- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Advanced Child Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Turbo tax asked me to enter the Advanced Tax Credit received on schedule 8812 for both myself and my husband. Essentially entering the same amount twice. But when I did this I immediately saw my tax owed amount drop by almost $1000. Why is that? Does this sound correct?

I would think this amount entered should just offset the tax credit we qualify for but not reduce the taxes I owe?. Did I make a mistake somewhere?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Something is wrong if your amount received reduces the amount you owe. You need to go through the return and review. If that does not find the error, go through your entries again. Did you enter amount received as a minus number? Dont know if it is even possible to do that.

Did you divide the amount received and put half for you and half her him?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

I didnt divide the number. The return asked how much was claimed on the form the govt sent each of us and each had the same amount. So I just entered that. The program is not finding any errors. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

I thought that might be the problem. Glad it is resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

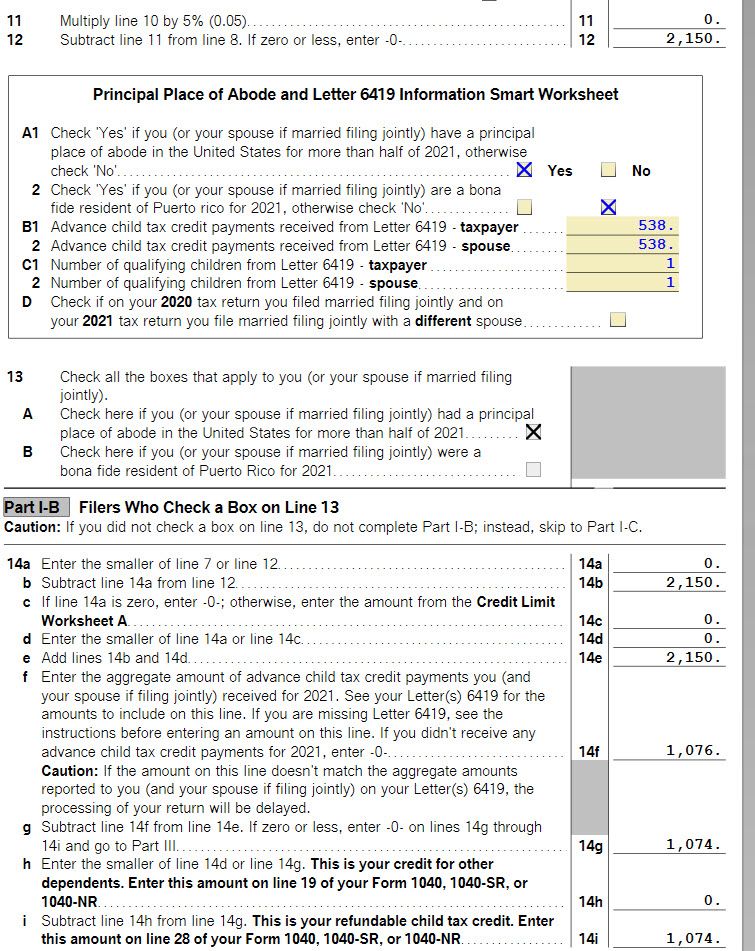

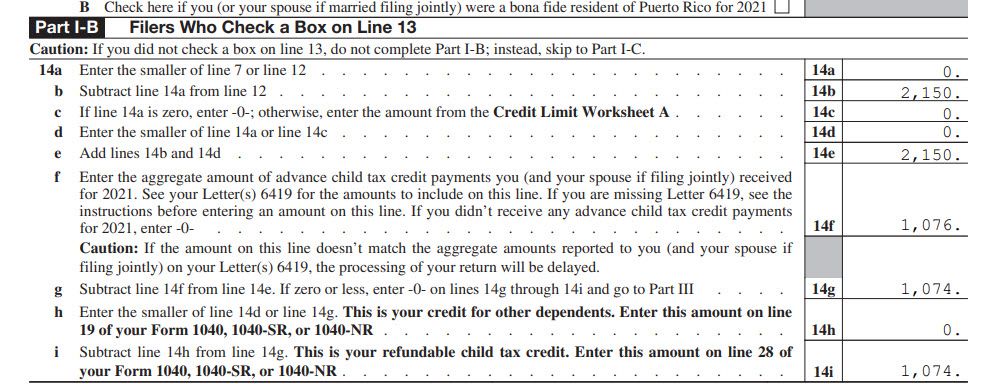

If I read what the schedule says the numbers reconcile. I do not understand why once I entered this section the return showed a reduction in the amount owed. Basically before updating section A1 & B1 below, I owed more. I even removed the amounts and redid it and the program handled it the same way. Both times it reduced my taxes owed by $1,094

