- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: About PayPal 1099k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

Hi, I just received 1099k from PayPal. My gross number are only 2500. It’s not meet federal minimum requirements for $20000 but I still receive it. I guess it’s because My PayPal address are Illinois.

1:should I only file this only in Illinois?because my W2 and all other documents are in MN. Should I count this as other state income?

2:Since I don’t think it’s self employment.can I file it using free edition? If not. Which CD version should I buy to fill this form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

You need to enter all of your earnings on your 1040 and your state return. There is no minimum threshold for reporting on your tax return. The IRS requires each payment settlement entity, such as PayPal, to send you a Form 1099-K if it has processed at least $20,000 worth of payments and at least 200 transactions for you in the previous year. However, some payment settlement entities send out 1099-Ks to all vendors, even if they've only processed a handful of transactions and are below the threshold. However, you need to report this income on your federal and state tax return, regardless of whether you receive a 1099-K.

Usually a 1099-K would be reported through a Schedule C on your tax return. For tax purposes, self-employment income includes any part-time businesses or "side work" performed in which you are in business for yourself, rather than another person. You are also considered self-employed if you engage in business-like activities where you intend to make a profit. This would require TurboTax Home & Business (CD product) or TurboTax Self-Employed (online version).

For additional information on being self-employed, please see Am I considered self-employed?.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

I received a paypal 1099k because I sold old household items on ebay (at a loss). I'm in Virginia where they have lowered the reporting threshold to $600. I have read that sale of household items isn't normally taxable. I'm not running some kind of resale business, just doing a household cleanup...every few years I try to sell some items. So how do I report this?

Suppose I actually made money selling household items. That's supposed to be a capital gain reported on schedule C, not self employment. Would I still have to list this on schedule C? (I've never seen Schedule C.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

There is a way to report non-business income from Form 1099-K in TurboTax by following these steps:

