- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Backdoor Roth IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

During 2020, I contributed to my employer's Roth 401(k) and a Traditional 401(k). In late-2020, I also converted a Rollover IRA (pre-tax money from previous employers) to a Roth IRA. I'm assuming this is all taxable, but I don't understand how to answer the questions that TurboTax is asking.

So I have traditional IRA's and Roth IRA's still active without any recent contribution or withdrawal activity... How do these enter into the equation?

Do I have to worry about any 401(k) activity in my employer's account happening either this year or prior year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

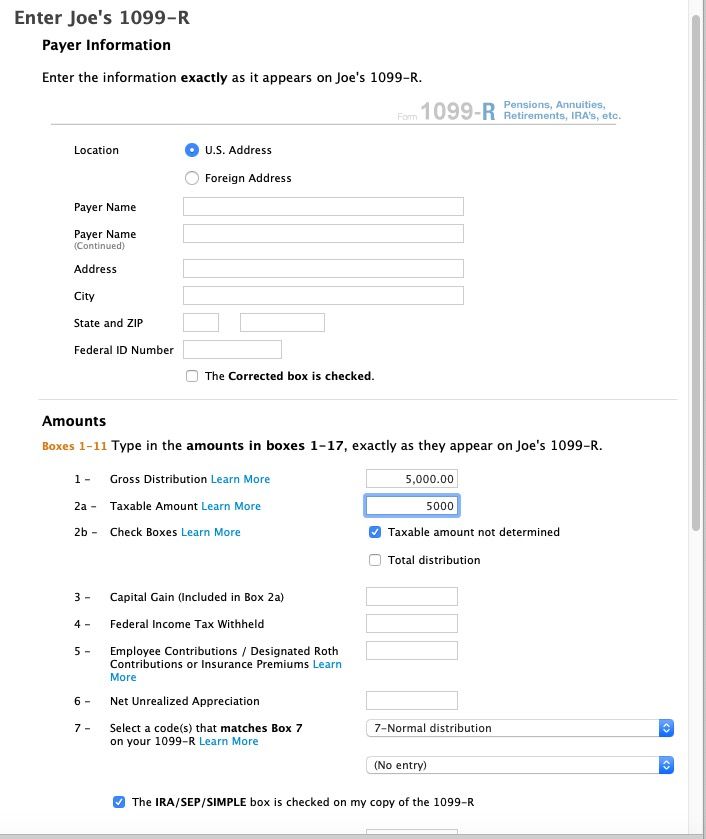

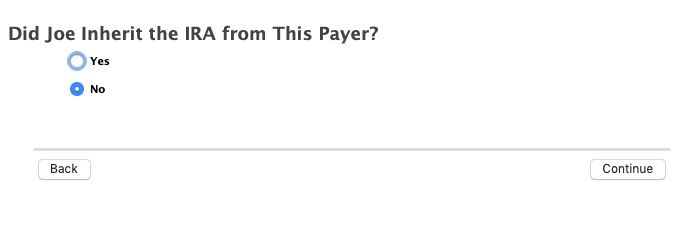

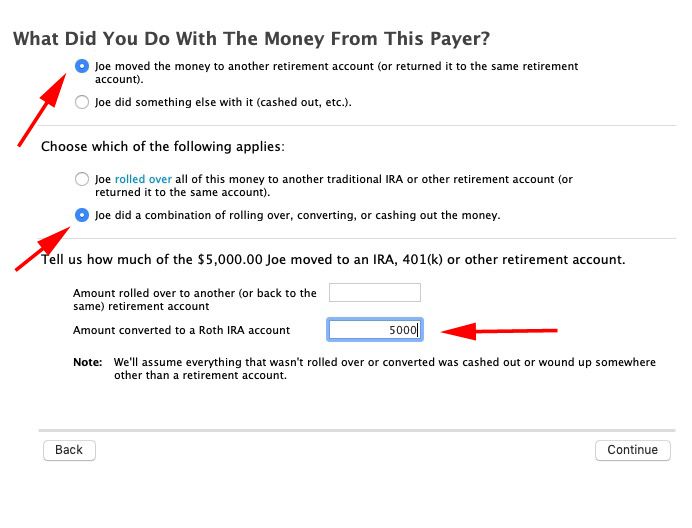

A rollover IRA should be a Traditional IRA. The 1099-R with the code 7 should have the IRA/SEP/SIMPLE box checked.

It will be taxable but there certainly is a way to indicate that it was converted to a Roth IRA (provided that it was converted within 60 days of the distribution).

