- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: After latest updates, during Federal Review, Turbotax is stating I have a W-2c coming for deferred S.S.? I didn't defer S.S.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After latest updates, during Federal Review, Turbotax is stating I have a W-2c coming for deferred S.S.? I didn't defer S.S.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After latest updates, during Federal Review, Turbotax is stating I have a W-2c coming for deferred S.S.? I didn't defer S.S.

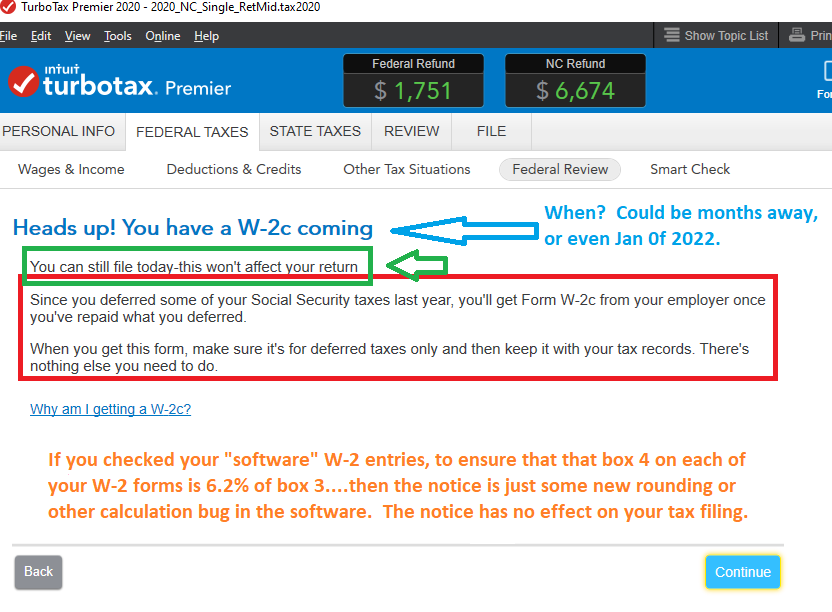

It is supposedly a "helpful" notice (which may not be helpful) , and does not change, or stop your filing of taxes in any way.

________________________

It is likely just a calculation screw-up in the software ...that does not affect your taxes in any way. (a bug introduced in Wed night's update...One TTX Rep said they'll fix that by the end of next week)

Just edit each W-2 you entered, and make sure box 4 is entered to be the same number as on your paper/PDF W-2 from that employer. If box 4 is 6.2% of box 3...then nothing is wrong, and ignore that notice entirely. (Unless you've also entered some Self-employment income.....then you do have to revisit that section first)

(unless box 4 is significantly lower than 6.2% of box 3...then the notice is valid...but it is just a reminder/"Notice" and you can still file without doing anything else)

______________________________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Wisco920

New Member

smiklakhani

Level 2

Greenemarci2

New Member

gerald_hwang

New Member

user17550208594

New Member