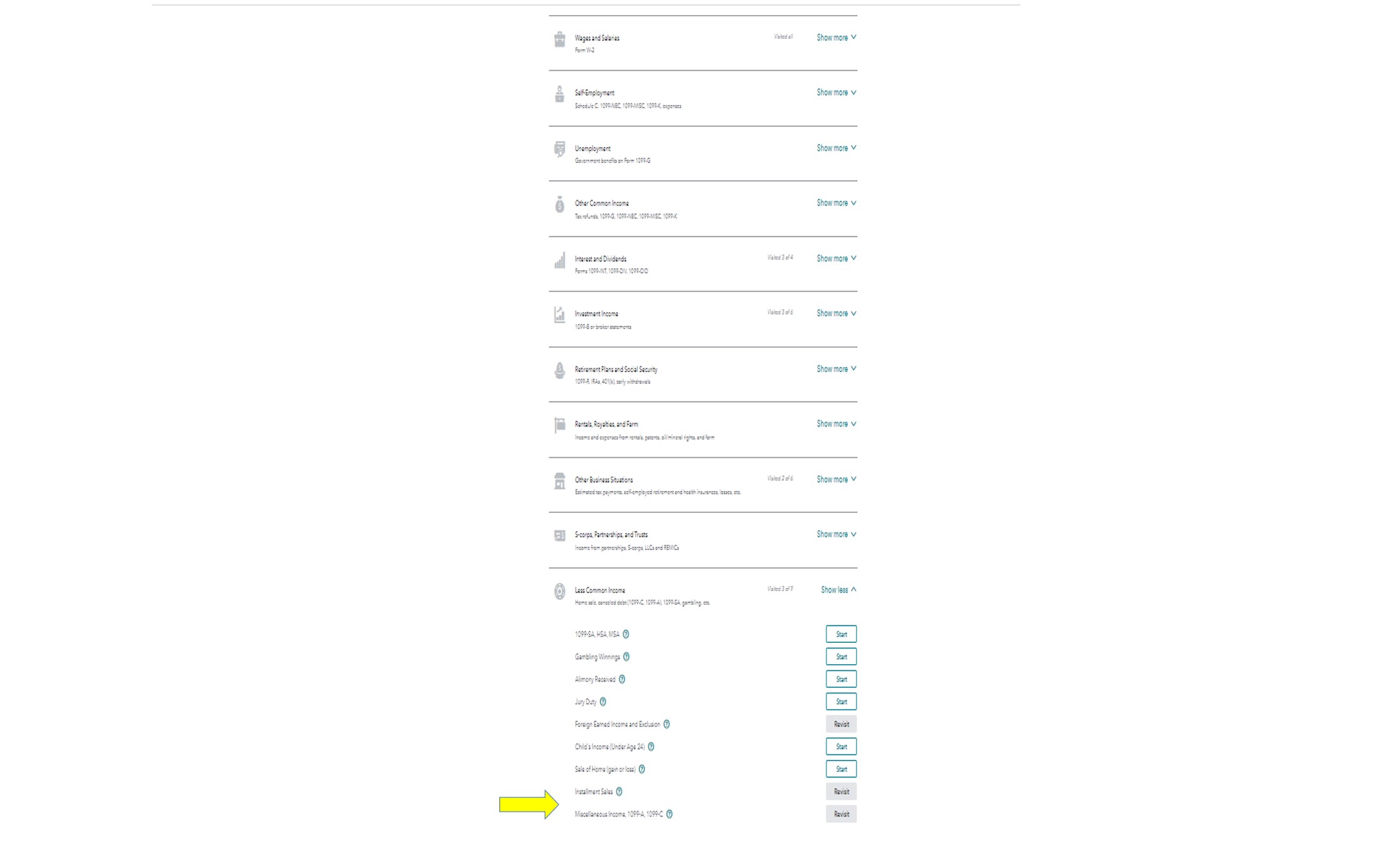

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

- Next, enter an adjustment to reflect the cost of these items as an offsetting, negative amount.

Checking through 2020 Form 760 Instructions, there is no reference to having lowered the reporting threshold to $600. You may be thinking of when Form 1099-MISC is required to be issued. This does not mean that income less than $600 does not need to be reported. It just means you will not receive Form 1099-MISC. The IRS taxes worldwide income for US Citizens.

Schedule C is for self-employment income and expense reporting.

Capital Gains are reported on Schedule D. If you prefer to report Form 1099-K as a capital gain, then see: An alternative for reporting Form 1099-K for personal items.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

Thanks for that information. Definitely helpful.

Regarding the limits for a 1099K form, the state of Virginia (and other states) have imposed lower reporting thresholds, so a 1099K must be sent to me if I have more than $600 in payments. In previous years a 1099K would not be sent unless the federal threshold of $20k was met.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

Yes, several states have lowered the income threshold for the 1099-K to be issued, and more states are planning on lowering the income levels in the future.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

Comment says after entering 1099K amount, to next enter an adjustment to reflect the cost of these items. Where/how do I do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

Both following options will report Form 1099-K and also zero it out on your return. This will mean you appropriately pay -0- tax on the non self-employed income.

For reporting Form 1009-K for personal items sold not associated with a trade or business, you have two options:

- Option 1 in TurboTax Premier or higher: reporting Form 1099-K as investment income

- Go to the search box and enter Investment Sales

- Select Jump to Investment Sales

- Select Other at the next screen, OK, what type of investments did you sell? and click Continue

- At Tell us more about this sale, enter in the name, such as Form 1099-K eBay Personal Property Sales and the Payer's EIN and click Continue

- At Now we'll walk you through entering your sale details, under the first dropdown menu, What type of investment did you sell? Select Personal Items

- Answer How did you receive this investment with an option from the dropdown menu.

- Enter the Description. If you are uncertain what date you purchased the goods, select Something other than a date so that TurboTax will enter Various

- Next, enter your Sale Proceeds and an equal amount for the Total Amount Paid and click Continue. The description for the cost should include Cost of Personal Property

- Select None of these apply at Let us know if any of these situations apply to this sale and Continue

- Continue through the rest of the prompts

- Select Add another sale to add the next Form received

- Option 2 in TurboTax Deluxe or higher: reporting it via Other Miscellaneous Income is acceptable to the IRS.

- From the left menu, go to Federal and select the first tab, Wages & Income

- Add more income by scrolling down to the last option, Less Common Income, and Show more

- Scroll down to the last option, Miscellaneous Income, 1099-A, 1099-C and Start

- Choose the last option, Other reportable income and Start and Yes

- Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

- For a description, include Form 1099-K and Personal Property Sales

- Next, in other reportable income also, enter an adjustment to reflect the cost of these items as an offsetting, negative amount up to the amount of the income.

- For the cost description, include Form 1099-K and Cost of Personal Property

- In other words, if the goods cost you $100 and Form 1099-K was for $10 in sales, the maximum cost allowable would be $10.

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

I'm finally trying to actually fill this out and following option 1 I ran into a complication. I get to a box that says "date sold or disposed". I sold a dozen items on different dates on ebay, not one item. The info box in turbotax says, "If you sold a security on multiple dates enter each sale separately with its own date." Does this mean if I want to use method 1 I need to make a dozen entries, somehow splitting the 1099-K amount into portions for each item sold? Is it allowed to leave the date blank? Method 1 seems a little better in that it collects the information together into one entry, but can I use it with multiple sales? Is method 1 preferred over method 2 assuming I'm using Premier?

Another question: when I follow either one of these methods TurboTax doesn't know I'm entering a 1099-K, right? I enter that as part of the description. If I follow method 2 I am making two independent entries.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

About PayPal 1099k

I recommend Option 2. It is way simpler. You are allowed to sell personal property without creating taxable income. You should report the 1099K income as Less Common Income. Other Taxable Income and then report the value of the personal items as a negative reversing entry in Other Taxable Income:

You will result with two entries - 1099K Income From Sale of Personal items - and - Cost of Personal Items Reported on 1099K - one positive and one negative offsetting. each other to result in zero additional taxable income.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rosenbaumjohnmichael

New Member

craignvalle

New Member

marmarin-v

New Member

kt0802

New Member

pjtansey1

New Member