- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: A few questions before I file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

Hi there,

I'm using TurboTax Home & Business (bought software), and Married Filing Jointly.

I am the one filing, and my spouse has a small business (i have nothing to do with it).

Below are my questions:

- Some of the business-related forms have my SSN on it (not the spouse's), and both of our names are on it. There are some business forms that has only my spouse's name/SSN on it, which got me worried. Is this normal? The ones that I found that has my SSN on it are:

- 8995-A - Qualified Business Income Deduction

- Schedule C - Loss Netting and Carryforward

- 4562 - Depreciation and Amortization

- UBIA (Unadjusted Basis Immediately after Acquisition of Assets) have an absurdly high value (compared to the size of current business), which I did not input. I'm not sure I understand it even after I google it. While I'm sure I input everything correct, I want to make sure if I overlooked something, causing something to be miscalculated?

- If I don't e-file state tax, will turbotax still give me forms that I can print out and mail it on my own? (I feel like $20 just for filing is too much.. after all, I purchased Turbotax to save money)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

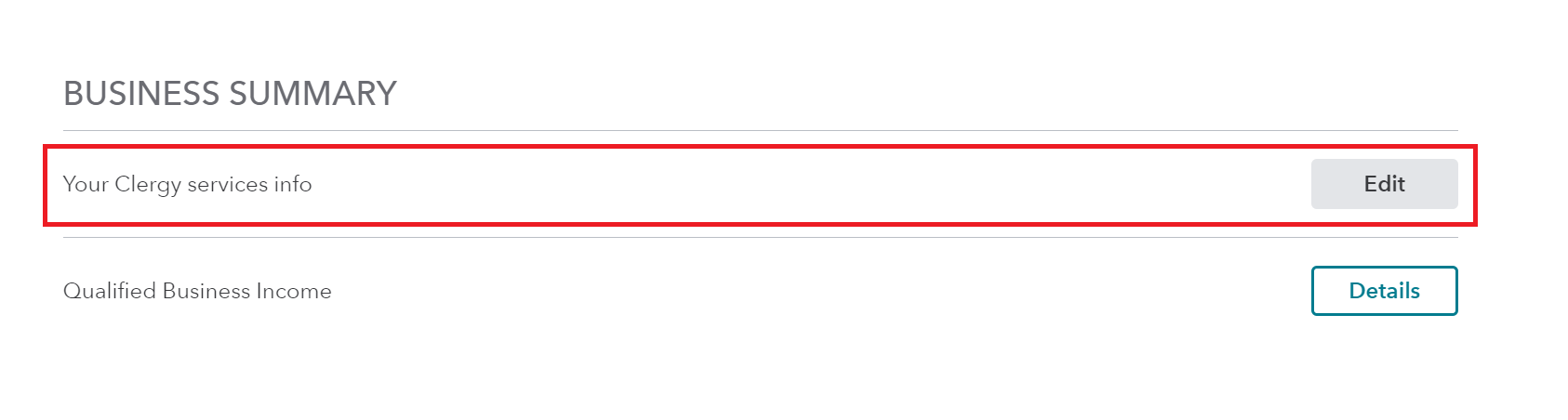

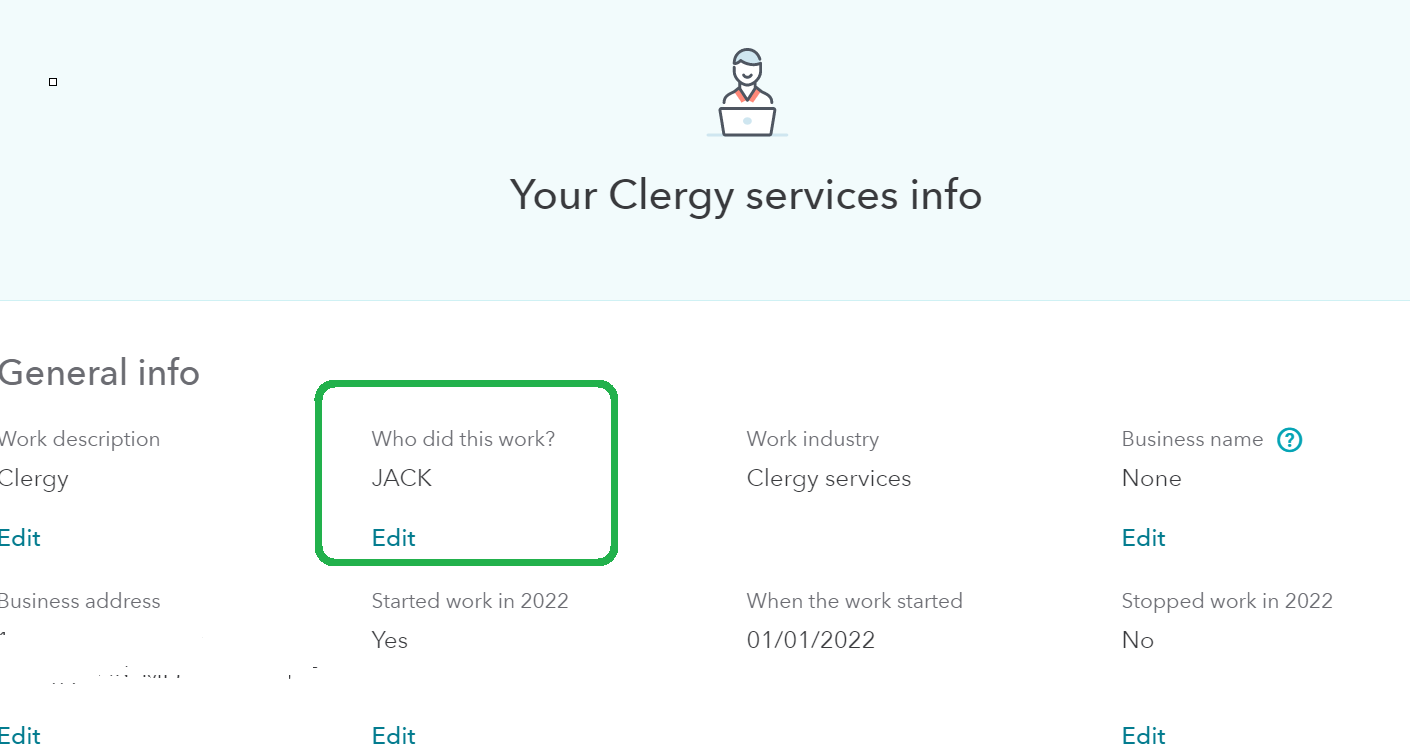

1. No, if it is you spouse's business it should be her name/social on the forms. Go back to the Self-Employment section and make sure the Business Info is correct.

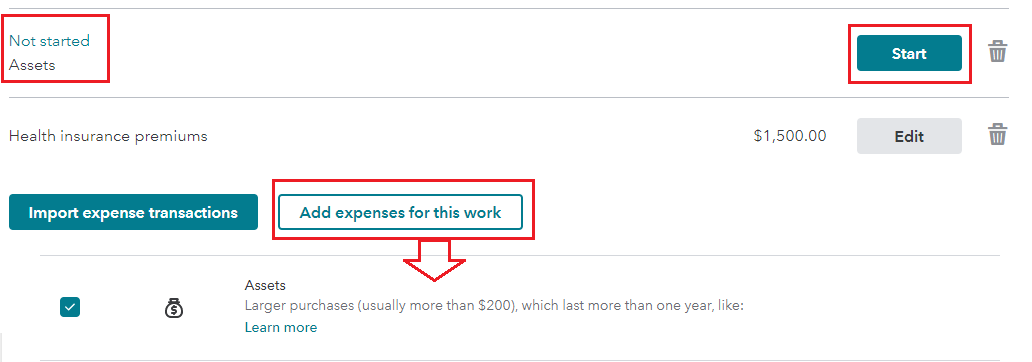

2. The UBIA might be high IF there are a lot of business assets that had special depreciation or 179. You can check this on the Depreciation Worksheet.

3. Yes you can print and mail the state tax returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

Hi Mary, appreciate your comments.

1. That's the thing, I input the business in my spouse's name. Still, only "Schedule C (Form1040) - Profit or Loss From Business" just shows my spouse's name and SSN. But all other forms are in my SSN.

