- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Promptly rejected federal tax return e-filing for no good reason at all

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Promptly rejected federal tax return e-filing for no good reason at all

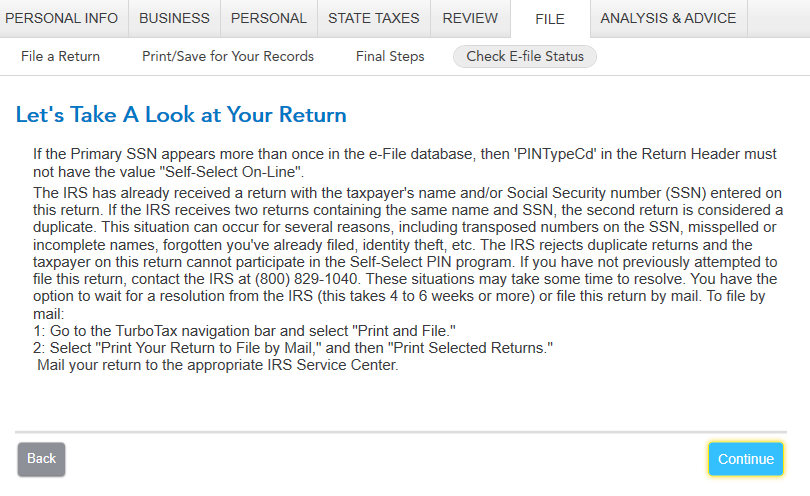

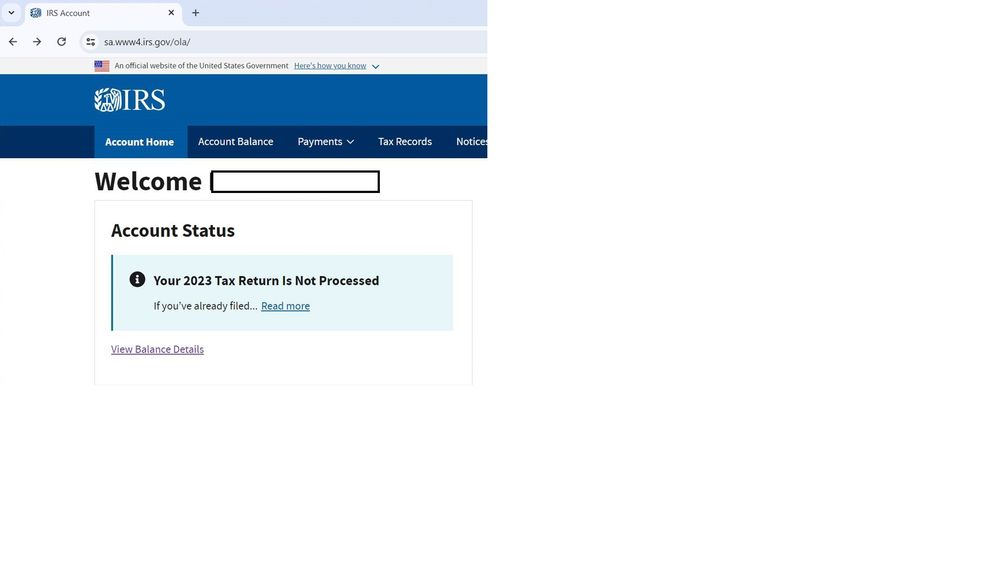

I filed by 2023 federal tax return electronically, was promptly rejected within minutes. TurboTax e-file status has the following explanation: "If the Primary SSN appears more than once in the e-File database, then "PINTypeCd" in the Return Header must not have the value "Self-Select On-Line"" What does this mean? Furthermore, it says: "The IRD has already received a return with the taxpayer's name and/or Social Security number (SSN) entered on this return. If the IRS receives two returns containing the same name and SSN, the second return is considered a duplicate. This situation can occur for several reasons, including transposed numbers on the SSN, misspelled or incomplete names, forgotten you've already filed, identity theft, etc. The IRS rejects duplicate returns and the taxpayer on this return cannot participate in the Self-Select PIN program. If you have not previously attempted to file this return, contact the IRS at [phone number removed]." I have since logged into my IRS account to verify that nobody has filed 2023 return under my name, so what the hell is going on? On the second page of Turbo Tax explanation, it said "The IRS Couldn't Confirm your Identity, It looks like the AGI amount entered before filing didn't match what the IRS has in their database. I again logged into my IRS account for 2022, and verified the AGI recorded there is an exact match to what I entered this year, and also agrees to my printed AGI record from 2022. So none of the explanation makes any sense at all. I am at a loss as to exactly what is the cause of this rejection, and how to fix the situation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Promptly rejected federal tax return e-filing for no good reason at all

Generally this rejection means someone has filed using your name and ssn as a primary tax payer. There is some contradictory information you are given though.

Can you try and re-file and see if it goes through? If not, can you take screen shots of the reject info you see?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Promptly rejected federal tax return e-filing for no good reason at all

Both my spouse and I have checked on irs.gov and confirmed that neither has filed the tax return for 2023. We have tried to e-file again, yet the federal tax return is rejected for the same reason. Is there a way for Turbo Tax to solve this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Promptly rejected federal tax return e-filing for no good reason at all

Reason of Rejection:

We have confirmed that we have the correct SSN in Turbo tax. We confirmed from the IRS.gov website that our 2023 tax return is not filed and the AGI from 2022 we entered in Turbo Tax is the same as what we have in the IRS database.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Promptly rejected federal tax return e-filing for no good reason at all

Were you able to solve your issue?

If not, please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Cornfused357

New Member

josephetc

New Member

josephetc

New Member

dawnschen

Returning Member

Jam89

Returning Member