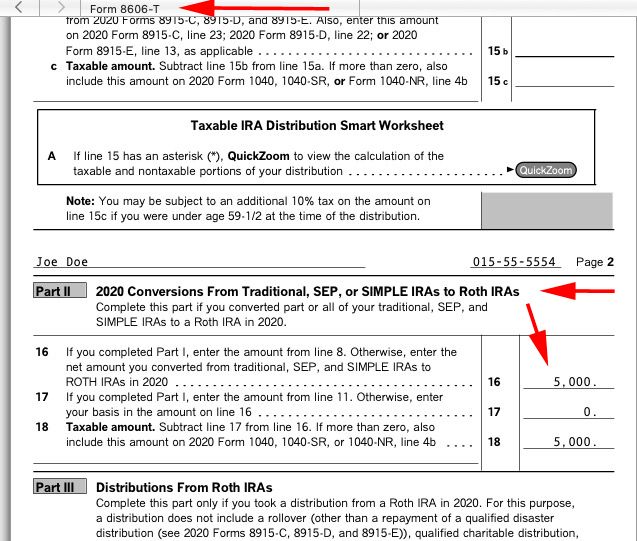

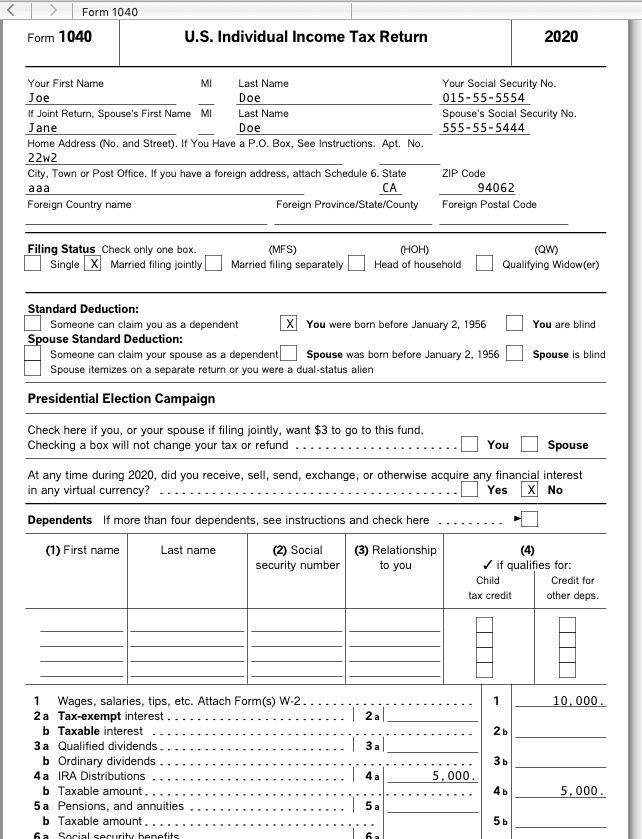

See below for a $5,000 IRA distribution converted to a Roth.

Note: There is not difference in the tax between your method and the correct method, but only the correct method will produce the required 8606 form that reports the Roth conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

What interview questions don't you understand?

What you described is simply a 401(k) to a Roth IRA which is taxable. Nothing that you described has anything to do with a "backdoor Roth".

What code is in box 7 on your 1099-R? If a code G then it was a direct rollover and you simply check the box that the money was moved to a Roth IRA which would be taxable.

If a code 7 or 1 then you just say that you moved the money to another retirement account and converted to a Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

Thank you for the reply.

The code in box 7 is a 7, so this is a taxable distribution. While my IRA custodian knows I rolled this distribution into a Roth, there doesn't *appear to be anything on the tax return (or in TurboTax) that indicates this money went into a Roth. It's as though I cashed out a pre-tax IRA, paid the tax, and now I can do what I want with the money. It's now mine to track, and the custodian will know and specify that all future distributions are non-taxable.

Thanks for your help... let me know if I got this wrong.

-JV

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

A rollover IRA should be a Traditional IRA. The 1099-R with the code 7 should have the IRA/SEP/SIMPLE box checked.

It will be taxable but there certainly is a way to indicate that it was converted to a Roth IRA (provided that it was converted within 60 days of the distribution).

See below for a $5,000 IRA distribution converted to a Roth.

Note: There is not difference in the tax between your method and the correct method, but only the correct method will produce the required 8606 form that reports the Roth conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

no pii

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

You rock! Thanks for the excellent reply - complete with screen shots. Awesome!

Soo.... now I get to the TurboTax screen where it's asking for the 'Value of Your Traditional IRA'. So I gather they're looking for the Dec 31 balance of ALL my non-Roth IRAs?? Why do they need that? (my distribution is already fully taxable!). Would this include any of my Employer retirement funds? (I think these are 401(k) funds and not IRAs - correct?)

So thankful for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

@ReformedGuy wrote:

You rock! Thanks for the excellent reply - complete with screen shots. Awesome!

Soo.... now I get to the TurboTax screen where it's asking for the 'Value of Your Traditional IRA'. So I gather they're looking for the Dec 31 balance of ALL my non-Roth IRAs?? Why do they need that? (my distribution is already fully taxable!). Would this include any of my Employer retirement funds? (I think these are 401(k) funds and not IRAs - correct?)

You only get that question if you answered yes to the question that asks if you have any non-deductible contributions in your IRA. The total value of all Traditional, SEP and SIMPLE IRA's that existed on Dec 31, 2020 is so the nondeductible basis can be prorated properly between the 2020 distribution and total value of All IRA accounts. Your non-deductive "basis" must be reported on a 8606 form each year that you make a non-deductible IRA contribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Backdoor Roth IRA

My forms follow that example, but the TurboTax questions do not.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

frankiestylez

New Member

ab28

Returning Member

deadbugdug

New Member

FitWit

Level 2

honeybadgerm

Returning Member