2. I have not entered the Depreciation section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

Yes, that's normal. If you are listed first on the tax return then all tax forms that belong to the return, with the exception of the business schedule will be under your name and social security number (SSN). The business will be under your spouse.

The assets for the business will be the depreciation section.

- Search (upper right) > Type schedule c > Click the jump to...Link

- Edit beside the business and you may need to 'Add more Expenses for this work' or select Assets

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

Hi Dianne, thank you for your reply.

For UBIA, after some googling, I think it is because I put my current home as home office. So total value of the home multiplied by some factors (such as how much % of home I use for business, etc..)

But I could not figure out how the numbers are exactly calculated. Does anyone know how it is calculated, so I can cross-check the number? Also, not sure if having mortgage affects this value..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

A few questions before I file

UBIA (unadjusted basis of qualified business property immediatly after acquisition) is the cost of business property before depreciation, but only include it for the first ten years from when it was put into service for the business, or until it is fully depreciated, whichever is later. You can learn more here: UBIA

Your mortgage would not affect the UBIA, as it is just a loan on your house, not property. As an example, if you purchased equipment that cost $10,000 in year one of the business, and that was all the property the business owned, the UBIA would be $10,000 in every year of the business for the first ten years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jt7405

New Member

user17696257333

New Member

unablezhy

New Member

kathy-pemberton46

New Member

Mcastro845

Returning Member