- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

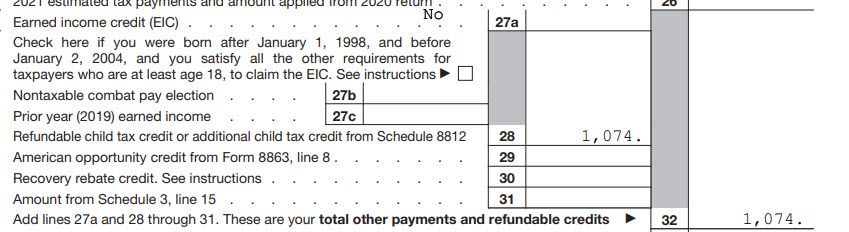

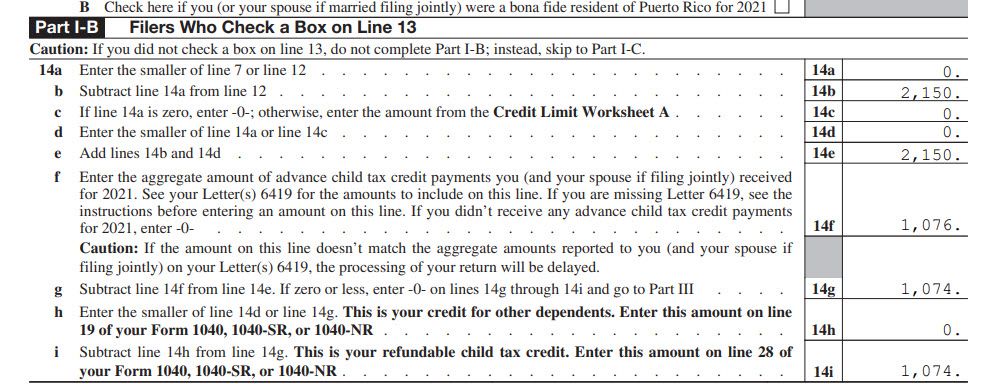

if my child tax credit is supposed to be $2150 for 1 child, and I received a total of $1076 as ADV Payments, why is this considered a refund due back to me for child tax credit itself. This is what is reducing the total taxes I will owe but I do not follow why I am being refunded as far as the Child Tax credit below.

Can someone explain this? Otherwise I am just going to assume the Overall Taxes Due is correct and that turbo tax calculated correctly.

The math is all right. Its the logic my brain is not comprehending....it could be I am just tired and not thinking clearly.

March 5, 2022

10:59 PM