- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- problem with 1099-div multiple state tax exempt income input

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

problem with 1099-div multiple state tax exempt income input

I have one 1099-div that has multiple states with tax exemptions (actually, 31 states)

When I enter all of these states with their associated values, the program tells me the sum of the individual values does not sum to the total value in box 12. The data I have from my broker is given in percentages. Total from box 12 is $941.71 - the data I have entered is shown in the table:

| Pennsylvania | 13.82 | 130.14 |

| New York | 10.15 | 95.58 |

| New Jersey | 9.07 | 85.41 |

| Texas | 8.61 | 81.08 |

| Illinois | 7.57 | 71.29 |

| California | 6.37 | 59.99 |

| Alabama | 4.57 | 43.04 |

| Massachusetts | 4.28 | 40.31 |

| Arizona | 3.81 | 35.88 |

| Connecticut | 3.79 | 35.69 |

| Florida | 2.99 | 28.16 |

| South Carolina | 2.97 | 27.97 |

| Colorado | 2.73 | 25.71 |

| Minnesota | 2.2 | 20.72 |

| Missouri | 2.16 | 20.34 |

| Tennessee | 1.83 | 17.23 |

| North Carolina | 1.73 | 16.29 |

| Iowa | 1.48 | 13.94 |

| Puerto Rico | 1.47 | 13.84 |

| Wisconsin | 1.38 | 13.00 |

| Michigan | 1.05 | 9.89 |

| Indiana | 1.04 | 9.79 |

| Georgia | 0.9 | 8.48 |

| Hawaii | 0.75 | 7.06 |

| Ohio | 0.69 | 6.50 |

| Louisiana | 0.58 | 5.46 |

| Washington | 0.54 | 5.09 |

| District of Columbia | 0.52 | 4.90 |

| Virginia | 0.44 | 4.43 |

| Nevada | 0.29 | 2.73 |

| New Mexico | 0.19 | 1.79 |

| $941.71 |

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

problem with 1099-div multiple state tax exempt income input

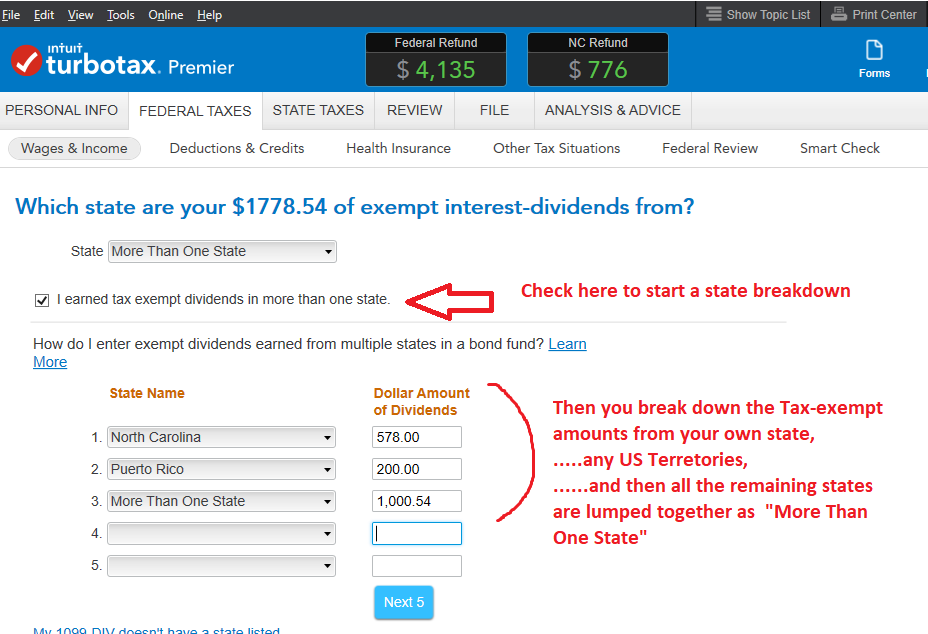

NO...You're doing unnecessary work. (probably some strange rounding in your situation though)

You only do Your own state, plus any US Territory (Puerto Rico etc), and the rest are lumped together as one entry as "Multiple States" (Online software) or "More than one state" (Desktop software).

(Unless you live in MN, CA, IL.....and UT is somewhat different too)

_________________

Example for an NC resident:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

problem with 1099-div multiple state tax exempt income input

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bob_Mackenzie

Level 2

Twins dad

New Member

marka333

Returning Member

wbmeredith

Level 2

robertscottydavis

New Member