- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Question Regarding Reporting Income as a Cleaner through Turno Airbnb

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question Regarding Reporting Income as a Cleaner through Turno Airbnb

Hi,

I am seeking guidance on how to report my income as a cleaner through the third-party app, Turno Airbnb.

For the entire year, I earned $1,250, but I did not receive a 1099-K form from Stripe, the payment processor used by Turno. When I reached out to Stripe to inquire about the absence of the 1099-K, they informed me that since I earned over $600, it is Turno's responsibility to provide the appropriate tax form.

However, when I contacted Turno, they stated that Stripe handles all tax form issuance for cleaners. I am now unsure of how to proceed with reporting this income on my tax return.

Could you please advise me on the correct way to report this income, given the circumstances?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question Regarding Reporting Income as a Cleaner through Turno Airbnb

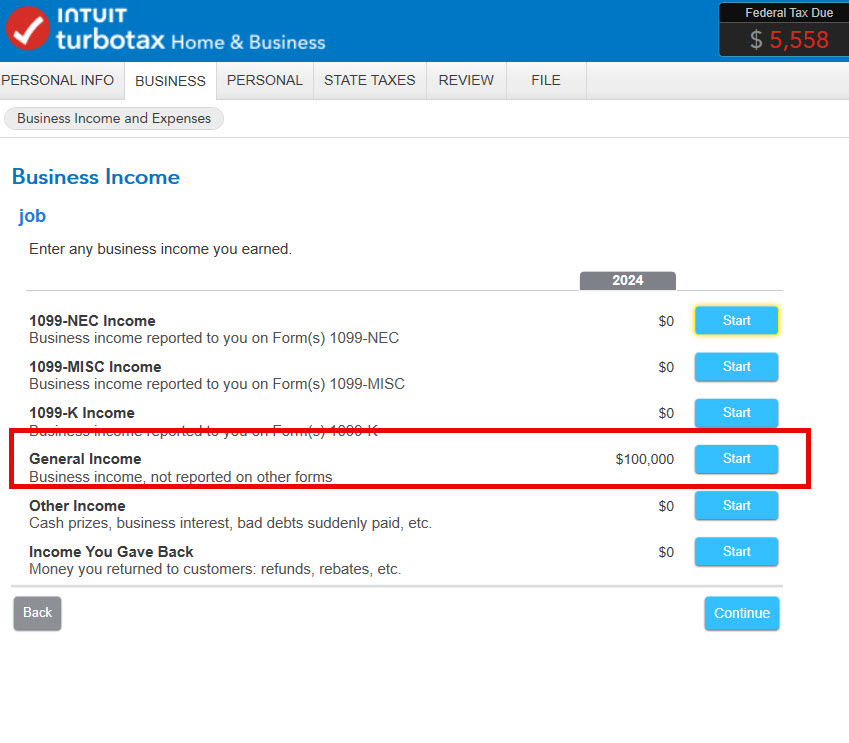

Although a third-party issues your payment, you are Self-Employed and need to use Home and Business Desktop or Self-Employed Online.

Your income, as well as expenses will be reported on Schedule C and carry to your tax return Form 1040.

Setup your business if 2024 was your first year. Enter the income under "General Income" since you don't have a tax document such as Form 1099-K.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lukas1994

Level 2

Lukas1994

Level 2

ripepi

New Member

matto1

Level 2

Shamuj02

Level 1