot email my state return due to error message

I have entered a pension withdrawal on my fed return. I have entered all the info as it appears on my 1099-R. when I got to file my state return I keep getting message that Tax-Exempt Pension should not be entered directly on Form 1 for State Electronic Filing- You should enter the info on the Fed Return form 1099-R and / or use Pension and Annuity smart worksheet to make any tax-exempt adjustments. I have triple checked my entries on my fed return. this seems to be some kind of bug? I've already paid $29 for my State e-file and I cannot get to do it. HELP!!!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

cannot email my state return due to error message

If you are trying to designate your retirement distribution as non-taxable you would enter your Form 1099-R into TurboTax in the Federal section under "Wages & Income".

You will designate it as tax exempt on the follow-up screens after you have entered your Form 1099-R.

You can do the following:

- Open you tax return

- Click on the Search icon at the upper right of your TurboTax screen

- Type "1099-R" in the search bar and hit enter

- Click on the link "Jump to 1099-R"

- This will take you to the 1099-R section of your TurboTax program.

- if you need to add a new Form 1099-R, select "Add another 1099-R"

On your follow-up screens after you have entered Form 1099-R, you will be asked questions about your retirement income.

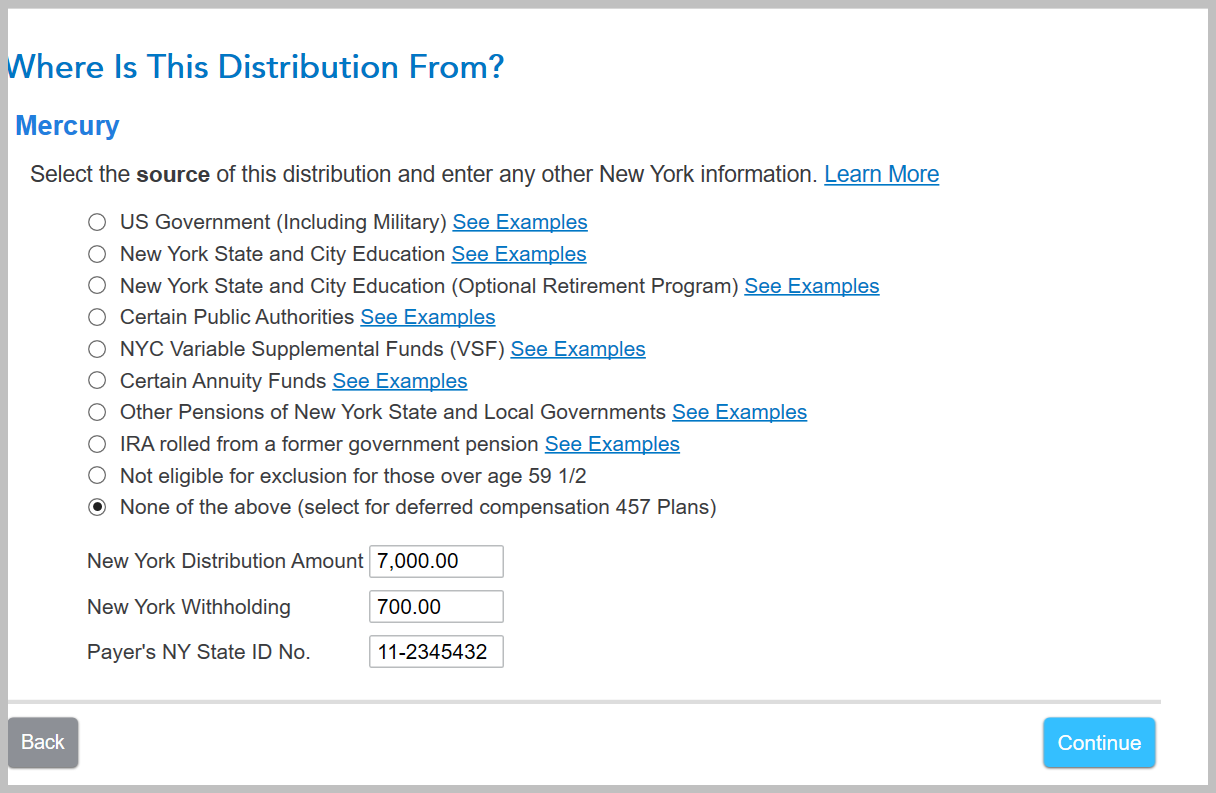

You will see a screen that says, "Where Is This Distribution From?"

This selection will help determine if your retirement distribution is taxable or not. For example if your state excludes state or government pensions, this is where you would designate that here.

Click here for the IRS instructions for Form 1099-R.

Click here for instructions on where to enter your Form 1099-R

If you have additional information or questions regarding this, please return to Community and we would be glad to help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cejn1958

New Member

juelyn74

New Member

Scotto1

New Member

bill-kirk465

New Member

natashadixon007

New Member