- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 2023 Form 8936 Availability

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

It’s 2/10/2023 now on the east coast. Still no updates. Anyone?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Still unavailable for me on 2/10 on the desktop version. Very disappointed in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

February 10th and my Turbo Tax Deluxe still showing form 8936 "available soon". Not sure how some people are getting it, but I'm gonna call Turbotax today and try to find out what's going on. Maybe it's a state thing since some states also have EV rebates so they have to update state by state. I'm in Pennsylvania and no luck here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

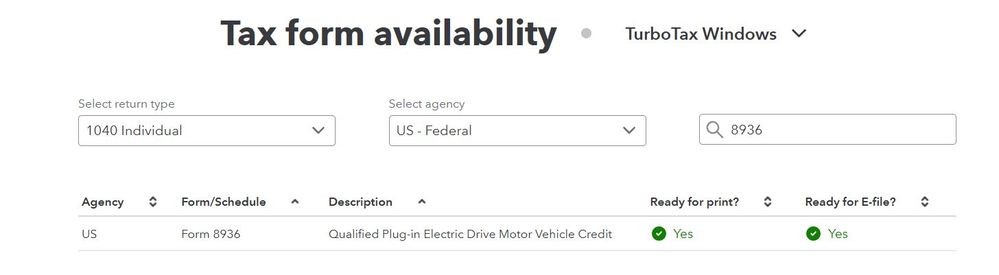

Their own website shows it available:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Very annoying. February 10 9:04am EST and now instead of "2/9/23" is says "available soon". The IRS released it in late January. WTF. Seriously lacking on Intuit's part. After more than 20 years of TurboTAx it may be time to switch if they can't get their act together.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

wow, this has turned into a clown show, lesson learned on my part.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Just spoke with a rep. No help at all. Said that I would have to put it on a Schedule K. I'm not filing as a business. Sent me an email link, but was just for business filing.

10:08am in NJ. Using desktop Premier for Mac

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Hi Alicia

Still no update for TurboTax Deluxe, spoke to a TT expert, tried a manual update, install as admin, etc. It appears TurboTax Live customers can file their taxes using form 8936, but Deluxe users cannot because the updated form 8936 does not integrate into the Deluxe software. How can we fix this please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Just re-checked at 10:45 EST and there was an update available. Form 8936 is ready to file. Hope this happens for everyone else today.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

YOU ARE A GENIUS!! THANK YOU, THANK YOU, THANK YOU! I have confirmed that the latest update includes the form 8936 and can now file! You are awesome!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

finally, it updated and filed both Fed and State.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

Yesterday afternoon, February 10th, I was able to download and install latest TT updates which included the Form 8936. Minutes ago I successfully submitted my Fed and State returns. YIPEE!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

I researched and it seems Qualified Plug-In Electric Drive Motor Vehicle Credit on 8936 should be available to all (30% credit up to $1000. If I am getting EV credit ($7500), is that going affect credit on 8936? Turbo tax is not calculating any credit on 8936.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

No, the EV credit is up to $7,500 Form 8936, a EV charger is up to $1,000 Form 8911. Also, all credits are added up before figuring the EV charger credit on Form 8911. Calculating all credits includes the EV Car Credit (up to $7,500) if you purchased one too. If your credits before claiming the Form 8911, Alternative Fuel Vehicle Refueling Property Credit are more than your tax on line 16 of your 1040, then you will lose the credit or it'll show zero. It takes into account additional credits like the CTC or Child Tax Credit (Schedule 8812), Home Energy Credits, Retirement Savings Credits, carry forwards, all added together first. And, if credits are more than your tax (TMT), you will unfortunately lose the credit from Form 8911 EV Charger, it won't carry forward.

See Form 8911, pay attention to Part III on how it's calculated for personal use, if using a desktop version you can get this information from your Forms Mode in Form 8911. Again, if other credits including solar and others add up to more than your tentative tax, you will lose credit forever, according to current guidance. Remember, you received a 7,500 EV credit; this is a dollar for dollar reduction or credit on tax due, alone, not including the Standard Deduction or other possible credits like solar or carry-forwards calculated first as guided by Form 8911.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2023 Form 8936 Availability

@MichaelG81 Thanks a lot Michael for the detailed explanation. My total tax before any credits is way more than my credits (EV, Charger, Child). If that's the case, what could be the reason TT is calculating $0 credit on 8911 for alternative fueling vehicle credit?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DirtyDawg4

New Member

aalvarado606

New Member

doubleO7

Level 4

nahumveach

New Member

HollyP

Employee Tax Expert