Also what does Question A1 mean? Is it just asking if we lived in the US for at least 1/2 the year or more? Seems like a basic question but want to be sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

you misread my response. I was stating I didnt enter anything wrong. Issue isnt resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

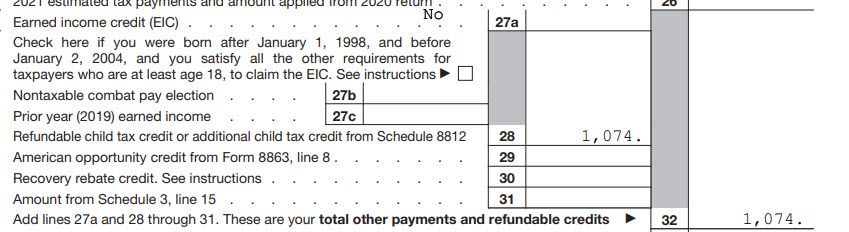

As soon as you entered your children Turbo Tax gave you the full amount for the Child Tax Credit. So your refund would look too high. Then later you enter how much Advance you already got so it is subtracted. Check line 28. Line 28 is not the advance you already got but just the remaining amount. The total credit or the advance does not show up on your tax return.

Oh and your total refund isn't necessarily the amount of the credit. It either adds to your refund or reduces a tax due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Based on the information provided above, if you had a balance due before you enter the two amounts with a total of $1,076, you balance due should have gone up by $1,076; if you had a refund before you entered the two amounts, your refund should have gone down by $1,076.

If you don't mind, send me a screenshot of the refund monitor. With that, we can better understand the issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

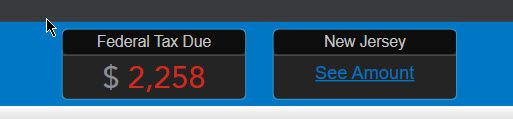

It’s not a refund guys. Turbo ax said I owed $3300 and after I entered this info it now said I owed $2200.

either way I owe no refunds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

@FangxiaL Well then TurboTax is wrong . I didn’t do anything except enter sections A1 and B1.

I also need to review my deposits because I don’t think we received $1076 I think it was just 538. But turbo tax prompts to enter this number twice for my husband and my myself because we each received this form. If we are married and filing jointly wouldn’t we just report this amount one time?

i don’t know if this will fix the issue but I find the wording on the forms messy and confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Are you sure? Maybe it was a refund being reduced.

Look at your tax return. What lines? What's on lines 24, 28, 30 and 35a or 37 for Tax due. Look over your return. What lines don't you understand?

Before filing, You can preview the 1040 or print the whole return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Yes double check your bank deposits. The 6419 letters should be half for each spouse. So the IRS is saying you got 1076 total.

You can check both your IRS accounts to see when and how they sent the psyments

Your Online Account | Internal Revenue Service

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

Yes I am positive. Refunds are not shown as RED. 😀see attached. It was 3352 before it reduced to this. I dont mind it being less but I want to understand why when entering the ADVCTC payments it reduces what I owe? I am baffled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

@VolvoGirl I verified the adv child tax credit is correct that I received. Weird that this is happening.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advanced Child Tax Credit

if my child tax credit is supposed to be $2150 for 1 child, and I received a total of $1076 as ADV Payments, why is this considered a refund due back to me for child tax credit itself. This is what is reducing the total taxes I will owe but I do not follow why I am being refunded as far as the Child Tax credit below.

Can someone explain this? Otherwise I am just going to assume the Overall Taxes Due is correct and that turbo tax calculated correctly.

The math is all right. Its the logic my brain is not comprehending....it could be I am just tired and not thinking clearly.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

evan-scott1

New Member

ericag569

New Member

dmraye

New Member

reeree1121

New Member

AJSR111

New Member