- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered f...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

I am also experiencing something similar. 16 I is 0 but it is making me refill it as 0 but then not accepting it. I do have other 16 categories on my K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Go back to the K-1 interview and cycle thru until you reach the box 16 drop down box with the entries.

To delete 16 I, put the pointer on the amount and delete it. Then put the pointer on the descriptor to the left and click on it. The drop down menu will appear. Scroll up to the top where it is blank and click on it. That will delete the descriptor. Both the amount and the descriptor must be deleted to clear the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

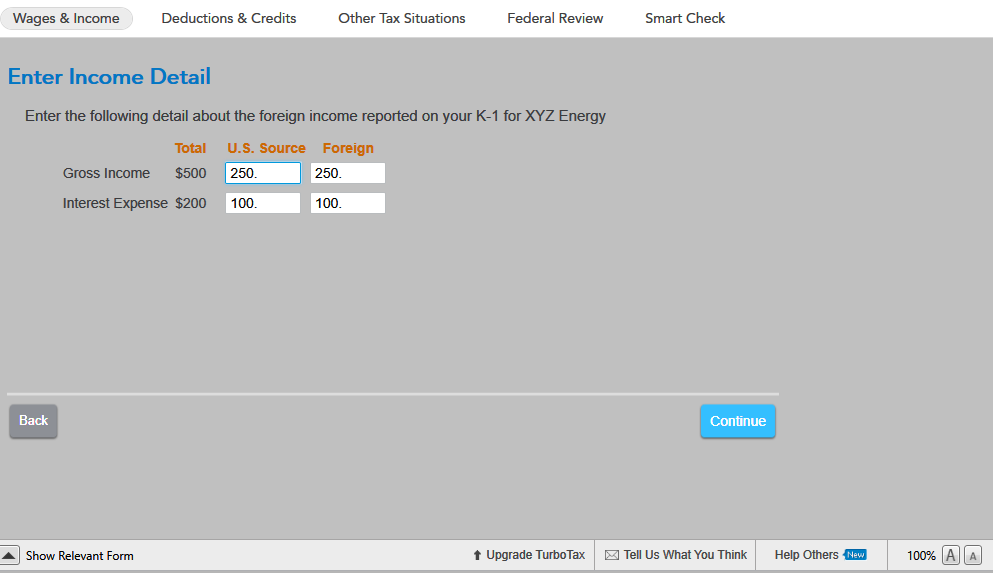

Below is the screen that appears after the "Enter Box 16 Info." Note that you can have either foreign or U.S. interest expense or both but there has to be a corresponding income to match. If in your case you only have foreign interest expense, then insert foreign income that is at least equal to the expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

I have this message "schedule_wks k-1 trust this form cannot be filed at this time you must obtain an update...."

I know this is an error; I got this form straight from my advisor. My software is up to date and I have been updating it every day now for a week. I am going to wait till Friday and then I am going to file regardless. Intuit if you are reading this. Please delete this superfluous error message or "update" the correct from. Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

You will still have to wait a little while if you want to file electronically. Trust K-1's are not available yet in TurboTax.

For the most up to date list, check forms availability here: IRS forms availability table for TurboTax individual (personal) tax products.

For more details about entering a K-1 in TurboTax, see: Where do I enter a K-1 that I received?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Thank you that like telling when when it would be available was very helpful. I was getting all kinds of contradictory info that the K-1 was available, or that it was a computer glitch etc. That link was wonderfull. I owe you a box of chocolates !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Do I still need to wait to efile a return with a K1 or should this be working now? I'm unable to file due to an error, so it seems like the feature is available now but something is wrong. (?)

I'm getting the same error from the start of this thread. "Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H for foreign sourced income at the individual level on the K-1 Additional Information worksheet line 1."

On my K1 I received, I have the foreign income coded as B "Gross income from all sources" and I have info for code P "Total foreign taxes paid." It sounds like Turbo Tax doesn't think Box B is a valid way to code the foreign income this year because the description doesn't explicitly say "foreign", but Box 16 is the foreign transactions, so it would seem all the codes for Box 16 would related to foreign income.

I had the same two codes combo (B & P), same descriptions last year and it filed fine so it seems like a bug in TurboTax last year or this year, but not sure where to go to find answers.

Anyone else having issues with this? Did the rules on this change from 2019 to 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

1. No, the Trust K-1's are available now. But, this appears to not be a Trust K-1, since foreign income is reported in Box 14 for a Trust K-1, but Box 16 for a Partnership. See this list for the most recent updates: TurboTax IRS Forms Availability.

2. The program is looking for more information about the foreign income. Going back through the original entry may be useful.

At Enter Box 16 Info, above the box for Enter Other Codes where Code B and P are entered, there is another entry for Box 16a - Foreign Country or U.S. Possession. This should be completed.

Secondly, if you are only reporting the earned income from this activity and foreign tax paid for a foreign tax credit, answer No to the question following Box 16, regarding claiming both the foreign earned income exclusion and the foreign tax credit.

If you are using TurboTax CD/Download, go to Forms Mode to open this worksheet.

There are not significant changes to the rules from 2019 to 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Thanks @KathrynG3 . I checked all those fields in the form for box 16 (i.e. 16a and both the codes for B&P) and they looked the same as they do on the form from 2019, so I ended up deleting the whole K1 and re-entered it and that seemed to fix it. I was able to submit after that. You must be right, there must have been some other field that was a conflict and the error check was just flagging on the field that was right. Thanks for your help! I'm unblocked now. 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

I also had issues with this Box 16 and others. I did what you said, deleted the K-1 and re-entered it again. Had the same issues with return again, but this time it was asking for information for a Schedule E. I switched to forms mode, looked at the Sched. E, there was nothing on it, deleted the form and that seemed to clear up my problem and I was able to E-file with no errors. Very frustrating and I'm not entirely confident the return is correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

I am getting the error: No foreign source income at individual level has been listed on the K-1additional information worksheet line 1. I have code A Canada, Code B 815, code I 120.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

For a 1065 K-1, box 16 is for foreign transactions. You can read the details on pages 14 and 15 here.

You may need to contact the issuer. You need the income invested in the foreign country, what country and how much tax was paid to compete the form 1116 for credit for tax paid to a foreign country. What you have listed may be all the correct information, but it isn't matching up with the instructions so it may be a matter of communication.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Unfortunately I contacted them and they said that what was on the K-1 is all the information they had. I did solve the problem by deleting the interest expense. It raised my taxes by $11, but that's OK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

Definitely a bug in Turbotax. Neither TurboTax for Home & Business NOR TurboTax for Business understand Form 1116. Buggy buggy buggy.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can't file due to this: K-1 Wks-Partnerships (xxx LLC): Box 16 Description has been entered for foreign tax paid or accrued but no entry has been made for codes D-H or for foreign sourced income at the individual level on the K-1 Additional Information w

It depends. Please clarify your issue In order for me to understand your dilemma. Are you saying you have codes D-H listed on your physical K-1 with no amounts listed? if so, You may need to access this information on the supplementary statement that came with the K1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17552101674

New Member

caroltseng501

New Member

anthonysalasr22

New Member

kac42

Level 1

steve-knoll

New Member